Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 05, 2018

Singapore’s private sector economy on course for best quarter since mid-2014

- February PMI signals a solid improvement in business conditions

- Jobs growth among the fastest in recent years

- Business confidence remains upbeat

- Input costs rise sharply, driven by strong wage growth

Singapore’s private sector economy is on course for its best quarterly gain in almost four years, after showing a strong improvement in business conditions during February, according to Nikkei PMI data. However, the upturn was marred by strong inflationary pressures.

Domestic-led growth

The headline Nikkei Singapore PMI™ rose from 53.6 in January to 55.3 in February, signalling one of the strongest improvements in the health of the private sector in the past four years. The latest reading took the average PMI so far in the first quarter to the highest since Q2 2014.

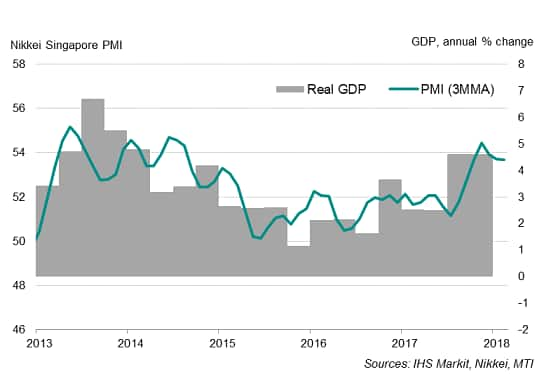

Singapore PMI and economic growth

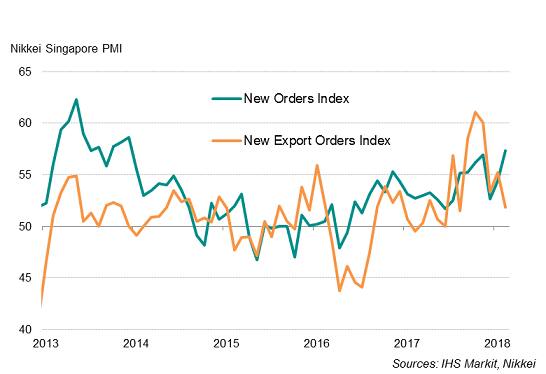

Both output and new orders grew strongly, with survey data suggesting that domestic demand was a key driver in February. Export growth slowed to a six-month low. Business confidence remained positive, boding well for economic activity in coming months.

New business

Overall, the latest Nikkei Singapore PMI is running at a pace broadly consistent with a GDP annual growth rate of around 4% in February, presenting an upside risk to the government’s forecast range of 1.5% to 3.5% for 2018 GDP.

Strong job gains

Labour market prospects meanwhile continued to brighten in February amid robust economic growth. The pace of job gains was among the fastest in the survey history (since August 2012), and accompanied by strong wage growth, reflecting the recent tightening of the labour market. With further evidence of rising capacity pressure, hiring sentiment will likely remain buoyant in the months ahead.

Strong wage pressure

Companies continued to struggle with rising costs, especially in terms of staff overheads. The overall rate of input price inflation struck a survey-record high during February. Notably, wage growth was the third-fastest in the survey history.

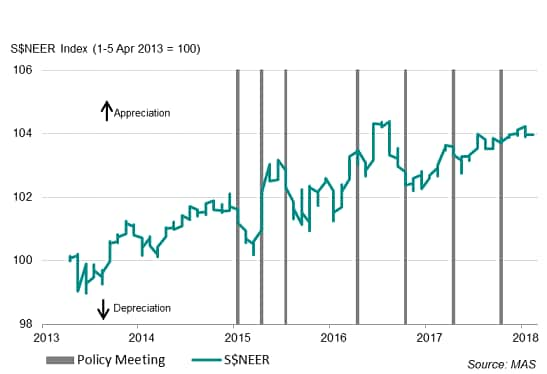

While the recent appreciation of the Singapore dollar could help contain imported inflation, the stronger currency is likely to be less effective against rising labour costs. However, some relief for could come from the extension of government policies, including the wage credit scheme and corporate income tax rebate, as announced in the Budget 2018.

Monetary Policy

Stronger economic growth has added to expectations that the Monetary Authority of Singapore (MAS) may soon normalise policy. The central bank maintained its target for 0% appreciation of the NEER after its October 2017 meeting. However, core inflation remains largely subdued so far, which would make policy tightening an unattractive proposition. The PMI survey showed average prices charged by firms continuing to rise, and at the strongest rate for three months. Inflation is expected to pick up this year as rising costs are eventually passed through to higher consumer prices. For the moment, IHS Markit expects the neutral monetary policy stance to remain in place at least until the MAS’s next meeting in April 2018.

Strengthening SGD

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapores-private-sector-economy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapores-private-sector-economy.html&text=Singapore%e2%80%99s+private+sector+economy+on+course+for+best+quarter+since+mid-2014","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapores-private-sector-economy.html","enabled":true},{"name":"email","url":"?subject=Singapore’s private sector economy on course for best quarter since mid-2014&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapores-private-sector-economy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Singapore%e2%80%99s+private+sector+economy+on+course+for+best+quarter+since+mid-2014 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapores-private-sector-economy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}