Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 24, 2018

Romania cross a turbulent zone while flying with only one engine on

- Decelerating household consumption has become the only growth driver of the Romanian economy in the second quarter of 2018 as investments contracted.

- Household consumption remained strong, but has decelerated. Export growth slowed down as well. On the positive side, FDI inflows rose and export of goods and industrial orders has sustained strong growth, allowing to expect sustained growth momentum in the near term.

- Household consumption will continue to drive economic growth, but unbalanced growth, rising current-account and fiscal deficits, and poor governance are making the country vulnerable to external shocks.

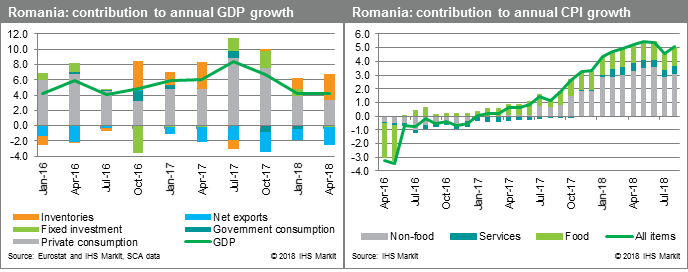

Although quarterly GDP growth accelerated to 1.4% in the second quarter, the detailed data show that gross fixed capital formation contracted in a year. Annual GDP growth remained slightly above 4% in the second quarter and was driven by private consumption. Export growth decelerated and household consumption growth momentum is losing steam as well.

Weak growth composition and poor policies weigh heavily on medium term growth prospects

IHS Markit has been expecting rising investment in 2018, but has also acknowledged the risks associated with its development in our previous forecasts. Romania requires investment in infrastructure and efficiency to sustain its growth potential. However, public investment has been vulnerable this year because of the rising budget deficit, while slowing growth in the eurozone and looming trade war risks, as well as the unpredictable tax environment, may result in lower investment in the private sector as well.

Even though export of goods continued rising at almost 7% y/y in the second quarter, deceleration in export growth was driven by weak volumes in export of services. Trade flows in the region are important determinant of export of services growth as well as export of transport services comprise the largest share of Romanian exports of services. However, country suffers from very poor quality of road infrastructure and weak investment growth does not bode well for further growth. Household consumption, which is supported by procyclical expansionary fiscal policy is now the only growth driver. Romanian economic growth has become even more uncertain because now only one of the growth engines is fully operational.

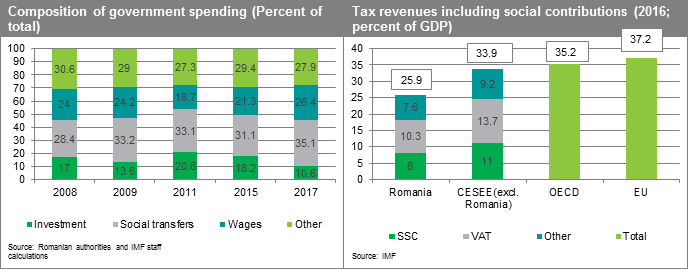

Government policy has not been supportive of long-term sustainable growth. Composition of Romanian public expenditures have been deteriorating lately, with decreasing share of investment while tax collection has been weak as well compared with the peers (see the charts below). At the same time rather weak predictability of tax system may also scare away some of the potential local and foreign investors.

Export growth had been accelerating for the past two years, but the trajectory of unit labour costs (as a performance relative to the rest of 37 industrial countries) has changed and has been trending upwards. Meanwhile, investment in equipment has been weak. Gross fixed capital formation has been growing since 2017 and might have somewhat improved the competitive position of the Romanian industrial sector, but investment disappoints this year again.

Short-term growth potential might still be there, but economy can easily slip

Nevertheless, economy still has some growth potential left. Net wages rose 13% y/y in the first half of 2018, while inflation is expected to slowly recede, although remaining above the central bank target rate in 2018. This means that at least in the short term the Romanian economy will continue to be driven by rather rapid household consumption growth, but its momentum will dwindle. Registered unemployment remained at 3.5% in July, but the number of vacancies has been decreasing this year.

The current-account deficit, which is expected to be at around 4% of GDP in 2018, increased by EUR220 million in the first half of 2018, compared with the equivalent period a year earlier. On the positive side, FDI inflows rose by EUR670 million during the same period. Strong growth in the value of new orders and so far sustained growth momentum in export of goods allow to expect decent growth in industrial production in the near term as well.

Nevertheless, unbalanced growth, rising current-account and fiscal deficits, and poor governance is making the country vulnerable to external shocks and capital outflows. The number of potential risks has been increasing recently. Turbulence in other emerging markets, decreasing investor risk appetite, rising trade barriers, and weakening growth in eurozone might all be potential triggers. In September forecast round, IHS Markit has reduced Romanian GDP growth projection for 2019 from 3.4% to 2.8%, while in 2018 GDP is expected to grow by 3.8% y/y.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fromania-cross-turbulent-zone.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fromania-cross-turbulent-zone.html&text=Romania+cross+a+turbulent+zone+while+flying+with+only+one+engine+on+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fromania-cross-turbulent-zone.html","enabled":true},{"name":"email","url":"?subject=Romania cross a turbulent zone while flying with only one engine on | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fromania-cross-turbulent-zone.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Romania+cross+a+turbulent+zone+while+flying+with+only+one+engine+on+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fromania-cross-turbulent-zone.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}