Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 03, 2020

Public Mass-shooting Risk

Companies that operate in the United States face risks of business disruption due to public mass shootings. Whether operations must stop due to a police investigation, the impact on staff and customers, licensing problems, or, though less likely, physical damage, businesses need to understand the risk in order to make mitigation plans.

IHS Markit operates a proprietary database of US public mass-shooting incidents, defined as four or more people injured or killed, not including the perpetrator, that occur in or near commercial or public establishments. Based on these geocoded and metadata tagged records, we are able to draw risk assessments and statistics on the impact of firearm violence on US business operations.

In our second quarterly report we analysed 701 qualifying public mass-shooting attacks that occurred between 1 January 2014 and 31 December 2019, looking at frequency, size, timing, location, and business closure metrics. In addition to risk differentiation by state based on the number and size of public mass shootings, we delivered analysis on attack trends and most likely business closure times in the wake of an incident. We also included a deep dive into unique closure and re-building costs affecting schools following a mass shooting. Here is a selection of analysis from our report.

Key findings:

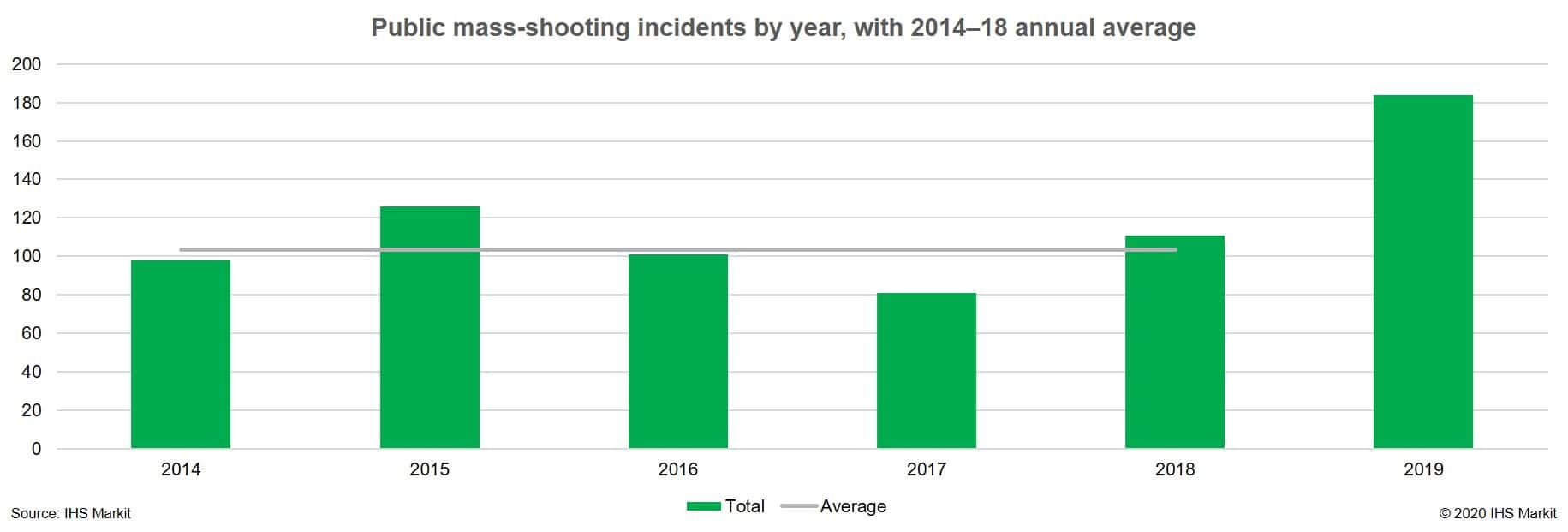

- Public mass-shooting incidents are on an upward trend. IHS Markit recorded 78% more public mass shootings in 2019 than the preceding five-year average.

- Bars, lounges, or nightclubs scored the highest, at 39%, in terms of type of business impacted by a mass shooting.

- Based on the available data (202 of 701 incidents), post-shooting closures of up to one day were the most usual at 36%; however, we recorded five incidents with more than 50 days of closure and almost 20% of the affected businesses closed permanently.

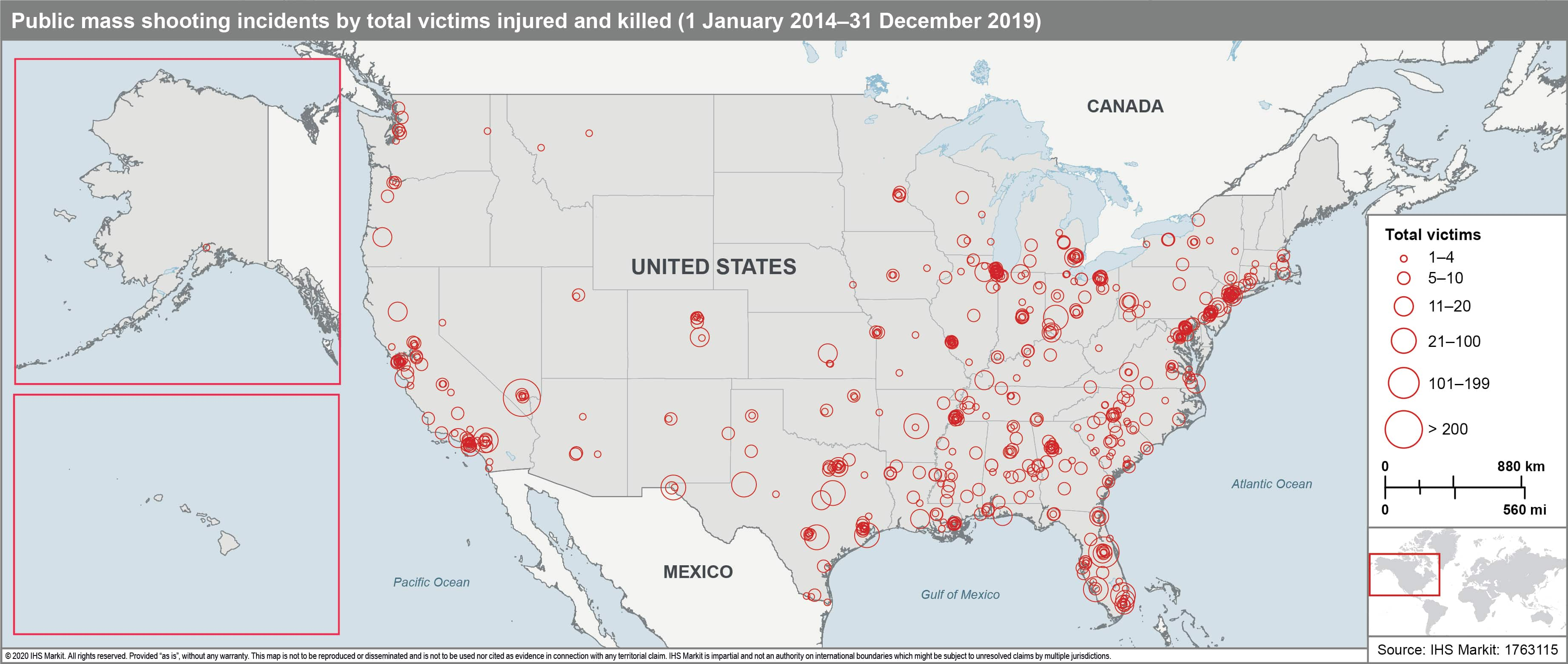

- Although there is a statistically significant correlation between a state's population and the number of public mass-shooting incidents recorded, there is a concentration of states with the highest public mass-shooting incident rates in the southeast.

- All incidents on campuses during school hours resulted in closure time, and we have found a correlation between the number of fatalities and closure days. However, school district approaches to closure and reopening vary, but often include making plans for physical damage repairs, additional campus security personnel and equipment, and reconstruction of buildings heavily associated with the shooting incident.

In 2019, there were 78% more public mass-shooting incidents than the preceding five-year average.

Public mass shootings are on an upward trend according to our data. Increasing from 103.4 incidents per year on average from 2014‒19, up to 184 incidents in 2019 is a significant jump. The increase occurred across several states and at least 14 major cities, including Chicago, which went from two recorded public mass shootings in 2018 to fourteen in 2019.

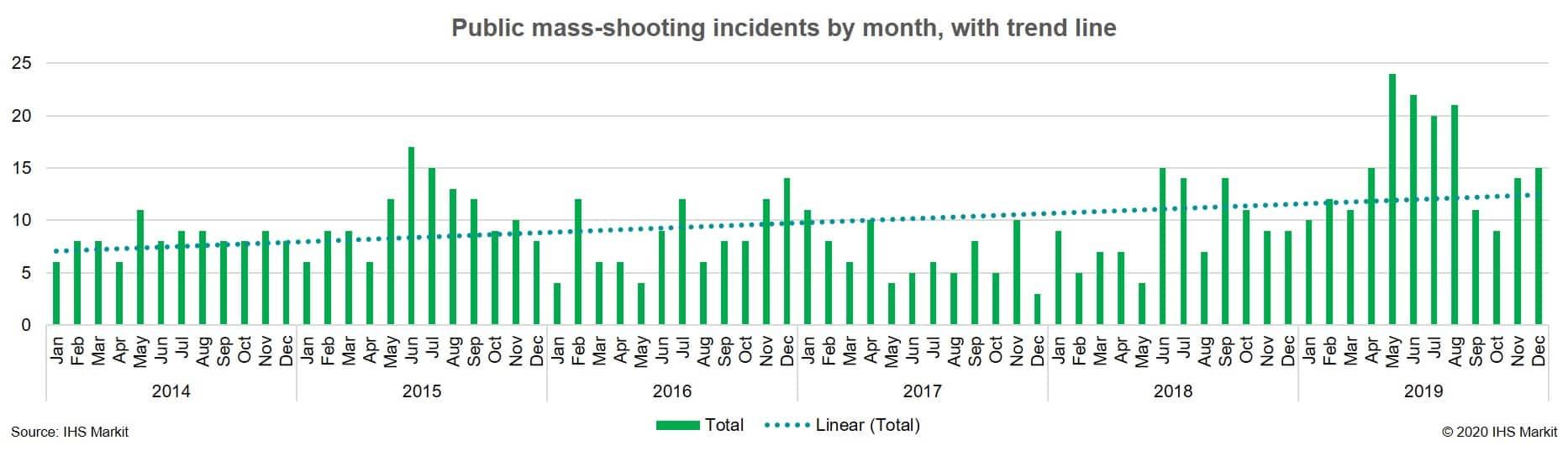

On average there were 9.7 commercial-space mass shooting incidents per month in the collection period (1 January 2014 to 31 December 2019); the trend line shows an increasing incident rate. Incident rates from the record peak in the late spring and summer of 2019 came down, but the final three months of the year continued to show elevated incident numbers, with a monthly average of 12.7 in Q4 2019 (versus 8.3 in Q4 2014; 9 in Q4 2015; 11.3 in Q4 2016; 6 in Q4 2017; and 9.7 in Q4 2018).

Public mass shooting victim totals tend toward the lowest end of the range, with 94.7% of attacks claiming 10 or fewer victims; large attacks (20‒100 casualties) are becoming more common and lead to longer business closures.

Most (50.2%) public mass shootings claimed the minimum four victims (injured or killed), while the next highest category (44.5%) was 5-10 victims. In fact, there is a significant drop off in number of public mass shootings recording more than seven victims. Very large casualty attacks (over 100 victims) are comparatively rare (1.6%), with two between 2014‒19; however, large attacks (20‒100 casualties) are occurring more frequently, with increased capability of shooters, and have a bigger disruptive impact. Our data also shows that longer-term closures of businesses tend to occur following attacks motivated by hate crime or terrorism (school attacks tend to follow a different pattern).

The 12 largest attacks (with 21‒471 victims) occurred in just six states. Notably, Texas had the most, with five (41.7%), though it has just 8.8% of the US population. Florida had the second highest number of large attacks, with three (25%), although it has just 6.4% of the US population.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpublic-massshooting-risk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpublic-massshooting-risk.html&text=Public+Mass-shooting+Risk+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpublic-massshooting-risk.html","enabled":true},{"name":"email","url":"?subject=Public Mass-shooting Risk | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpublic-massshooting-risk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Public+Mass-shooting+Risk+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpublic-massshooting-risk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}