Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 05, 2019

IHS Markit US PMI hints at weak economic growth persisting into third quarter

- Uplift in services PMI does little to change picture of lacklustre GDP growth at start of third quarter

- Manufacturing slowdown gathers pace

- Future business expectations hit new low

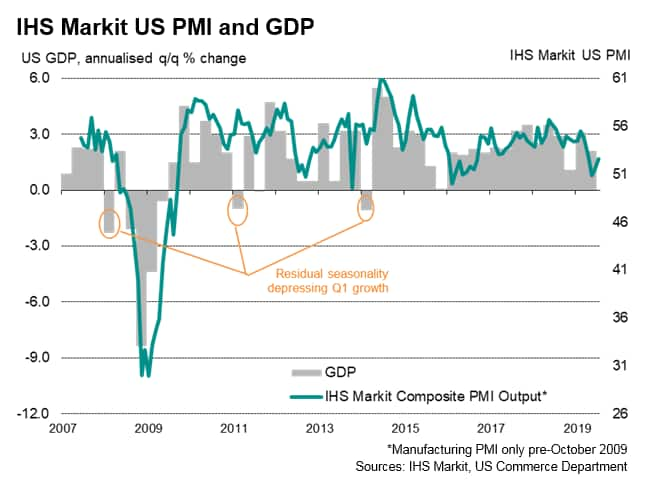

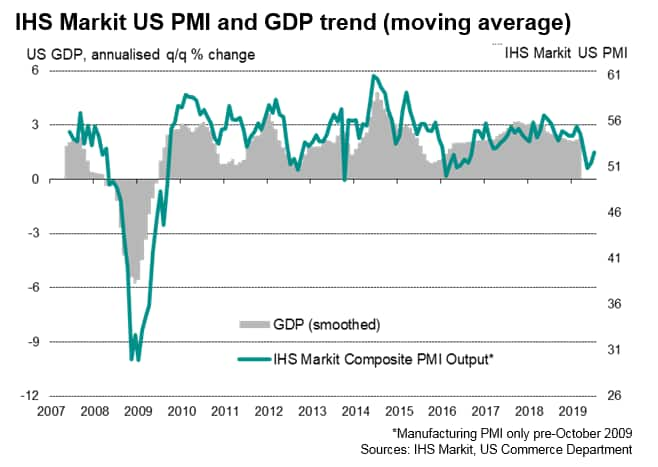

The pace of US economic growth slowed in the second quarter, and PMI survey data hint that the expansion could remain relatively lacklustre in the third quarter.

An improvement in the overall rate of services sector business activity growth signalled by the IHS Markit Services PMI for July is welcome news, with firms reporting the quickest increase in activity for three months. Inflows of new business meanwhile grew at the fastest rate since March.

However, although this represents an improvement on the average pace of expansion seen in the second quarter, July's rate of growth of services activity remained markedly weaker than seen in the first quarter.

Moreover, the services PMI data follow news that the manufacturing sector reported its toughest month since 2009 in July. The IHS Markit survey is indicative of manufacturing production falling at an annualised rate in excess of 3% and flirting with recession, led lower by a deterioration in exports.

Taken together, the weighted average of the PMIs for manufacturing and services points to GDP expanding at an annualised rate of under 2% in July, below the 2.1% gain seen in the second quarter and among the weakest rates recorded over the past three years.

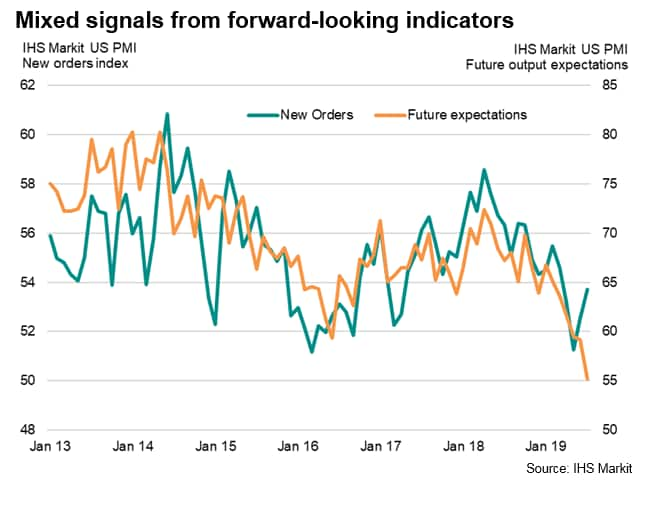

Although new order inflows picked up at the aggregate level across both sectors, companies grew increasingly cautious about the longer-term outlook. Trade war worries and wider geopolitical jitters, as well as growing concerns that the economic cycle has peaked, pulled the survey's future expectations index to the lowest since comparable data were first available in 2012. Hiring has meanwhile been hit, in line with the deterioration in confidence about the business outlook. The monthly gain in employment recorded in July was unchanged on the 26-month low seen in June.

The drop in confidence suggests downside risks have increased in the near-term at least, hinting that the upturn in growth seen in July could prove short-lived and hence adding to signs that GDP growth could remain disappointingly modest in the third quarter. Much will depend on trade war developments, and the ability of the service sector to sustain growth and offset the manufacturing slowdown.

Further reports:

- Analysis of the July flash US PMI surveys

- IHS Markit US PMI signals greatest pressure on corporate earnings since 2016

- Using the PMI to nowcast US GDP

For more information contact economics@ihsmarkit.com.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-us-pmi-hints-at-weak-economic-growth-persisting-into-Q3-aug19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-us-pmi-hints-at-weak-economic-growth-persisting-into-Q3-aug19.html&text=S%26P+Global+US+PMI+hints+at+weak+economic+growth+persisting+into+third+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-us-pmi-hints-at-weak-economic-growth-persisting-into-Q3-aug19.html","enabled":true},{"name":"email","url":"?subject=S&P Global US PMI hints at weak economic growth persisting into third quarter | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-us-pmi-hints-at-weak-economic-growth-persisting-into-Q3-aug19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+US+PMI+hints+at+weak+economic+growth+persisting+into+third+quarter+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-us-pmi-hints-at-weak-economic-growth-persisting-into-Q3-aug19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}