Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 05, 2018

PMI surveys signal Chinese services lead business activity

- Caixin Composite PMI Output Index accelerates to 51.9 in November

- Service business activity recovers notably

- Combined new export business declines, dragged by lower goods export sales amid trade wars

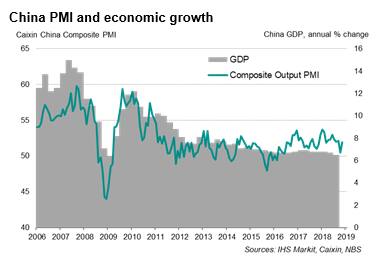

Fears over a sharp slowing in economic growth on the Chinese mainland eased as the latest Caixin service sector PMI rebounded midway through the fourth quarter. The upturn helped offset the subdued manufacturing sector, which has stalled amid ongoing trade frictions.

The survey nonetheless indicates that the underlying rate of growth has cooled again in the fourth quarter, with business confidence about the year ahead also deteriorating as trade war worries exacerbated growing concerns over the weakening demand environment.

Growth rebounds from two-year low

Faster economic growth was signalled in November after the Caixin China Composite PMI™ Output Index (which covers both manufacturing and services) rose from 50.5 in October to 51.9. The rise was the biggest gain (in terms of index points) for over two years, though still failed to regain the ground lost in October, which had seen the index fall to a 28-month low. As such, the average PMI reading for the latest two months puts the fourth quarter on course for the weakest expansion since the second quarter of 2016.

Two-speed economy

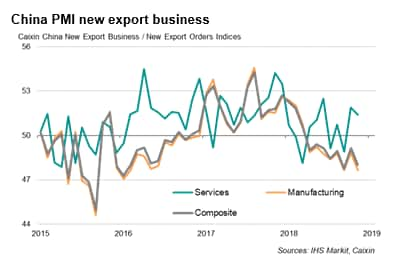

More encouragingly, the survey data hint at the emergence of a two-speed economy. Stalling manufacturing growth caused by declining exports contrasted with faster services expansion, which points to domestic demand playing a greater role in driving economic activity against a deteriorating global trade situation.

Service sector growth accelerated to the fastest since June, buoyed by an improvement in domestic demand and steady services export growth.

In contrast, manufacturing output stagnated in November amid tepid demand conditions, failing to grow for the first time since June 2016.

Rising trade tensions continued to be a source of consternation in the factory sector, reportedly weighing on foreign demand for Chinese manufactured products. New export orders for goods fell at an increased rate, but improved demand from domestic customers helped push overall factory order book growth up to the highest since July.

Despite service sector exports rising solidly, the newly-launched composite new export business index covering both manufacturing and services fell for an eighth consecutive month, as the decline in goods exports overwhelming the gain in exports of services.

Gloomier outlook

Forward-looking indicators urge caution in interpreting November's upturn as the start of a stronger growth phase, suggesting the soft-patch has further to run, though much will of course depend on the developing trade picture. Business expectations about the year ahead deteriorated to the joint-lowest since comparable data were first available in 2012. Optimism was especially weak again in manufacturing, albeit lifting from October's low, mainly reflecting trade war and tariff concerns. However, service sector optimism slipped to the third-lowest recorded since data were first collected in 2005.

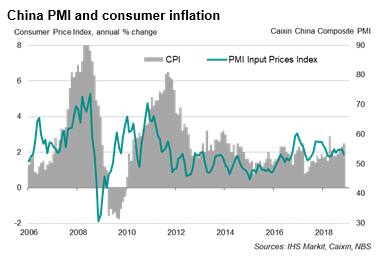

Waning cost pressures

Cost inflation meanwhile abated in November, coinciding with the sharp decline in worldwide oil prices. Brent crude fell over 20% in November. The PMI's input price index was the lowest for six months. Average selling prices were kept steady in the latest survey period. While manufacturers reduced factory gate prices, service sector charges barely rose.

Bernard Aw, Principal Economist, IHS

Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-signal-chinese-services-lead-business-activity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-signal-chinese-services-lead-business-activity.html&text=PMI+surveys+signal+Chinese+services+lead+business+activity+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-signal-chinese-services-lead-business-activity.html","enabled":true},{"name":"email","url":"?subject=PMI surveys signal Chinese services lead business activity | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-signal-chinese-services-lead-business-activity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+surveys+signal+Chinese+services+lead+business+activity+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-signal-chinese-services-lead-business-activity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}