Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 31, 2019

Indonesian manufacturing upturn gathers momentum midway through the second quarter

- Nikkei Indonesia Manufacturing PMI™ rises to nine-month high

- Renewed growth in new orders

- Optimism surge to highest in over two years

The pace of Indonesia's manufacturing growth gained momentum in May, according to the latest PMI™ survey data, boding well for the economy in the second quarter after a disappointing performance in the opening three months of 2019. The survey also indicated a surge in business optimism about the year ahead, pointing to a brightening economic picture for the second half of the year in a post-election environment.

Manufacturing upturn gains pace

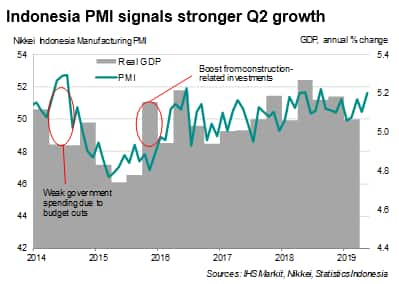

The Nikkei Indonesia Manufacturing PMI™ rose from 50.4 in April to 51.6 in May, its highest in nine months and signalling a further improvement in manufacturing conditions. The headline PMI, a composite indicator derived from various survey sub-indices, provides a quick snapshot of the health of the manufacturing economy, though also acts as a useful indicator of growth in the overall economy.

The average PMI reading of 51.0 so far in the second quarter is the highest since the third quarter of 2018, therefore hinting strongly at an acceleration of GDP growth after the annual rate of growth slowed to 5.1% in the first quarter.

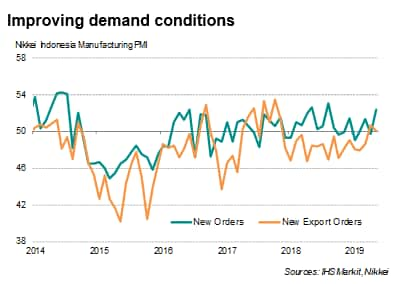

Survey sub-indices provided evidence that the manufacturing upturn has more room to run in coming months. A dip in demand conditions during April proved short-lived, with new order intakes increasing in May at the fastest pace since last August.

Firms responded to greater demand by scaling up production. Output growth midway through the second quarter was the strongest for a year. With production rising, firms raised purchasing activity which, in turn, boosted input stock levels.

Optimism highest for over two years

The cherry on the cake was a significant surge in optimism. This was indicated by the Future Output Index rising to its highest since February 2017, with a large majority of survey participants expecting their firms to be producing higher output over the next 12 months. This index also registered the largest monthly rise (an increase of 15.6 points) since data on this indicator were first available in early 2012. Firms expect higher sales projections, greater marketing activity and anticipated post-election stability to drive production.

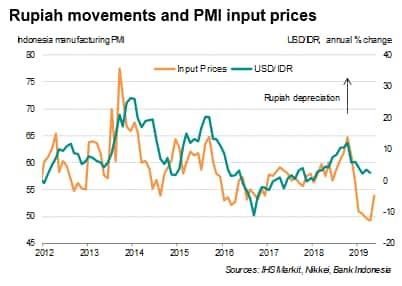

Higher prices

Stronger demand conditions were accompanied by increased inflationary pressures. Input costs rose for the first time since February, increasing at the fastest rate so far this year, driven by a weaker rupiah and greater costs for raw materials. Consequently, higher expenses led Indonesian manufacturers to raise average selling prices.

Policy

The sustained manufacturing upturn, as reflected in recent PMI surveys, suggest that the goods producing sector should help drive faster economic growth in the current quarter, with domestic demand being an increasingly important driver of business activity. The latest PMI reading is consistent with GDP growth at an annual rate of 5.2%.

This should come as a welcome relief for Indonesian policymakers at a time of slowing global growth and renewed trade war fears. In particular, Bank Indonesia will have more time to consider if monetary support is needed, especially when a recent depreciation in the rupiah and the country's widening trade deficit constrain the extent to which monetary policy can be loosened.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

For more information about the PMI surveys and the Nikkei PMI for Indonesia, please contact economics@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findonesian-manufacturing-upturn-gathers-momentum.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findonesian-manufacturing-upturn-gathers-momentum.html&text=Indonesian+manufacturing+upturn+gathers+momentum+midway+through+the+second+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findonesian-manufacturing-upturn-gathers-momentum.html","enabled":true},{"name":"email","url":"?subject=Indonesian manufacturing upturn gathers momentum midway through the second quarter | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findonesian-manufacturing-upturn-gathers-momentum.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Indonesian+manufacturing+upturn+gathers+momentum+midway+through+the+second+quarter+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findonesian-manufacturing-upturn-gathers-momentum.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}