Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 13, 2017

New banking report for Morocco

We have launched a banking risk rating for Morocco - 35, in the Medium Risk category, equivalent to BBB+ to BBB- on the generic rating scale. This rating puts Morocco in the same risk category as Kuwait, South Africa, and the United Arab Emirates, among others. Morocco's rating is driven by credit risk, capital, and qualitative risk factors that include large borrower concentration and modest provisioning.

Asset quality is expected to remain stable in the near term; banks continue to face a medium level of credit risk

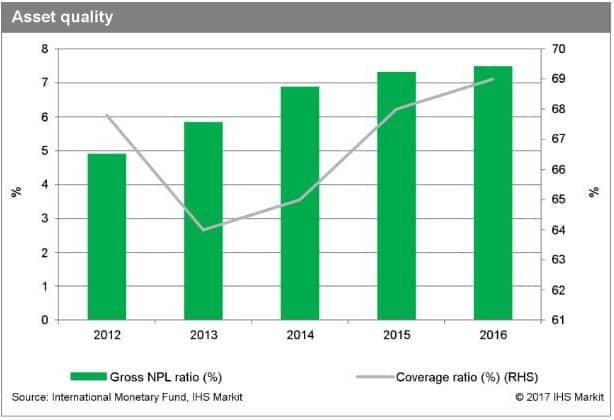

In the near term, asset quality is likely to remain relatively stable as pressure on borrowers ease upon improving economic conditions. The gross NPL ratio has already showed signs of stabilisation since mid-2015, oscillating around 7.5%, after increasing for five years in a row from 4.7% in 2011. This headline ratio underestimates the actual level of impairments on banks' balance sheets because of a favourable treatment of irregular and restructured loans, however. The economic environment will also support lending acceleration in 2017-18. Credit growth is expected to remain at a moderate pace going forward given Morocco's stage of economic development, although some modest credit risk accumulation is likely as banks lower lending standards upon strong competitive pressure. Exposure to large borrowers is the most notable credit risk in our view. According to the International Monetary Fund (IMF), large borrowers - those accounting for at least 5% of banks' Tier 1 capital - represented 297% of the sector's Tier 1 capital as of end-2016. This very large share exposes banks to significant risks from the default of one large borrower. Concentration in the portfolio is also tied to the high share of real estate loans, equivalent to 43% of the sector's total loan portfolio. Moreover, weak payment culture is a notable source of credit risk in Morocco. Corporations typically face significant payment delays, which have increased in 2016 and 2017, hurting their cash flows and their own ability to meet financial obligations, in turn negatively affecting asset quality. On average, payment delays are around 99 days as of 1 September 2017, according to Coface. It is worth noting that state-owned enterprises and local authorities also are weak payers, although since early 2016 a law limiting state-owned firms' payment delays to a maximum of 60 days should help contain new arrears accumulation.

Good capital buffers are under pressure

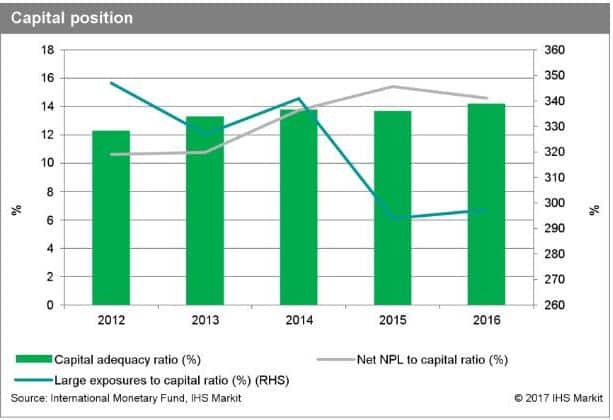

Moroccan banks' headline capital position is good but faces areas of vulnerabilities. As of year-end 2016, the sector's capital adequacy ratio and Tier 1 ratio stood at 14.2% and 11.5% respectively. Banks' capital position is supported by a strong regulatory framework, as Bank Al-Maghrib, the central bank, has set minimum capital requirements above Basel III standards. However, banks' capital position shows sensitivity to relatively weak provisioning and large borrower concentration. The ratio of NPLs net of provisions to shareholders' equity stood around 15% in 2016. Furthermore, large borrower concentration is an additional concern. The IMF revealed that four banks would face capital needs if their largest borrower were to default, and all banks would face such needs if the three largest borrowers were to default on their obligations, for 0.8% and 3% of GDP respectively.

Outlook and implications

A medium level of credit risk, weak asset quality, and the vulnerability of Moroccan banks' capital position are the main risk concerns behind the rating of 35 that we have assigned to Morocco's banking sector. The banking sector has a sound liquidity position, with most funding coming from domestic deposits. In addition, the regulator has set a strong regulatory and supervisory framework, which is regularly subject to improvements that aim to bring standards ever closer to international best practices. The Stable outlook reflects our forecast of near-term asset quality stabilisation and lending revival, supported by improved economic conditions. Economic growth should rebound to 4.3% in 2017 after falling to 1.0% in 2016 as weather conditions and agricultural output normalise from a dismal 2016 season. Faster-than-expected credit growth over a multi-year time horizon, especially if driven by significant easing of lending standards as banks face high competitive pressure, would most likely trigger a change of the rating outlook to Negative. Meanwhile, asset quality recovery and increased provisioning would be expected to prompt a change in the banking sector's rating outlook to Positive. This, coupled with a tightening of the NPLs' definition towards international standards, would further strengthen banks' financial position in a medium-term perspective and potentially lead to a rating upgrade, after the initial negative effect on the sector's gross NPL ratio and prudential capital ratios have been absorbed.

Camille Chavrier is an Economist for the Banking Risk service at IHS Markit

Posted 13 November 2017

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-banking-report-for-morocco.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-banking-report-for-morocco.html&text=New+banking+report+for+Morocco","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-banking-report-for-morocco.html","enabled":true},{"name":"email","url":"?subject=New banking report for Morocco&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-banking-report-for-morocco.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+banking+report+for+Morocco http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-banking-report-for-morocco.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}