Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 05, 2018

Initial eurozone GDP estimates to be revised, in line with PMI

- Initial GDP estimates tend to underestimate growth in periods of strong expansion

- PMI-based estimates can provide an accurate guide to final GDP numbers

- Survey data signal 1.0% quarterly GDP growth rate in January, though initial estimates could signal 0.8%

At 58.8, the final Eurozone PMI for January 2018 came in slightly higher than the earlier flash estimate, registering the strongest monthly expansion since June 2006.

A regression-based model suggests that, if this level is maintained on average in February and March, the PMI is indicating that first quarter GDP would rise by approximately 1.0%.

The official initial estimate of GDP is likely to come out weaker than this, however, following the trend of recent releases which show weak initial estimates to be subsequently revised higher (and more in line with the PMI).

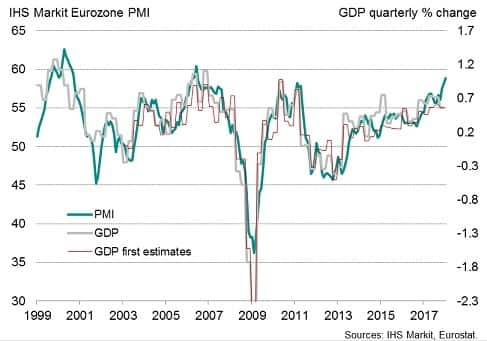

Eurozone PMI v GDP estimates

For the same reason, the 0.6% GDP rise signalled by Eurostat’s preliminary flash estimate for the fourth quarter of 2017 is likely to be revised higher, most likely to approach the 0.8% signalled by the PMI.

To illustrate, in early-2017 the PMI was signalling a strong upturn in the eurozone, boding well for an impressive year of economic growth. Our PMI model pointed to a 0.6% rise in 2017 Q1 GDP. The preliminary flash estimate from Eurostat merely showed a 0.46% gain. However, this has since been revised up to 0.63%, representing an upward revision of 0.17%.

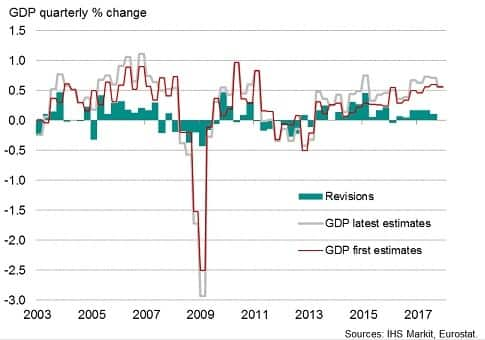

Eurostat Eurozone GDP revisions

Similarly in the second quarter of 2017, an initial estimate of 0.56% GDP growth has since been revised higher to 0.73% (a +0.16% revision). That compared with a PMI signal of 0.75%.

So far, third quarter 2017 GDP growth has been revised up from an initial estimate of 0.6% to 0.71%. The PMI had signalled a 0.67% rise.

Hence we expect fourth quarter 2017 GDP growth to be revised higher from the initial 0.6% estimate, and for first quarter 2018 GDP to initially disappoint relative to the PMI signal by around 0.2% (i.e. 0.8%).

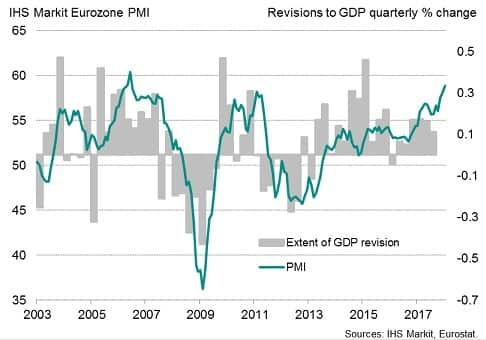

GDP revisions and the PMI

It is by no means a straightforward process of estimating the error in Eurostat flash estimates. As our chart shows, the official early estimates of GDP tend to be revised higher at times of strong growth and revised lower during downturns or periods of weak growth.

Unlike GDP data, PMI data are not revised after initial publication. However, early official GDP estimates are based on incomplete data for the quarter, often including data for only the first two months of the calendar quarter. In the case of the eurozone, data for some countries are also not available at the time of the preliminary flash release. Any data that are available may also contain initial calculation errors.

The scope for revision is therefore often quite substantial. The recent revision history of eurozone GDP data show that the absolute error (i.e. ignoring positive or negative signs) since 2003 has been 0.18%, ranging from +0.47% to -0.43%.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finitial-eurozone-gdp-estimates-to-be-revised-in-line-with-pmi.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finitial-eurozone-gdp-estimates-to-be-revised-in-line-with-pmi.html&text=Initial+eurozone+GDP+estimates+to+be+revised%2c+in+line+with+PMI","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finitial-eurozone-gdp-estimates-to-be-revised-in-line-with-pmi.html","enabled":true},{"name":"email","url":"?subject=Initial eurozone GDP estimates to be revised, in line with PMI&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finitial-eurozone-gdp-estimates-to-be-revised-in-line-with-pmi.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Initial+eurozone+GDP+estimates+to+be+revised%2c+in+line+with+PMI http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finitial-eurozone-gdp-estimates-to-be-revised-in-line-with-pmi.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}