Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 24, 2018

Eurozone off to flying start in 2018 as PMI shows fastest growth for nearly 12 years

- Flash Eurozone PMI at 58.6 in January, highest since June 2006

- Survey data signal 1.0% quarterly GDP growth rate

- Strong gains seen in France and Germany while rest of region enjoys best growth since mid-2006

- Job creation highest since September 2000

- Prices rise as fastest rate since April 2011

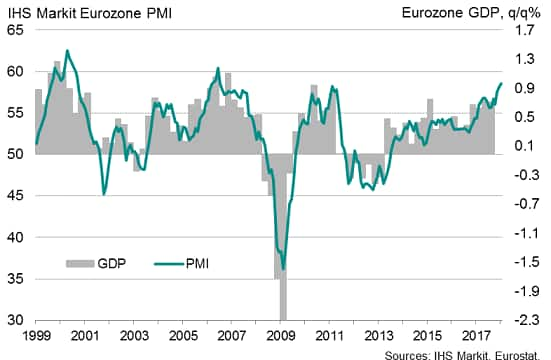

The latest survey data indicate that the eurozone has got off to a flying start in 2018. Business activity is expanding at a rate not seen for almost 12 years. The headline IHS Markit Eurozone PMI rose to 58.6 in January, according to the ‘flash’ estimate (based on approximately 85% of final replies), up from 58.1 December and its highest since June 2006.

Historical comparisons, based on a simple regression model, suggest that the acceleration of growth pushes the survey data into territory consistent with the economy expanding at a quarterly rate approaching 1%.

Eurozone economic growth

The upturn is also encouragingly broad-based. Service sector growth accelerated to the fastest since August 2007 amid higher business and consumer spending. While manufacturing growth edged lower, it would be wrong to see this as a sign of industrial weakness: the latest three months have seen the strongest factory output increase since 2000.

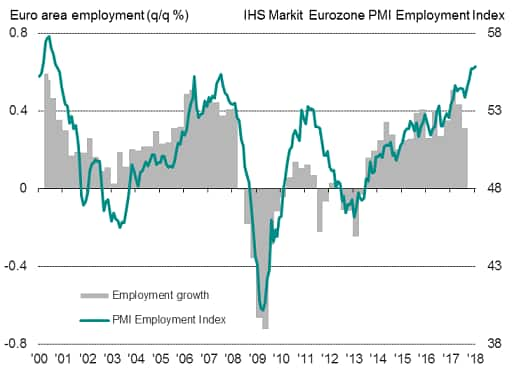

Growth has fuelled demand for labour as firms expand capacity, adding to positive signs for the upturn to become increasingly self-sustaining. The January surveys showed employment growing at the fastest pace for 17 years. An improving labour market should feed through to higher consumer spending, which should help further drive the economic upturn as 2018 proceeds, as well as higher wages.

Eurozone employment

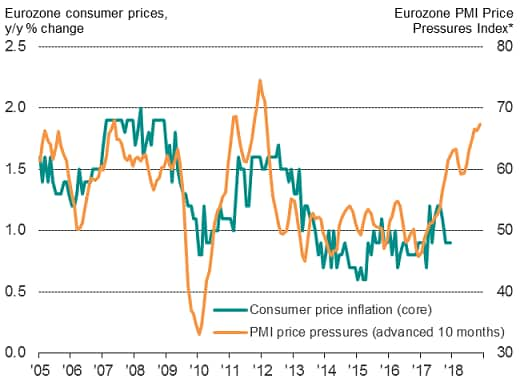

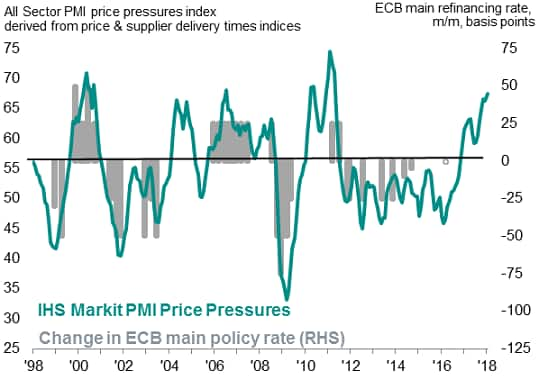

Price pressures are meanwhile running at their highest for almost seven years, accelerating further at the start of 2018 according to the flash PMI results. Higher oil prices have pushed up costs, but pricing power more generally has improved as demand outstrips supply for many goods, leading to a sellers’ market.

Eurozone inflation

Broad-based upturn by region

By country, growth in Germany came in only slightly weaker than December’s peak, which had been the highest since April 2011, though future optimism ticked higher, and both jobs growth and price pressures hit near seven-year highs. Growth was led by manufacturing, though the expansion of service sector activity accelerated in January. The January PMI data are historically consistent with German GDP rising at a quarterly rate of just over 1%.

In France, the composite PMI ticked higher, albeit down on November’s peak. The latest three months have seen France’s best growth spell since the spring of 2011 and the strongest employment gain since mid-2001, albeit with the pace of job creation cooling slightly in January. Price pressures rose to the highest since 2011. The January PMI data are historically consistent with French GDP rising at a quarterly rate of 0.8%.

Elsewhere, business activity rose at the fastest pace since July 2006, with manufacturing recording the strongest monthly increase in output since April 2000. Service sector growth accelerated but remained below some of the peaks seen last year. Prices charged rose at the steepest rate for nearly a decade.

Forecast revisions?

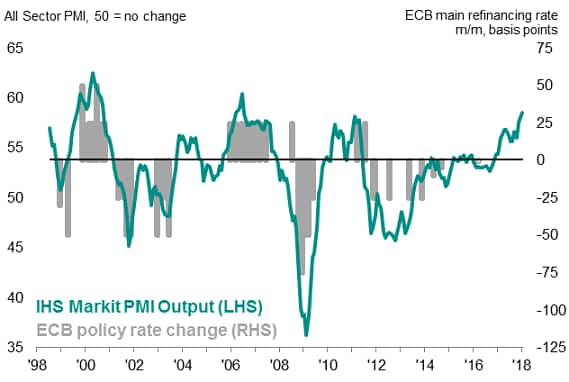

With such a strong start to the year, expect to see forecasters mark up their expectations of eurozone growth and inflation in 2018, and for policymakers to sound more hawkish.

Assuming the survey indicators remain strong during the opening quarter, such a solid start to the year would significantly add to the chances of the eurozone economy expand by considerably more than 2% in 2018.

ECB policy and business activity

ECB policy and PMI price pressures*

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flying-start-2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flying-start-2018.html&text=Eurozone+off+to+flying+start+in+2018+as+PMI+shows+fastest+growth+for+nearly+12+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flying-start-2018.html","enabled":true},{"name":"email","url":"?subject=Eurozone off to flying start in 2018 as PMI shows fastest growth for nearly 12 years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flying-start-2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+off+to+flying+start+in+2018+as+PMI+shows+fastest+growth+for+nearly+12+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flying-start-2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}