Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 14, 2019

IHS Markit Fair Value Case Study - Japan Golden Week

Fair Value Event: Japan Golden Week Exchange Holiday

April - May 2019

IHS Markit Fair Value in Review

When market quotations are not readily available, such as when a foreign security's primary market is closed, many funds switch to fair value pricing. Using fair value pricing ensures that long-term investors in the fund benefit from the most accurate share price possible. IHS Markit provides an independent fair value service that calculates the best estimate of stock and bond prices outside of active trading hours.

The following case study provides an analysis of fair value results for the Japan Golden Week stock exchange closure that spanned six days from 29 April to 6 May 2019 and included several consecutive national holidays. In the absence of readily available quotes for Japanese securities during this holiday, IHS Markit provided fair value prices for Japanese securities to enable investors, primarily mutual funds with Japanese exposure, to calculate their net asset values (NAVs) accurately.

IHS Markit Fair Value Results

Throughout the Japanese stock exchange holiday, IHS Markit continued to provide fair value prices, calculated using patent-pending multi-factor methodology, for 3000+ Japanese securities. Global, regional, sector, and entity specific factors were used to indicate macro and micro level risks. The most common input factors in the IHS Markit Japanese fair valuation models included:

- Nikkei Futures

- Japan ADRs

- S&P Futures

- Sector ETFs

- Currency JPY.USD

Table 1: Average Accuracy Statistics for Japan Securities

The values above are below our typical range, given small market movement during this period.

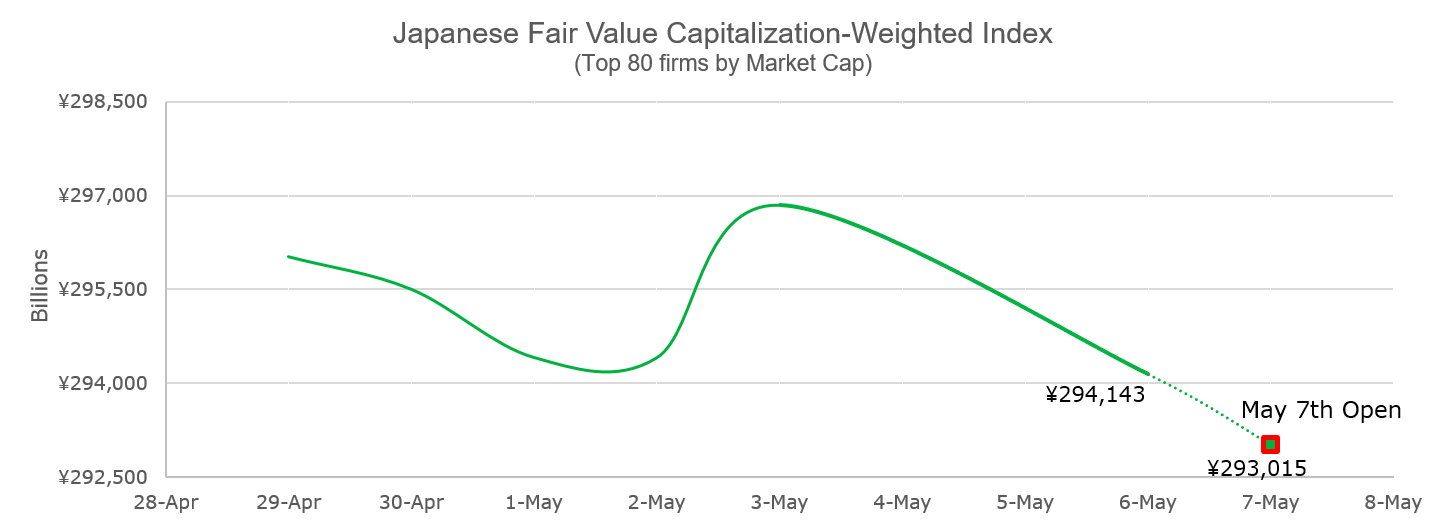

Top 80 Large Caps in Aggregate

The chart below tracks the Japanese market movement during Golden Week using our fair value prices for the 80 largest Japanese firms by market capitalization. The prices are aggregated using a capitalization weighted index calculation method similar to that of the Nikkei 225 or S&P 500. Each firm is weighted by its market capitalization and aggregated for a total value in billions of yen. The value for 7 May uses the actual open prices that mark the end of Golden Week.

<span/>Extraneous Events and the Nikkei Futures

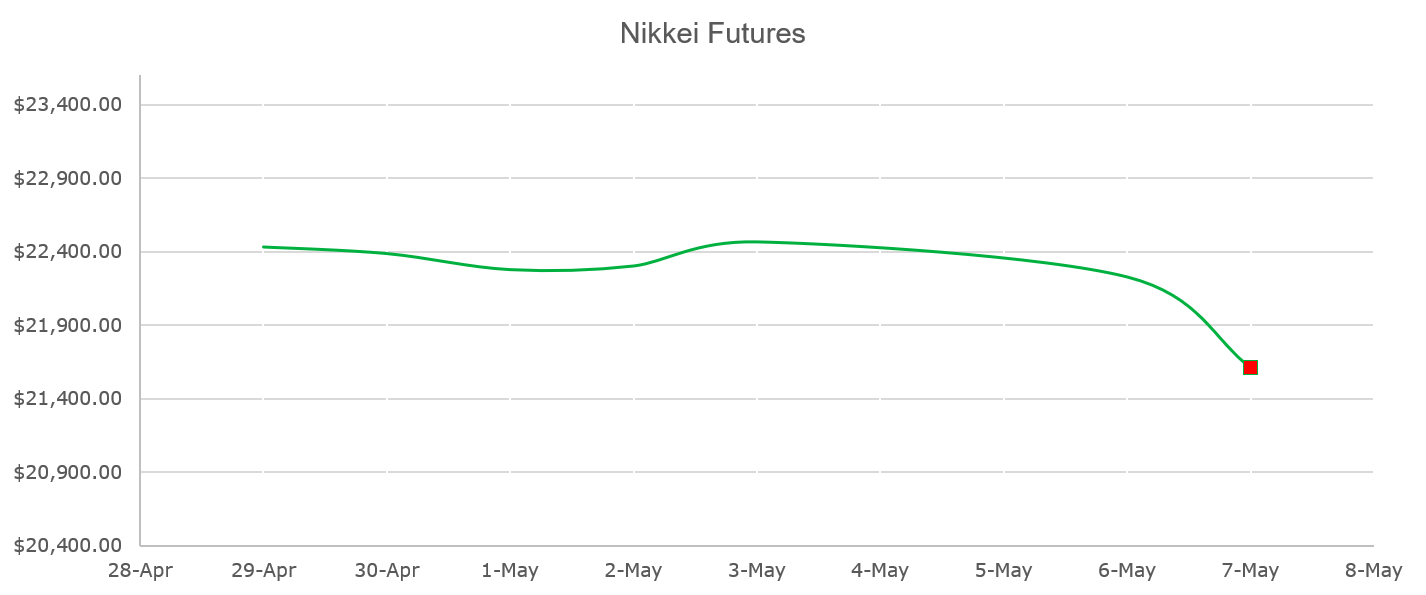

During the exchange closure, the movement of the Nikkei Futures Index reflected the overall movement of the Japanese market. As such, this country specific factor is one of the most common factors used to calculate our fair value prices for Japanese securities. From the start of Golden Week on Monday 26 April through Friday 3 May, the Nikkei Futures rose 1%. The weekend of 4-5 May, the U.S. president announced a new round of tariffs on Chinese goods. This extraneous event resulted in a 1% decrease in the Nikkei Futures overnight, and the gains made over the entire previous week were lost.

<span/>As a result, our fair value weighted aggregate for the 80 largest Japanese firms rose slightly over 1% from 26 April to 3 May and dropped just under 1% over the weekend.

Table 2: Return Statistics for Nikkei Futures and Fair Value Market Cap Aggregate

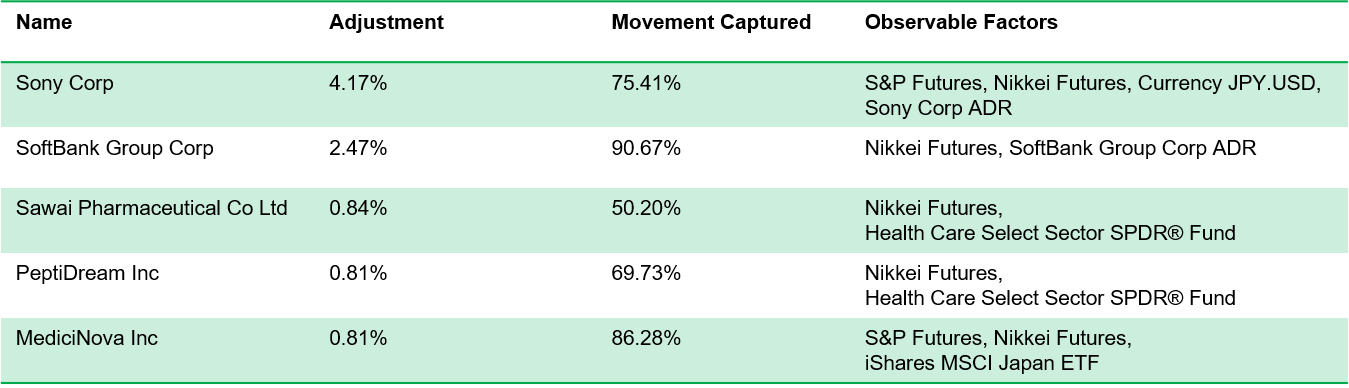

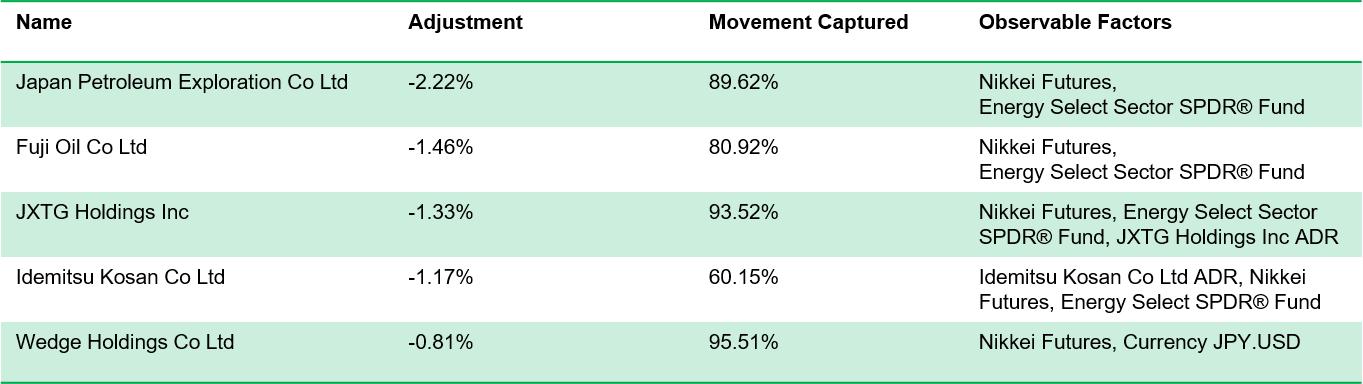

<span/>Tables three and four below highlight securities that were fair valued and captured significant movement.

Table 3: Fair Value Adjustment Up

Table 4: Fair Value Adjustment Down

Related Reading

- The Value of Fair Value Beyond Compliance

Fair Value Pricing Case Study: Istanbul Stock Exchange Closure August 2018

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-fair-value-case-study-japan-golden-week.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-fair-value-case-study-japan-golden-week.html&text=S%26P+Global+Fair+Value+Case+Study+-+Japan+Golden+Week+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-fair-value-case-study-japan-golden-week.html","enabled":true},{"name":"email","url":"?subject=S&P Global Fair Value Case Study - Japan Golden Week | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-fair-value-case-study-japan-golden-week.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+Fair+Value+Case+Study+-+Japan+Golden+Week+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-fair-value-case-study-japan-golden-week.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}