Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

QUARTERLY

Aug 03, 2015

Power, revenue, and profitability drive groundswell of consolidation in semiconductor industry

A number of high-profile acquisitions by top semiconductor suppliers in the last few months has raised both interest and concern among customers and suppliers alike on the evident accelerating pace of consolidation in the semiconductor industry.

In May, Avago Technologies announced plans to acquire Broadcom for $37 billion, the largest acquisition deal in the history of the technology industry. Avago began growing its business through acquisition with its purchase of LSI in 2014. However, the Broadcom buy is a much larger deal, with Avago acquiring a company larger than itself. Avago said great cost synergies could be realized in the merger, and anticipates saving $750 million annually in 18 months.

The Avago announcement followed a wave of significant mergers and acquisitions (M&A) among top chip suppliers, including NXP and Freescale Semiconductor; Infineon and International Rectifier; Cypress Semiconductor and Spansion; Qualcomm and CSR; Globalfoundries and IBM Microelectronics; and Avago and Emulex. Shortly after the Avago-Broadcom news broke, Intel announced plans to acquire Altera.

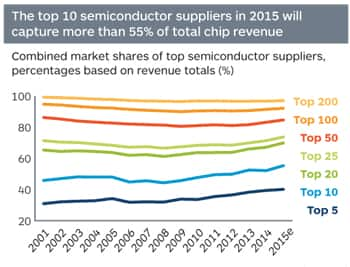

Overall, the semiconductor industry has seen a steady increase in consolidation among the top 10 suppliers since the 2008 economic downturn. Based on announced M&A plans, IHS Technology projects that the top 10 this year will capture 55.3% of the industry's $366.7 billion in estimated annual revenue, up from 44.3% in 2008. Meanwhile, the top 25 in 2015 will capture 74% of total semiconductor revenue, leaving nearly 270 companies to chase the remaining 26%.

One notable benefit of increasing the size of a company is the associated growth in average profit margins as a result of economies of scale, which is essential for an industry that IHS expects will see slower growth in coming years.

The highest level of consolidation can be found in the memory and microcomponent chip segments, with the top five companies accounting for nearly 90% of total revenue in these markets. In comparison, the analog IC, discrete, optical, and sensor markets have seen either minimal consolidation or outright deconsolidation, even though analog ICs could be next to see growth in consolidation activity.

Several factors have driven M&A activity in recent years. Companies are restructuring product lines and market focus, creating a stronger presence in target market segments, and pursuing synergies in creating solutions-oriented offerings. For example, Freescale and NXP ranked third and fourth, respectively, in semiconductor revenue from automotive products in 2014. While Freescale is a leading supplier of microcontrollers for automotive applications, NXP is a top supplier of analog application-specific standard products and discrete components for automotive. Together, however, their complementary portfolios will let both players deliver systems solutions to customers. Their merger could also vault them to the top, displacing Renesas Electronics, the current market-share leader in automotive semiconductors.

Dale Ford is vice president, thought leadership, IHS Technology

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq23-power-revenue-and-profitability-drive-groundswell-of-consolidation-in-semiconductor-industry.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq23-power-revenue-and-profitability-drive-groundswell-of-consolidation-in-semiconductor-industry.html&text=Power%2c+revenue%2c+and+profitability+drive+groundswell+of+consolidation+in+semiconductor+industry","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq23-power-revenue-and-profitability-drive-groundswell-of-consolidation-in-semiconductor-industry.html","enabled":true},{"name":"email","url":"?subject=Power, revenue, and profitability drive groundswell of consolidation in semiconductor industry&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq23-power-revenue-and-profitability-drive-groundswell-of-consolidation-in-semiconductor-industry.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Power%2c+revenue%2c+and+profitability+drive+groundswell+of+consolidation+in+semiconductor+industry http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq23-power-revenue-and-profitability-drive-groundswell-of-consolidation-in-semiconductor-industry.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}