Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 02, 2019

PMI signals deepening UK manufacturing downturn in August

- Manufacturing PMI signals steepest downturn since 2012

- Order books fall at increased rate as export losses deepen

- Job shedding persists as optimism slides lower

- Higher import costs offset weaker global commodity prices

The UK manufacturing downturn intensified in August, as producers reported the steepest drop in new business for over seven years.

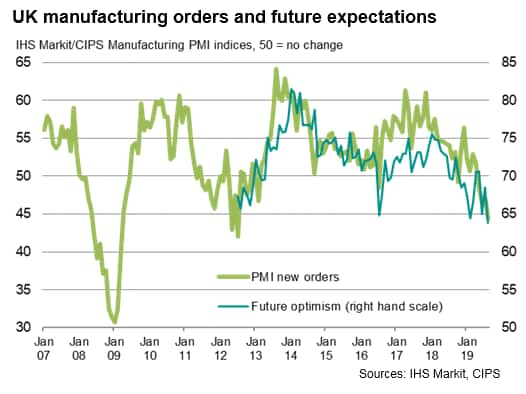

The headline IHS Markit/CIPS UK Manufacturing PMI® dropped to 47.4 from 48.0 in the prior two months, its lowest since July 2012 and indicating the fourth successive monthly deterioration of business conditions. Only on three occasions since the global financial crisis ten years ago has the goods-producing sector reported a steeper rate of contraction.

Output slumps despite stock building

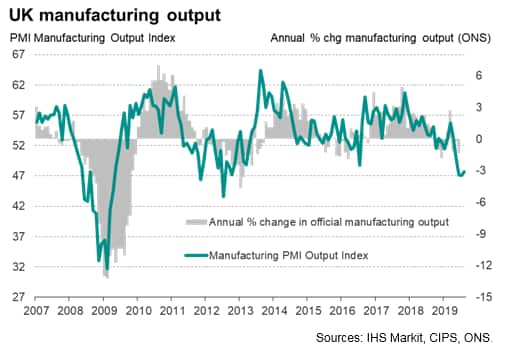

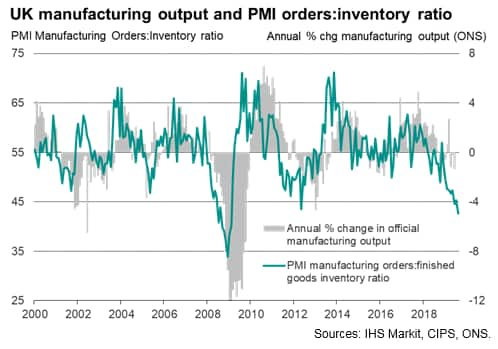

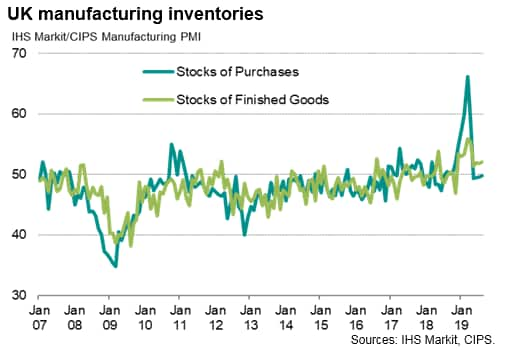

Although the survey sub-indices showed the rate of contraction of output easing slightly in August, the pace of decline remained among the steepest seen over the past decade, commensurate with production falling at an annual rate of over 3%. Moreover, the easing in the rate of output decline primarily reflected stock building ahead of a possible disruptive no-deal Brexit at the end of October. Worryingly, while stocks of finished goods rose, inflows of new orders slumped to the greatest extent since July 2012.

The combination of rising inventories and a steeper rate of loss of new orders sends an increasingly negative signal for future production. The forward-looking orders-to-inventory ratio fell to its lowest since 2009.

While we may continue to see some further stockpiling in coming months as the October 31st Brexit deadline nears, the production trend further ahead looks set to deteriorate markedly from already worrying levels in the absence of a revival in demand.

Exports fall at second-steepest rate since 2009

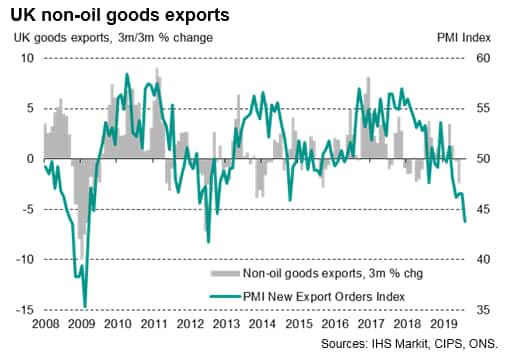

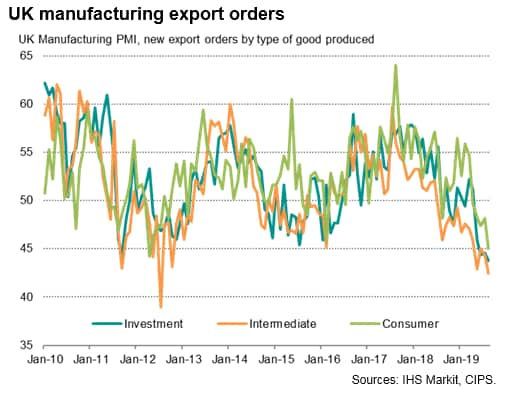

Digging deeper into the new orders data, a key area of weakness was exports, where the latest decline in new orders has been exceeded only once (in 2012) since the height of the global financial crisis. Exports have now fallen in nine of the past 13 months, with the rate of decline gathering substantial momentum in August.

The worsening export trend has coincided with a weakening of global demand since early 2018, but many companies also report that the drop in demand has been exacerbated by uncertainty relating to Brexit. In particular, producers of intermediate goods (inputs supplied to other companies) have reported an especially marked downturn in foreign demand over the past year and into August, in part due to customers reportedly shifting to EU-based suppliers.

Further job losses as optimism slides

The lack of new orders meant backlogs of work likewise fell at one of the sharpest rates seen over the past decade, which in turn encouraged manufacturers to cut headcounts again. Employment fell for the seventh time so far this year, with the rate of job losses continuing to run at one of the steepest seen over the past seven years.

The trimming of headcounts also reflected deepening concerns about the outlook. Firms' expectations of future output deteriorated markedly in August to the lowest since data on future expectations were first collected in 2012. Anecdotal survey replies regarding the outlook were increasingly dominated by worries over the disruptive impact of Brexit as well as concerns over a broader slowing of economic growth at home and abroad.

Weak global demand keeps prices down

Both input prices and selling prices continued to rise, in many cases reflecting higher import costs arising from the depreciation of the pound. However, lower global commodity prices, linked in turn to the cooling of global demand, meant the overall rates of inflation remained among the lowest seen since 2016.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-deepening-uk-mfg-downturn-in-aug19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-deepening-uk-mfg-downturn-in-aug19.html&text=PMI+signals+deepening+UK+manufacturing+downturn+in+August+++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-deepening-uk-mfg-downturn-in-aug19.html","enabled":true},{"name":"email","url":"?subject=PMI signals deepening UK manufacturing downturn in August | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-deepening-uk-mfg-downturn-in-aug19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+signals+deepening+UK+manufacturing+downturn+in+August+++%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-deepening-uk-mfg-downturn-in-aug19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}