Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

SPECIAL REPORTS

Jun 03, 2019

Limited Partner Perspective: The Evolution of LP Reporting and Analytics

The way LPs use data to drive decision-making is changing dramatically. But what types of data are they demanding, and what insights are they generating from it? Experts from Cambridge Associates and IHS Markit explore the current state of reporting and analytics among today's investors.

A number of factors have impacted the way investors approach reporting and analytics. ILPA has considerably broadened the types of data investors are requesting from their GPs, and the competition for investment has given LPs more power to demand customized reporting that suits their specific needs. At the same time, analytic technologies have matured, enabling LPs to use the data more effectively.

The trend has left many GPs struggling to understand what LPs really need and what they're actually doing with the data. Jess La Roche, Director at Cambridge Associates, and Paulo Nunes, Director LP Market Strategy at IHS Markit, share their insights on the rapid evolution of LP reporting and analytics.

Requirements vary widely from LP to LP

According to La Roche, many factors influence a specific LP's data requirements."The size and age of the portfolio, the size of the staff, and the amount of scrutiny that the LP's decisions are subjected to by various stakeholders all impact its data requirements," she said.

"Newer, smaller private investors may not need a lot of data as they are just starting their program and may not have resources in place to collect, monitor and analyze large quantities of data. Investors with a larger staff, however, may have both the need and the resources to use the data to understand the portfolio and gain insights on a deeper level."

She also pointed out that some investor types, such as public pensions, need to meet very specific needs around reporting, which leads to a greater need for data.

LPs seek data in four key categories

In his role at IHS Markit, Nunes has an opportunity to interact with a wide range of investors across the private markets."The need for a more comprehensive analysis is increasing the appetite for data," he agreed. "Investors are taking a more active role in the management of their investment portfolio, and that requires more visibility and control."

Nunes classified the most critical investment data for LPs into four key categories:

- LP fund information that tracks the overall commitment and value of the LP's holdings includes data such as capital calls, distributions, and quarterly net asset value.

- Fund investment information that sheds light on the performance of the portfolio companies can be extracted from the schedule of investments and investment updates.

- Company operating data enables LPs to analyze the financial performance and valuation metrics of the individual portfolio companies.

- Market data such as benchmarks or other information that is not specific to funds in the LP's portfolio helps LPs contextualize their investment performance within the broader market.

The evolution of LP analytics

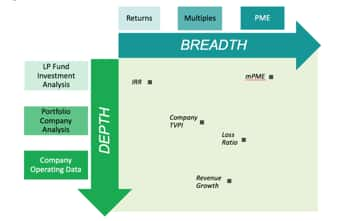

The types of analysis and reporting that LPs perform on their investments has evolved in recent years. Historically, LPs focused on net IRR, but they are starting to ingest and analyze broader and deeper data sets in order to analyze the portfolio on a "net to LP" level.

IRR is still the first stop along the way, with LPs using their capital call and distribution notices and capital account statements to calculate this metric, but more and more investors want to be able to go further. They seek to gain greater insight into their investments by collecting PME data from multiple sources in order to benchmark their performance. And a growing number of LPs are digging deeper and looking not only at the gross portfolio performance of funds and associated data points there, but at loss ratios and operating data.

What insight are LPs seeking?

LPs who collect a broader and deeper array of investment data are using it to help them achieve several key investment objectives:

- Performance insight.LPs are using market data to help them understand their portfolio performance—both good and bad—in relation to the broader market.

- Value creation.LPs are using data to understand the true value a GP is providing, determine whether the GP's fund perspective lines up with theirs, and decide whether or not to continue to invest.

- ESG/governance. LPs are examining company-level data to ensure it aligns with their broader investing goals.

- Risk analysis.LPs are analyzing performance metrics such as loss ratios to understand, on a deeper level, the potential risks their current holdings may be exposing them to.

Bridging the data gap

GPs are still playing a game of catch-up when it comes to delivering a deeper level of investor reporting, and sophisticated investors who have evolved beyond IRR can experience difficulties in collecting the data they need. While capital call and distribution notices and capital account statements are easy to come by, investment-level data and company operating data are not.

The LPs at the forefront of this data-driven approach are part of a broader trend towards greater transparency and sophistication across the private markets. To stay relevant and responsive to the needs of the LP community, GPs need to be able to adjust their data-collection and reporting processes to meet rapidly evolving expectations. As the data requirements of increasingly sophisticated LPs continue to mature, it will require GPs to rethink the supporting processes and technologies that support the firm's data-collection and reporting activities.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flimited-partner-perspective-the-evolution-of-lp-reporting-and-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flimited-partner-perspective-the-evolution-of-lp-reporting-and-.html&text=Limited+Partner+Perspective%3a+The+Evolution+of+LP+Reporting+and+Analytics+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flimited-partner-perspective-the-evolution-of-lp-reporting-and-.html","enabled":true},{"name":"email","url":"?subject=Limited Partner Perspective: The Evolution of LP Reporting and Analytics | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flimited-partner-perspective-the-evolution-of-lp-reporting-and-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Limited+Partner+Perspective%3a+The+Evolution+of+LP+Reporting+and+Analytics+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flimited-partner-perspective-the-evolution-of-lp-reporting-and-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}