Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 23, 2019

Securities Finance Q2 Review

Securities Finance Q2 Review

- $2.59bn in global Q2 securities lending revenues

- IPOs boost US equity lending revenues

- Decline in fixed income revenues, particularly UST and USD credit

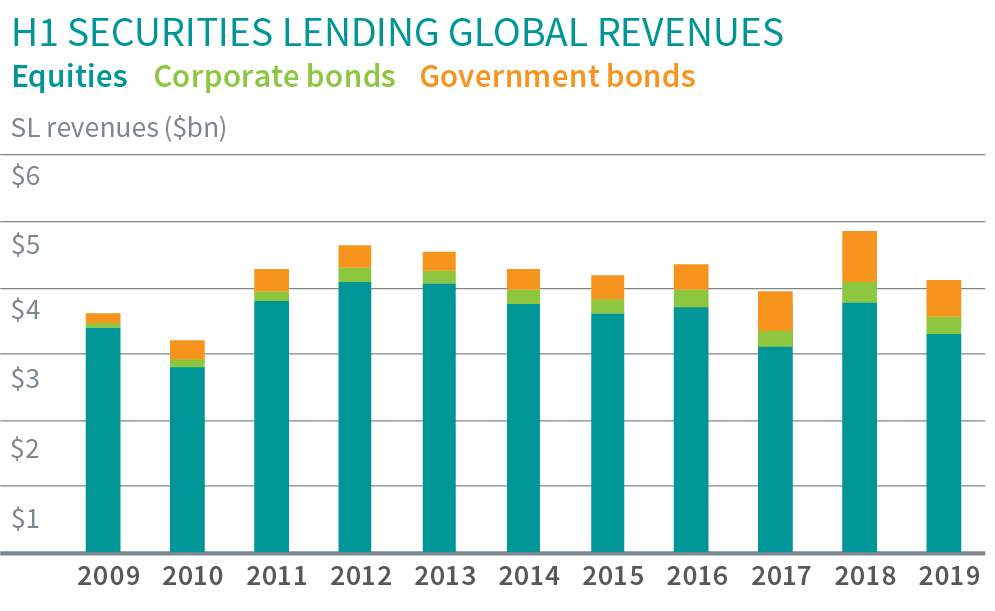

Global securities lending revenues for Q2 2019 came in at $2.59bn, 10% below the average Q2 revenue for the last three years. The largest contributor to the revenue shortfall was European equities, however within that asset class there were some bright spots such as specials demand for UK equities. Total loan balances fell 12% YoY, with the largest driver being declining demand for government bonds. There were some positive developments on the demand side, with an increase in special balances in some of the larger markets along with continued expansion in emerging asset classes.

Equity lending revenues came in at $2.1bn, a decline of 17 percent compared with Q2 2018. Despite the overall decline in revenues, the second quarter did see some signs of life for specials demand after a challenging first quarter. The spate of recent US IPOs made an outsized contribution to equity special balances. The most notable was Beyond Meat, where fees for new borrows exceeded 300% during the 2nd week of June. Those lofty fees made the plant-based meat-alternative the most lending revenue generating security globally for Q2. The other significant revenue generator from the US IPO space was LYFT, which generated $31m in Q2 revenues. Lyft and Uber both attracted significant borrow demand, with loan balances greater than $1bn for each firm, however a larger float kept a lid on Uber fees.

ETF lending revenues continue to underperform relative to 2018, primarily the result of lower fees and balances for high-yield bond funds. While revenues have varied with fees for a few hard to borrow, or create, ETFs, overall borrow demand for the exchange traded products remains robust. ETF loan balances grew 12% YoY and are on pace for highest balances on record through H1. The most revenue generating funds continue to be USD HY credit, broad US equity index, leveraged loans and emerging markets.

Continued in full report via link below.

H1 Global PMI Update

- Global PMI™ holds at lowest since June 2016

- Downside risks to outlook as future expectations hit new survey low

- Weakness spread across developed and emerging markets

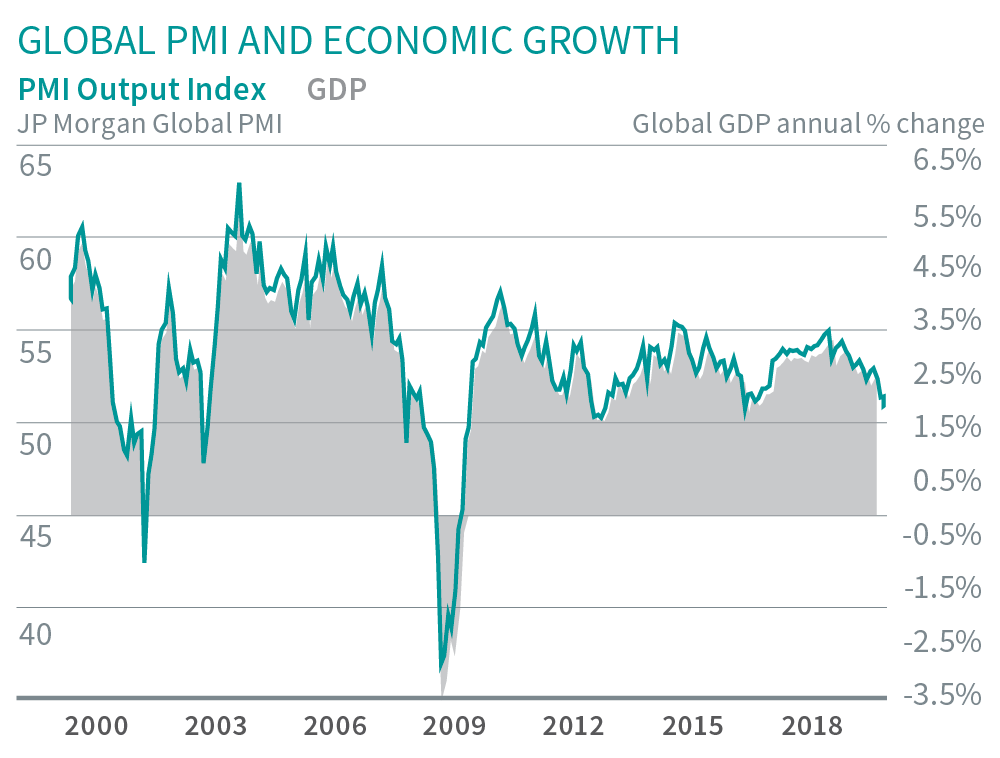

The pace of global economic growth remained stuck at a three-year low in June, according to the latest PMI surveys from IHS Markit, rounding off the worst quarterly expansion since the second quarter of 2016. Both employment growth and cost pressures also hit the weakest since 2016, while future business expectations sank to a new survey low.

A disappointing run of developed world PMI surveys for June concluded the slowest quarter of growth since 2013, with falling output in the UK accompanied by lacklustre growth in the US, Japan and Eurozone, albeit with the latter enjoying the strongest upturn.

Emerging market growth meanwhile hit a three-year low amid a broad-based deterioration in performance among the largest developing economies. Output fell in Brazil and Russia while slower expansions were seen in both China and India.

Continued in full report via link below.

Please join us for a webinar on July 25th where we will discuss the Q2 review and will be joined by special guest Chris Williamson, IHS Markit Chief Business Economist, who will provide an update on global PMIs.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q2-review.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q2-review.html&text=Securities+Finance+Q2+Review+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q2-review.html","enabled":true},{"name":"email","url":"?subject=Securities Finance Q2 Review | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q2-review.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+Q2+Review+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q2-review.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}