Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Aug 22, 2019

Nikkei 225 Dividend Point Index to see tepid growth in 2019

• Nikkei 225 Dividend Point Index estimated to finish the year at 452.47, representing an expected increase of 1.4%.

• Dividend outlook muddled by poor earnings prospects, attributed to the appreciation of the Japanese Yen and the ongoing trade war between the US and China.

• Fanuc unlikely to repeat special dividends in the remaining months of 2019 due to share buyback announced earlier this year.

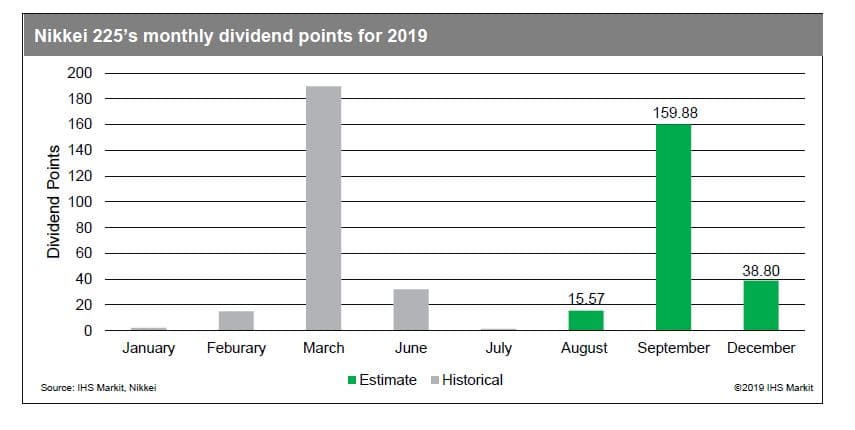

Nikkei 225 Dividend Point Index (DPI) has demonstrated strong growth in recent years; the index increased by 13.9% in 2017 and another 19.7% in 2018 to reach a record high of 446.3. However, we are expecting this growth to moderate in 2019. Due to multiple headwinds, we are forecasting the DPI to end the year at 452.47, representing a modest increase of 1.4%. The muted short-term outlook for dividends stem from poor earnings prospects, which can be attributed to rising trade tension between the US and China, and the strengthening of the Japanese Yen. Various companies have revised their earnings outlook downwards, and we expect 38 companies will report lower dividends this year, almost twice the number of companies that cut their dividends in 2018.

Elsewhere, we highlight that part of this slowing growth is also

attributed to the absence of the one-off special dividends from

Fanuc Corp (Fanuc), which generated 12.8 dividend points in 2018.

Although the company paid another special dividend earlier this

year, the dividend amount was only about half of what was paid last

year. These two one-off payments were paid in lieu of a share

buyback and we see a low likelihood that the robot maker will issue

another special dividend in the remaining months of 2019.

Guided dividends - upside potential if earnings outperform; minimum

downside risk

Guided dividends - upside potential if earnings outperform; minimum

downside risk

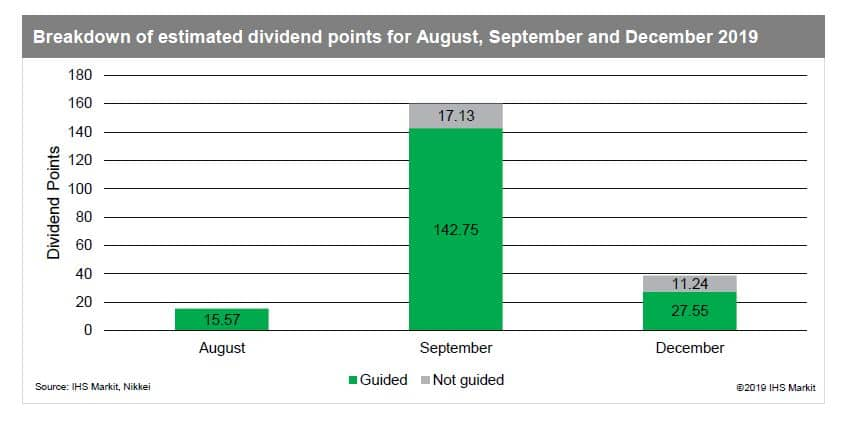

Japanese companies tend to be conservative with their guidance and we noted that companies that distribute actual dividends lower than guidance only represent a tiny fraction of the index constituents. Elsewhere, several companies such as Takeda Pharmaceutical Co, Mitsubishi Electric Corp and Ajinomoto Co typically distribute progressive dividends amid earnings volatility. As such, we see limited downside risk for guided dividends.

Unguided dividends - source of upside potential/downside risk

Companies that do not guide dividends present a key source of risk. In terms of upside potential, we see the likelihood of this occurring to be low as heavyweight stocks that do not provide dividend guidance have mostly underperformed in recent months and have indicated a dull outlook. As such, risk is towards the downside for unguided dividends as earnings may fail to meet expectation due to economic headwinds.

Top Contributors - three points to highlight

1. Fanuc clinched top spot for contribution in 2018 but is set to lose #1 spot in 2019; top three position reshuffles.

Fanuc was the top contributor in 2018 due to the massive special dividend it distributed as this one-off payment generated 12.81 in dividend points. However, we are not expecting any similar specials in the near term. This is mainly due to the share buyback plan announced earlier this year, which would see Fanuc buying back up to JPY 50bn worth of shares from April till October this year. Coupled with the expected ordinary dividend payout for FY20, this buyback would bring its running five-year total return ratio close to the cap of 80%. As such, we see very limited headroom for any similar supplementary special payouts during this ongoing FY.

KDDI Corp regains top spot as dividends in 2019 are projected to come in at JPY 110 per share, representing an increase of 15.8% from 2018. This contrasts from Fanuc and Tokyo Electron Ltd (Tokyo Electron) as both companies are expected to register a fall in dividends this year due to downbeat earnings projections. We are expecting Fanuc and Tokyo Electron to pay JPY 139 and JPY 193 per share for the upcoming FY20 interim dividends.

2. Majority of the risk is focused on the top 10 stocks.

The top 10 contributors represent 30% of the points on average in 2017 and 2018; a dividend surprise from any these companies will have a substantial impact as compared a company that has less weighting in the index. As such, it is imperative for traders to pay closer attention to companies, i.e. Fanuc, Canon and Toyota Motors that do not provide dividend guidance. For 2019, we are expecting the top 10 stocks to generate 132.8 in dividend points, contributing 29.3% to the projected DPI value for 2019.

3. One new entrant.

We are expecting Shin-Etsu Chemical to replace Takeda Pharmaceutical as one of the top 10 contributors in 2019. This stems from the expected jump in Shin-Etsu Chemical's dividends from JPY 175 per share in 2018 to JPY 210 per share in 2019 while Takeda Pharmaceutical is set to keep its dividends flat at JPY 180 per share for the tenth consecutive year. Based on the chemical company's positive dividend outlook, Shin-Etsu Chemical is likely to retain its position as one of the top contributors over the short term.

To access the report, please contact dividendsupport@ihsmarkit.com

Chong Jun Wong, CFA, Senior Research Analyst at IHS Markit

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-225-dividend-point-index-to-see-tepid-growth-in-2019.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-225-dividend-point-index-to-see-tepid-growth-in-2019.html&text=Nikkei+225+Dividend+Point+Index+to+see+tepid+growth+in+2019+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-225-dividend-point-index-to-see-tepid-growth-in-2019.html","enabled":true},{"name":"email","url":"?subject=Nikkei 225 Dividend Point Index to see tepid growth in 2019 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-225-dividend-point-index-to-see-tepid-growth-in-2019.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Nikkei+225+Dividend+Point+Index+to+see+tepid+growth+in+2019+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnikkei-225-dividend-point-index-to-see-tepid-growth-in-2019.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}