Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 09, 2020

Daily Global Market Summary - 9 November 2020

European equity markets closed significantly higher across the region, with major APAC markets also higher on the day. Most US equity indices closed higher except for tech on the announcement of a positive COVID-19 vaccine trial and Joe Biden being declared the winner of the US presidential election over the weekend. US and European government bonds were much lower on the day, while credit indices closed tighter with a particularly strong performance from high yield indices iTraxx-Xover and CDX-NAHY. Oil closed much higher on the day, while gold and silver were sharply lower.

Americas

- According to the latest returns (as of the morning of 9 November), former vice-president Joe Biden appears to have at least 279 electoral votes, or more than the 270 needed to win. As counting continues, President Donald Trump held a small lead in North Carolina, but trailed Biden in Nevada, Georgia, Pennsylvania, and Arizona. In response, Trump has initiated over a dozen court cases to expunge a number of mail-in ballots because of residency requirements, alleged lack of transparency by election officials, or mail ballots arriving late. Unless major episodes of irregularities or substantial fraudulent behavior surface, these lawsuits are highly unlikely to reverse the results. Although Biden won the national vote by 3%, President Trump did outperform many polling estimates that suggested that Biden would win easily, as Trump carried toss-up states such as Texas, Florida, and Ohio. (IHS Markit Country Risk's John Raines)

- A coronavirus vaccine developed by Pfizer Inc. and partner BioNTech SE showed in an early analysis to be more than 90% effective in protecting people from COVID-19, a much-better-than-anticipated result that marks a milestone in the hunt for shots that can stop the pandemic. The timetable suggests the vaccine could go into distribution this month or next, though U.S. health regulators have indicated they will take some time to conduct their review. Then it will take months for the companies to make enough doses for the general population. (WSJ)

- US equity markets closed mixed and near the lowest end of the day's range; Russell 2000 +3.7%, DJIA +3.0%, S&P 500 -1.5%, and Nasdaq -1.5%. The DJIA and S&P both reached new intraday record highs on Pfizer's vaccine announcement, with Russell 2000 futures even being briefly halted after exceeding the 7% limit up circuit breaker. The S&P 500 is now +8.6% this month.

- According to FactSet data, the best performing sector in the S&P 500 today was energy minerals +18.1% and the only sector lower on the day was consumer durables -1.9%.

- 10yr US govt bonds closed +12bps/0.94% yield and 30yr bonds +11bps/1.72% yield, which are the highest yields since 20 March and 19 March, respectively.

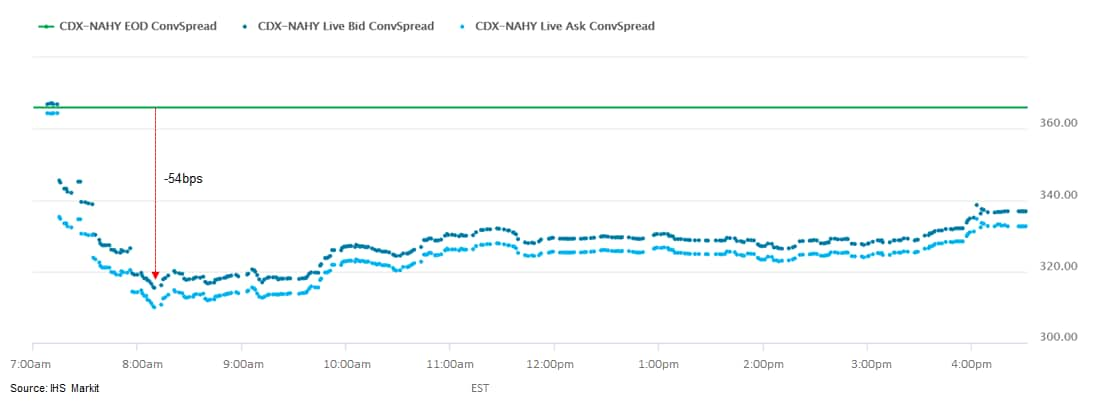

- CDX-NAIG closed -1bp/52bps and CDX-NAHY -30bps/336bps, with the

latter tightening by as much as 54bps by 8:10am EST (Price Viewer

chart below).

- DXY US dollar index closed +0.6%/92.75.

- Gold closed -5.0%/$1,854 per ounce and silver -7.6%/$23.70 per ounce.

- Crude oil closed +8.5%/$40.29 per barrel.

- The Federal Reserve is warning that asset prices in key markets could still take a hit if the coronavirus pandemic's economic impact worsens in coming months. "Uncertainty remains high, and investor risk sentiment could shift swiftly should the economic recovery prove less promising or progress on containing the virus disappoint," the Fed said in its twice-yearly Financial Stability Report, which is meant to spotlight emerging threats to the financial system. "Some segments of the economy, such as energy as well as travel and hospitality, are particularly vulnerable to a prolonged pandemic." (Bloomberg)

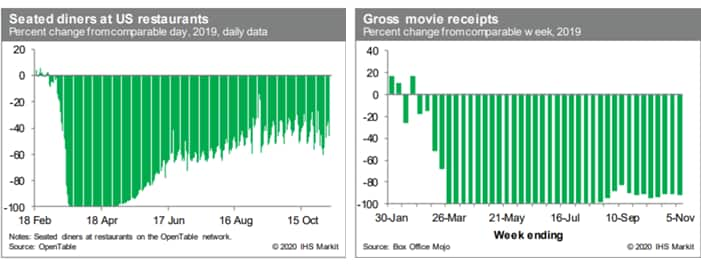

- Seated diners on the OpenTable platform averaged over the last

week were down 48.3% from last year, a degradation from the prior

weeks' reading of 45.6% down. Indeed, last week was the fourth

consecutive week of worsening year-over-year comparisons,

suggesting that dining out is weakening as the spread of COVID-19

accelerates. Meanwhile, box office revenues remain depressed (down

92.4% from last year), according to Box Office Mojo, as recovery in

the movie-theater industry has yet to gain traction. (IHS Markit

Economists Ben Herzon and Joel Prakken)

- Legal uses of atrazine are likely to adversely affect more than

half the 1,795 species listed under the Endangered Species Act

(ESA), according to a draft biological evaluation released last

week by EPA. (IHS Markit Food and Agricultural Policy's JR Pegg)

- The new assessment, which is the first step in EPA's endangered species review for atrazine, finds the widely used herbicide will also adversely affect some 40% of designated critical habitats.

- EPA also released biological evaluations for two similar herbicides - propazine and simazine. The agency found simazine is likely to adversely affect some 53% of listed species and 40% of critical habitats while propazine is likely to adversely affect 4% of listed species and 2% of critical habitats.

- The new evaluations come on the heels of EPA's decision to reregister the three herbicides, a move that has already drawn litigation from environmentalists unconvinced by the agency's review of the potential harms to human health and environment.

- The agency reregistered atrazine, propazine and simazine last month, with EPA Administrator Andrew Wheeler saying that new mitigation measures address concerns about the potential harms to the environment and public health and give US farmers "more clarity and certainty concerning proper use."

- Atrazine is the second most widely used agricultural pesticide in the US - applications to corn, sorghum and sugarcane account for more than 98% of the total use. Some 72 million pounds of atrazine are used annually on some 75 million acres of crops to control grasses and broadleaf weeds.

- EPA's interim decision reduces maximum application rates for atrazine used on residential turf and imposes limits to mitigate spray drift, including wind speed restrictions, application technology requirements, and a ban on spraying during a temperature inversion.

- Other label changes include new protective equipment and handling requirements for atrazine and simazine applicators.

- Critics of EPA's decision say the agency failed to fully consider atrazine's toxicity and ignored ample evidence that the herbicide - a known endocrine disruptor - poses undue risks to human health and the environment. They contend EPA wrongly relaxed the regulatory threshold intended to protect aquatic species, potentially harming the environment and undermining efforts to keep atrazine out of drinking water.

- The lawsuit, filed October 30 in the US Court of Appeals for the Ninth Circuit, echoes those concerns and alleges EPA has failed to show legal uses of atrazine will not cause unreasonable harm to public health and the environment.

- The petition for review, which asks the court to vacate the registration, was filed by the Center for Food Safety, Center for Biological Diversity, Beyond Pesticides, Pesticide Action Network North America and the Rural Coalition.

- Magna has released its results for the third quarter, which

show an improvement from the second quarter as production resumed

last quarter following the prior quarter's plant shutdowns because

of the COVID-19 pandemic. However, according to Magna, its

production globally was down 4% year on year (y/y) in the third

quarter and its results overall were weaker last quarter than in

the third quarter of 2019. (IHS Markit AutoIntelligence's Stephanie

Brinley)

- Magna said that the production level last quarter was better than the company had expected after the second-quarter disruptions. Magna reports a sales decline of 2.0% y/y to USD9.1 billion in the quarter ended 30 September 2020, compared with USD9.3 billion in the third quarter of 2019.

- The company reports net income attributable to Magna of USD405 million last quarter, an improvement from a USD233 million loss in the third quarter of 2019, which was partly related to a strike at General Motors' US plant in that quarter.

- Magna's income from operations was USD436 million in the third quarter, compared with a USD319 million loss in third quarter 2019.

- The company posted adjusted EBIT of USD778 million last quarter, compared with USD558 million in third quarter 2019. Magna reported its adjusted EBIT result in the third quarter was assisted by a higher margin on sales and the lack of a negative impact from the GM strike as in third quarter 2019.

- Magna's power and vision sales improved 1% y/y, seating sales improved 1.1%, body exteriors and structures sales decreased 3.2%, and sales of complete vehicles dropped 7.5% in the third quarter.

- Complete vehicle sales declined from USD1.5 billion in third quarter 2019 to USD1.4 billion last quarter; seating sales fell from USD1.27 billion to USD1.28 billion; power and vision sales improved to USD2.72 billion from USD2.69 billion; and body exteriors and structures decreased to USD3.86 billion from USD3.98 billion.

- When reporting its results in the third quarter, Magna upgraded its outlook slightly for its full-year 2020 results. Magna increased its guidance on its full-year 2020 sales to USD31.5-32.5 billion, from USD30.0-32.0 billion previously.

- The company now expects an adjusted EBIT margin of between 4.0% and 4.4%, up from prior guidance of between 2.9% and 3.3%, as well as capital spending of about USD1.3 billion.

- Autonomous vehicle (AV) startup Pony.ai has raised USD267 million in a Series C funding round led by the Teachers' Innovation Platform of the Ontario Teachers' Pension Plan, reports Xinhua News Agency. Pony.ai's existing investors, including Fidelity China Special Situations PLC, 5Y Capital, ClearVue Partners, and Eight Roads, also participated in the funding round. This latest funding round will bring the company's market value to USD5.3 billion. Pony.ai plans to use the infused capital towards research and development (R&D) of AV technology. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- In a press release, Riverstone Holdings LLC announced the signing of an agreement to acquire International-Matex Tank Terminal from Macquarie Infrastructure Corporation for a total consideration of $2.685 billion. The transaction is expected to close in late 2020 or early in 2021. International-Matex Tank Terminal operates 19 terminals (17 in the US and 2 in Canada) with a total storage capacity of about 48 MMbbl. Riverstone said the acquisition will drive growth and performance to deliver attractive returns to its investors. International-Matex Tank Terminals is primarily engaged in the handling and storage of bulk liquid products through its ownership and operation of 19 terminals throughout North America. It handles petroleum, biofuels, commodity/specialty chemicals, and vegetable/tropical oil products for customers including refiners, commodities traders, and chemical manufacturers and distributers. The company is based in New Orleans, Louisiana. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- Light-vehicle (LV) registrations in Brazil decreased 14.9% year

on year (y/y) in October, according to data from the National

Association of Motor Vehicle Manufacturers (Associação Nacional dos

Fabricantes de Veículos Automotores: Anfavea). Brazil's LV exports

dropped 17.7 y/y in October, while LV production declined 18.5%

y/y. (IHS Markit AutoIntelligence's Tarun Thakur)

- Brazilian LV sales topped 2.66 million units in 2019, roughly 8% higher than in 2018. LV sales were driven by increased availability of credit, and the sales increased last year despite a somewhat sluggish economy, which grew at 1.1% in 2019.

- Brazil's real GDP is expected to drop by 5.9% in 2020, and we expect a sharp drop in LV sales in Brazil to less than 1.9 million units this year, owing to the impact of the COVID-19 virus pandemic.

- The outlook for the Brazilian LV market is gloomy as the spread of the COVID-19 virus is likely to affect sales in October, followed by a weak recovery phase until 2025.

- Brazil's LV sales were 2.66 million units in 2019 and are forecasted to decrease 28.3% to 1.91 million units in 2020.

- Brazil's LV exports continue to be affected by an economic crisis in principal export market Argentina as it also struggles with the COVID-19 virus pandemic.

- IHS Markit forecasts Brazil's LV production will reach 3 million units in 2025.

- As per IHS Markit's Commodities at Sea, during October 2020, Brazilian iron ore and pellet shipments are calculated at 32.4 metric tons (mt), almost at previous year levels. There was an increase in shipments from PDM (18.3mt, up 7% y/y), CPBS (1.6mt, up 193%), and GIT (2.9mt, up 69%). The increase from the said three terminals counter balanced reduced shipments from Tubarao (3.8mt, down 47% y/y), Porto do Acu (1.6mt, down 12%), TECAR Terminal (2.4mt, down 5%), and Porto Sudeste (1.7 mt, down 2%). During 3Q20, iron ore production at the Vale's Northern, Southeastern, and Southern System stood at 56.9mt (up 3% y/y), 16.3mt (down 21%), and 14.9mt (up 52%). Total Vale iron ore and pellet production during 3Q20 announced at 96.1mt, down 1% y/y. While iron ore and pellets sales during the same period stood at 74.2mt, down 13% y/y. Vale in its recent quarterly report highlighted that the outlook for 2021 has improved, with WSA forecasting stability in steel production in China as economic activity normalizes and resumes its path away from heavy investments and towards consumption. Other regions ex-China are expected to partially recover with steel demand growing 9.4% in 2021 led by a more expressive recovery in India, ASEAN (Association of Southeast Asian Nations), Turkey, and Europe. For 2021, IHS Markit's Commodities at Sea forecast Brazilian iron ore and pellets shipments at 372mt, up 28mt y/y. (IHS Markit Maritime & Trade's Rahul Kapoor and Pranay Shukla)

Europe/Middle East/Africa

- European equity markets surged higher across the region; Spain +8.6%, France +7.6%, Italy +5.4%, Germany +4.9%, and UK +4.7%.

- 10yr European govt bonds were sharply lower across the region; Germany +11bps, France/Italy/UK +10bps, and Spain +8bps.

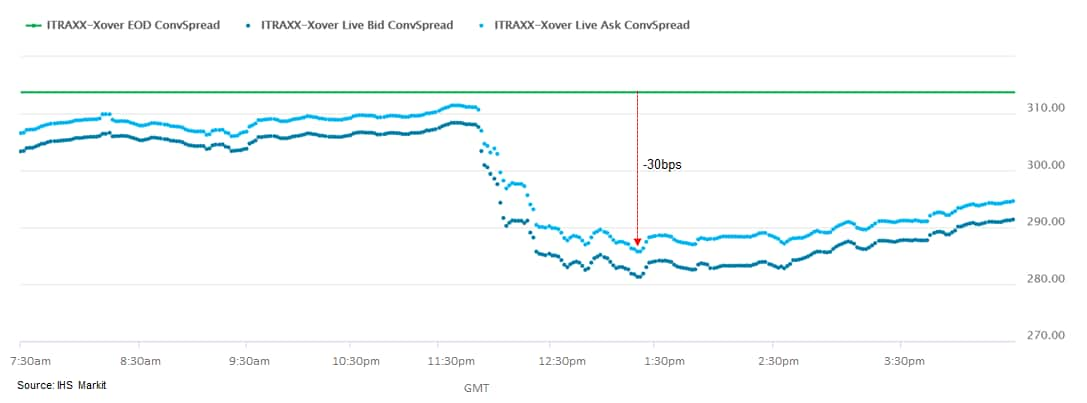

- iTraxx-Europe closed -2bps/50bps and iTraxx-Xover

-21bps/293bps, with the latter tightening by as much as 30bps by

1:20pm GMT (Price Viewer chart below).

- Brent crude closed +7.5%/$42.40 per barrel.

- Germany's Federal Statistical Office (FSO) external trade data

for September (customs methodology, seasonally adjusted, nominal)

reveal export and import changes by 2.3% and -0.1% month on month

(m/m), respectively. Import's underperformance needs to be seen

against the background of the surge in August (5.8% m/m).

Notwithstanding the ongoing trade recovery since May, trade levels

are still roughly 6.5% below those one year ago and in February.

(IHS Markit Economist Timo Klein)

- The seasonally adjusted trade surplus, which had dipped temporarily to EUR15.4 billion in August, rebounded to EUR17.8 billion, thus approaching its monthly average of 2019 (EUR18.9 billion) anew. This compares with April's near-20-year low of EUR3.1 billion.

- September's regional breakdown reveals a relatively uniform picture, except the outperformance of EU countries outside the eurozone. This reflects above-average economic resilience of Eastern European EU members to knock-on effects of the pandemic until September - note that this changed in October, however.

- With respect to non-EU trade, exports to and imports from China stood out positively at 10.6% year on year (y/y) and 3.0% y/y, respectively. In contrast, exports to the United Kingdom declined by 12.4% y/y and imports from there by 14.7% y/y as Brexit-foreshadowing effects dampened matters.

- Trade with the United States was a mixed bag - exports declined by 5.8% y/y, hindered by the particularly severe impact of the pandemic in the US, but imports from the US managed to increase by 3.0%, reflecting Germany's better domestic demand situation at that time.

- In unadjusted terms, trade and current-account surpluses bounced sharply in September compared with August. Although this was mostly seasonal, the y/y comparison also looks much more favorable than in August. The trade surplus slipped only marginally from EUR21.2 billion in September 2019 to EUR20.8 billion in September 2020, and the current-account surplus even increased from EUR23.5 billion to EUR26.3 billion owing to improving balances for services and the trade supplement component (a modest decline of the primary income surplus was a partial offset).

- Although recovery momentum tended to wane during the third quarter compared with the immediate rebound in May-June after the lifting of the administrative restrictions that had been imposed during the March-April lockdown, September's trade figures still look quite good. Increasing foreign demand from China is a key reason for this.

- The resurgence of COVID-19 cases in October and the ensuing renewed lockdown in November will lead to a fresh setback for trade. However, owing to the ongoing economic recovery in China and the fact that industrial production is not affected directly by Germany's tightened restrictions, it appears likely that trade data will hold up much better than back in March-April.

- Novo Nordisk (Denmark) has entered its largest acquisition of 2020 by striking a USD1.8-billion deal to acquire Emisphere Technologies (US). Novo Nordisk and Emisphere have been long-standing collaboration partners, dating back to 2007, on projects to enhance the oral absorption of molecules without altering their chemical form, biological integrity, or pharmacological properties. Emisphere's drug delivery technology is a core component of the oral formulation of Novo Nordisk's GLP-1, once-daily adjunctive treatment for type 2 diabetes, Rybelsus (semaglutide), under a licensing agreement. The financial terms of the deal mean that Novo Nordisk will acquire Emisphere on a cash basis for USD1.35 billion. In addition, Novo Nordisk will assume financial responsibility for Emisphere's royalty obligations valued at USD450 million. This brings the total size of the acquisition package to USD1.8 billion. There was a strong business case for Novo Nordisk's buyout of Emisphere for USD1.8 billion, which is that the Danish company is looking to the drug delivery specialist to boost its oral biologics offerings across a range of diseases, including the diabetes therapeutic area. This will require Novo Nordisk to make significant additional investments in the newly acquired company - likely to run into hundreds of millions of dollars - in order to streamline the future development of the technology with the company's R&D pipeline and reduce manufacturing costs of tablet-based diabetes drugs. (IHS Markit Life Sciences' Eóin Ryan)

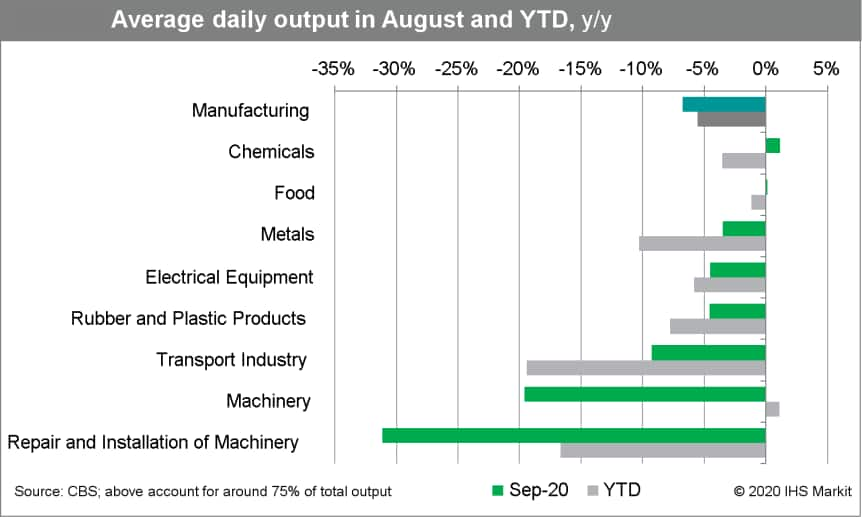

- The contraction in Dutch manufacturing output in September put

a halt to a three-month recovery following a record drop in output

in April to May. Given the resurgence of the COVID-19 virus across

Europe and severe measures to contain it, the risks in the short

term are skewed to the downside. (IHS Markit Economist Daniel Kral)

- In September, on a seasonally and working-day-adjusted basis, manufacturing output was down by 1.0% month on month (m/m), partially reversing the recovery since May. Output was down by 6.3% year on year (y/y) and by 4.8% compared with February, prior to the impact of the COVID-19-virus pandemic.

- On a seasonally unadjusted basis, in September average daily output of the Dutch manufacturing sector was down by 6.7% y/y, compared with negative 3.6% y/y in August. On a three-month moving average basis, output was down by 5.2% y/y.

- In September, almost two-thirds of the sub-components were a drag in annual terms. The biggest drops were recorded in the repair and installation of machinery, which was down by 31.2% y/y; machinery, down by 19.6% y/y; and transport, down by 9.3% y/y.

- The Dutch manufacturing purchasing managers' index deteriorated significantly in October, although still indicating mild expansion. The output sub-index dropped from 55.9 in September to 50.6 in October, the largest monthly drop over the last decade apart from April this year.

- The latest output and survey data indicate a sudden and broad-based deterioration in September. It is likely that output will continue to contract in the fourth quarter, although the index is unlikely to sink to the April low.

- The Dutch export sector is highly dependent on European demand,

with 70% of goods exports going elsewhere in the European Union.

The continued recovery in Dutch manufacturing activity is heavily

dependent on European demand.

- CNH Industrial has recorded an improvement in its financial

performance compared with the second quarter, which was hit by the

COVID-19-virus pandemic. For the three months ending 30 September,

the company's consolidated revenues grew by 2.1% year on year (y/y)

to USD6,492 million, of which its net sales from Industrial

Activities increased by 3.6% y/y to USD6,107 million. (IHS Markit

AutoIntelligence's Ian Fletcher)

- Its adjusted EBIT from Industrial Activities dropped by 16.2% y/y to USD238 million in the third quarter as it included a USD50-million gain a year ago from granting Nikola Corporation access to certain Iveco technology as an in-kind contribution from stock issuance.

- Nevertheless, its margin fell to 3.9% from 4.8% in the third quarter of 2019. CNH Industrial's net income fell from a profit of USD643 million to a loss of USD932 million. This includes a loss of USD1,207 million due to the negative fair value adjustment of the investment that it holds in Nikola. It also includes a tax benefit of USD82 million because of the release of valuation allowances on deferred tax assets in certain jurisdictions.

- Its adjusted net income stands at USD156 million, a decline of 29.4% y/y.

- Although the COVID-19 virus overhung the third quarter, this was not as detrimental to the performance of the business compared with the first half of the year.

- Nevertheless, although it has experienced a general improvement in market demand and in customer sentiment because of this, the company remains cautious over the uncertainty about the future impact on its markets and operations, and it certainly seems right to be so given the recent resurgence in Europe that has led to new restrictions.

- The company's financial results have been heavily affected by its involvement with Nikola in which it holds a 7% stake thanks to it supporting its truck development and European production plans.

- CNH Industrial benefited from a jump in its net income when Nikola became a listed entity in the second quarter of 2020, helped by a surge in the share price.

- However, Nikola had a challenging quarter after the business faced accusations by a research firm that led to its founder and executive chairman Trevor Milton stepping down.

- Nevertheless, the project between Iveco and Nikola is said to be making progress. CNH Industrial's chief executive Suzanne Heywood said that the first prototypes of the electric variant of the Nikola Tre, which will be built at its Ulm (Germany) facility, will begin in the fourth quarter of 2020 and it is on track to go in to production during the fourth quarter of 2021.

- Heywood also said that the hydrogen fuel-cell variant will also begin testing not long after, with production beginning in late 2023.

- A second wave of the COVID-19 virus pandemic threatens Poland's

fourth-quarter GDP results, triggering a steep reduction in the

central bank's growth forecast for 2021. (IHS Markit Economist

Sharon Fisher)

- As expected, the National Bank of Poland (NBP) kept the policy interest rate stable at 0.1% during its session on 6 November. Despite a modest weakening in October, inflationary pressures remain elevated, reaching a preliminary 3.0% year on year (y/y).

- After a third-quarter recovery (confirmed by strong monthly data on retail sales, industrial output, and corporate wage growth), the NBP warned that the second wave of the COVID-19 virus is raising uncertainty, with negative implications for short-term growth as restrictions are reimposed. The restrictions will be particularly detrimental to the services sector.

- The NBP released its new quarterly forecast at the latest session, putting average inflation at about 3.5% in 2020 (from 3.3% in the July forecast), 2.5% in 2021 (from 1.5%), and 2.6% in 2022 (from 2.1%). Poland's GDP is projected to fall by 3.6% this year (from -5.4% in the July forecast), while recovering by 2.5% in 2021 (from 4.9%) and 5.8% in 2022 (from 3.7%).

- The country's GDP growth could be even weaker than the NBP is expecting in 2020-21 if the country faces a new lockdown, which is increasingly likely as the number of cases and deaths continue to rise, inundating Poland's healthcare system. IHS Markit is tentatively planning to raise its 2020 GDP growth forecast (currently at -4.5%) in the November round while slashing its outlook for 2021 (now at +3.8%).

- European beekeepers are facing another bad year in 2020 as their honey harvests dropped by a record 40% from last year, EU farming association Copa-Cogeca wrote in a statement on 4 November. This means the bloc will only provide 40% of its own consumption this year, the farming group said, calling the development "a new blow for a sector that suffers from deep and structural market distortions". Copa-Cogeca points to "tense" climate conditions that reduced the flowering periods in most EU member states as the main reason behind the decline. Most worryingly, the association expects "unprecedented production losses" for the bloc's main producers in eastern and southern Europe after heavy rain and floods in these areas added to problems caused by drought in July. This would cause the "near absence" of certain honey types such as acacia, it claimed. This year's acacia crop in Hungary was only 10% of the usual production, while Austria reported the worst harvest in decades and there were also sharp drops in Portugal (down by 80%) and Italy (between -70% and -80% in the south), Copa-Cogeca outlined. Such low yields normally lead to higher prices for producers, but the group says this has not happened and prices continue to fall due to a lack of EU action on origin labelling and the adulteration of honey. The group therefore calls on European legislators to take serious actions to protect the sector, including risk management and promotion measures, origin labelling and stricter controls on imports. Etienne Bruneau, the chairman of Copa-Cogeca's honey working party, pointed out that they already asked the European Commission for such an emergency action plan earlier this year. "It is clear that the situation is not getting better, it is getting worse," he said, adding that bees provide a living for 650,000 beekeepers, pollinate the crops of many farmers, and create eco-system benefits for everyone. "This situation is therefore threatening well beyond the stakes of our sector," he argued. Bruneau called for new Common Agricultural Policy (CAP) measures to help EU honey producers deal with market volatility - along the lines of those that exist for milk and meat products. "There is an urgent need for such risk management and promotion measures for European products to be put in place for the sector," he stated. (IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- Russia's fresh food prices, as well as the cost of non-food

products were the key sources of inflationary pressure on the

overall consumer price index in October, according to detailed data

released by the Russian Federal State Statistical Service

(Rosstat). (IHS Markit Economist Lilit Gevorgyan)

- Headline inflation climbed to 4.0% year on year (y/y) from 3.7% y/y reported in September and 3.6% y/y in August. The fresh food products category recorded a surge of nearly 9.0% y/y in October due to the end of the harvest season.

- Therefore, overall food price inflation rose to 4.8% y/y in October from 4.3% y/y in September and 4.3% y/y in August. It is noteworthy that the cost of sugar rose by a huge 40% y/y, while prices of cereals stood at 22% y/y.

- The non-food products category reported 4.2 y/y gains compared with 3.8% y/y in September, and 3.4% y/y in August. The breakdown of the sub-index shows that tobacco, cleaning, and pharmaceutical products experienced the largest increases in costs in annual terms. Core annual inflation also rose to 3.6% y/y from 3.3% y/y in September and 3.1% y/y in August.

- The services category remained relatively stable, rising only to 2.6% y/y in October, from 2.5% y/y in September. This is reflective of muted activity by client-facing businesses. As expected, communication and medical services recorded the strongest demand in October, whereas passenger transport and tourism services continued to fall in y/y comparisons.

- The strongest inflationary development was in month-on-month (m/m) terms, with the headline CPI jumping from 0.1% in September to 0.7% in October. Non-food products recorded the fastest gains, most likely linked to the ruble's weakness. The Russian ruble weakened in October with USD:RUB trading at 77.6 in October, compared with 76.1 in the previous month.

- The October inflation print is slightly higher than the 3.9% y/y that IHS Markit had forecast for the month. The headline inflation is driven by several factors: imported inflation due to the ruble's weakness is one of them.

- The Russian currency has been affected by growing concerns about global and Russian economic recovery, and the weakness of crude oil prices.

- Russian state gas supplier Gazprom has said that it will open a further 90 compressed natural gas (CNG) stations for CNG-powered vehicles in 2021, according to Interfax news agency. Gazprom already has a network of 338 CNG stations across Russia. The company's deputy chairman Vitaly Markelov said, "The plans [for 2021] are ambitious - more than 90 [CNG filling stations]. This is virtually three times more than this year in which 36 stations are going to be built." Markelov also said that Gazprom, the Russian Industry and Trade Ministry, Kamaz, and the government of St Petersburg are discussing signing an agreement on developing the natural gas vehicle fuel market that could result in CNG filling stations in St Petersburg growing to more than 40. In 2018 Russian President Vladimir Putin said he favored a push for CNG vehicles in Russia over electric vehicles (EVs). It is logical for the Russian government to take this stance for a number of reasons: Russia has huge reserves of natural gas and therefore has a readily available and affordable source of the fuel type. Moreover, the resources and the will to create a meaningful EV charging network in Russia do not currently exist despite some token initiatives. In addition, the long distances between Russian population centers, as well as the cold weather, which shortens EV range, also count against the technology. As a result, EV sales are almost currently non-existent in Russia. (IHS Markit AutoIntelligence's Tim Urquhart)

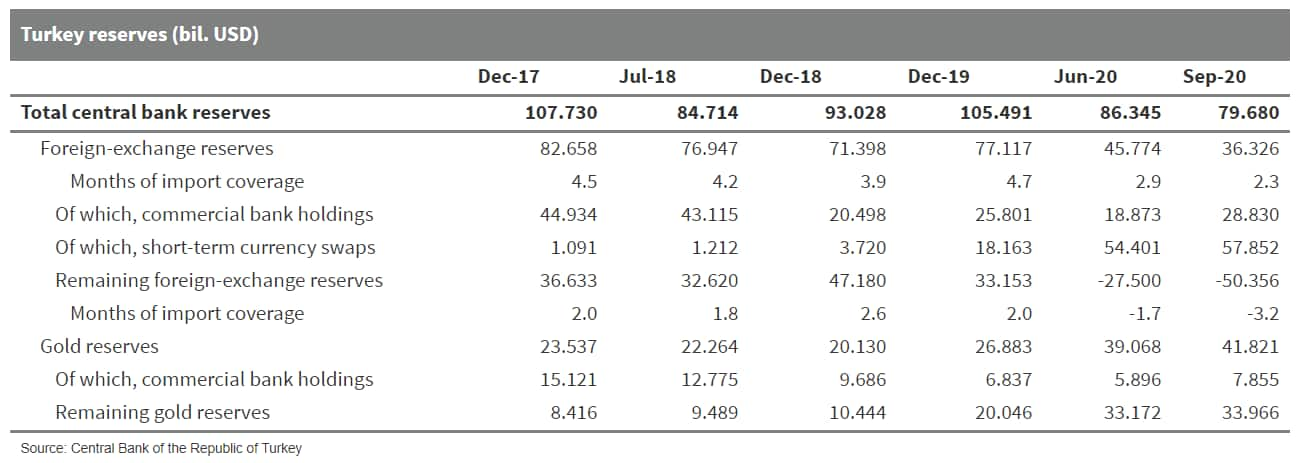

- Over the weekend of 7-8 November, two key Turkish officials -

central bank governor Murat Uysal and finance minister Berat

Albayrak - were among a number of changes to the economic

leadership. Although neither of the outgoing officials was

considered particularly independent of Turkish President Recep

Tayyip Erdoğan, the new officials are likely to adhere even more to

the president's demands. IHS Markit anticipates greater instability

and higher risks of an external financing crisis. (IHS Markit

Economist Andrew Birch)

- A number of changes within key economic roles occurred over the weekend of 7-8 November. One of the two most significant moves was President Erdoğan's dismissal of the Central Bank of the Republic of Turkey (TCMB) Governor Murat Uysal on 7 November. The second of the most significant moves was the resignation of Finance and Treasury Minister, and presidential son-in-law, Berat Albayrak on 8 November.

- Uysal was removed from office after just 16 months of his five-year term. He was a replacement for the previous TCMB governor, Murat Çetinkaya, whom Erdoğan removed from his post early because he refused to reduce interest rates as demanded by the president. Uysal stepped into the role in July 2019 and implemented rate cuts in each of the first nine policy meetings under his stewardship.

- Erdoğan has appointed Naci Agbal as the new TCMB governor. Agbal is a Western-educated former finance minister who had previously been serving as the chairman of the Presidential Strategy and Budgeting Committee. He has been viewed from the outside as one of few Justice and Development Party (Adalet ve Kalkınma Partisi: AKP) members arguing for internationally conventional monetary policy.

- As of the evening of 8 November, Erdoğan had yet to accept Albayrak's resignation. Initially believed to potentially be a defender of more conventional economic policies, Albayrak has proven to be a loyal Erdoğan follower, critical in implementing the economic policies that have led to the current economic conditions.

- Emerging from the 2008-09 global recession, the TCMB was viewed as one of the most respected central banks in the world for its handling of the global crisis and its institutional integrity. Now, 11 years later, Erdoğan has just appointed its third governor in the past one-and-a-half years. Moreover, the new appointee comes directly from serving within the AKP, a first since before the 2000s, and has no experience in the central bank.

- Although Agbal's previous defense of international conventional monetary policy provides some hope that the TCMB might shift to a more defensive monetary policy, the overt political maneuvering suggests to IHS Markit that the more likely course forward is that the TCMB will act even more in tandem with the president's direction.

- Given these assumptions, we will be removing any expectation

that interest rates will be raised in the near future. Moreover,

much of the "back-door" monetary policy tightening in which the

TCMB had been engaging, leading to the rise of the average rate of

funding in recent weeks, is likely to be unwound.

- The Turkish lira rallied from Friday's all-time low of ₺8.58 versus the US dollar to a two week high of ₺8.03/USD today at 6:30am EST on the dismissal of the TCMB's governor over the weekend.

- Gürcan Karakaş, CEO of Turkey's Automobile Joint Venture Group (Türkiye'nin Otomobili Girişim Grubu: TOGG), has announced the repurposing of the batteries of Turkey's first domestically produced electric vehicle (EV) for energy storage after the completion of their lives, reports Daily Sabah. He said, "We plan for the batteries to be used for energy storage in their secondary life after eight years of use in the car", adding, "In addition, our battery partner is a world leader in battery recycling and we will have access to this technology and business model." The second-life battery market has a great deal of potential for OEMs to monetize older batteries and potentially help cover the cost of a battery replacement or give the owner access to retained value at the end of a vehicle's life. Second-life batteries also have the potential to give power-generation companies and power grids much greater flexibility in terms of smoothing out periods of high energy demand by releasing energy stored in the batteries. In October, TOGG revealed that the longer battery life in its range of products than its competitors is driven by the use of liquid cooling and an innovative battery management system. The statistics came shortly after TOGG announced its partnership with China-based lithium-ion (Li-ion) battery-producing company Farasis Energy. In August, TOGG announced the signing of an agreement with German-based automotive engineering service provider FEV to collaborate on the production of a domestically made EV in Turkey. In July, TOGG started construction of a production facility in Bursa. Also in July, EDAG Engineering, a Wiesbaden (Germany)-based independent engineering company that serves the automotive industry, opened its first office in Turkey as part of its partnership with TOGG. (IHS Markit AutoIntelligence's Tarun Thakur)

- Zambian Watchdog on 5 November reported that commercial banks

in Zambia are failing to complete forex "spot" contracts because of

foreign exchange (FX) shortages in the market. According to media

reports, the Bank of Zambia (BoZ) is collecting FX from banks and

other financial institutions for the government to pay interest

that is now due on the Eurobonds. As a result of the FX shortages,

banks are paying forex spot contracts with a delay. (IHS Markit

Banking Risk's Ana Souto)

- In September, the Zambian government warned that it was at risk of a sovereign default after bondholders rejected the government's request for a six-month suspension of interest payments on a USD3-billion Eurobond.

- In IHS Markit's view, Zambian banks face moderate risk from an FX perspective. The sector has a moderate proportion of FX liabilities; 5.8% of total liabilities were in FX as of June.

- However, the known FX shortages in the economy is likely to result in uncertainty in the market, triggering customers to withdraw foreign deposits that represent the bulk of total deposits, at 96% of total deposits at the end of 2019.

- An additional concern is the fact that banks' exposure to foreign-currency-denominated loans is elevated, at 55.7% of total lending in June. The kwacha in March lost more than 20% of its value against the US dollar because of economic stresses related to the COVID-19-virus pandemic and is expected to continue to depreciate vis-à-vis major trading currencies as a result of sovereign debt default concerns, resulting in increased debt-service burden for borrowers, which significantly exposes the banking sector to short-term losses.

Asia-Pacific

- APAC equity markets closed higher across the region; Japan +2.1%, Mainland China +1.9%, Australia +1.8%, India +1.7%, South Korea +1.3%, and Hong Kong +1.2%.

- New Dairy increased its revenues by around 10% to CNY4.7 billion (USD691 million) in the first three quarters; net profit rose by 4% to CNY185 million. The company recorded very strong revenue growth of 39% to CNY2.1 billion in Q3 alone. It is planning an integrated supply chain for both offline and online channels. Its ecommerce sales tripled in H1. In Q3, it has bought Ningxia Huanmei Dairy and Fuzhou Aoniu. The revenue from these newly acquired companies is excluded in the Q3 report. Its product strategy is to concentrate on fresh dairy such as fresh milk and chilled yogurt. Fresh milk accounts for 60% of total revenue. The company has a strong category position in Sichuan, Yunnan, Hebei, Zhejiang and Shandong. China's fresh dairy consumption remains low but is growing around 10% year-on-year. Zheng Shifeng, a director of New Dairy, said:"Although the Xia Jin (Huanmei brand) has a high market share in the Ningxia region, more than 90% of its products are ambient. We will help them expand into fresh." The company is planning to expand into the northeast by acquisition. However, this will require considerable investment in establishing a cold chain. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Thermo Fisher Scientific (US) has signed a joint venture (JV) agreement with Innoforce (China) to set up a new pharma services facility in China focusing on integrated biologics and steriles drug development and manufacturing, the companies said in a statement. The new facility, which is expected to be completed in 2022, will be designed to meet good manufacturing practices (GMP). The US company's global pharma services network includes capabilities for drug product development, biologics manufacturing, sterile fill-finish, clinical trials packaging, and logistics. Financial details were not disclosed. The agreement will expand Thermo Fisher Scientific's presence in China, where the company has also signed an agreement with West China Hospital of Sichuan University (China) focusing on precision medicine, as well as investing USD9.5 million in a research and development (R&D) facility in Shanghai. Once it is operational, Thermo Fisher Scientific plans to transition part of its customer demand from its sites in the US, Europe, and elsewhere in the Asia-Pacific region to the new Hangzhou-based facility. The development highlights the continued development of infrastructure in China focusing on supporting the country's growing biotech industry, whose rapid development in recent years has been fostered by the Chinese government's pro-innovation policies. (IHS Markit Life Sciences)

- Chinese electric vehicle (EV) startup NIO has rolled out its 100-kWh battery pack across its entire line-up, which consists of the ES6, ES8, and EC6 sport utility vehicles (SUVs). With the new battery pack, the ES6, NIO's best-selling model, can now deliver a NEDC range of up to 610 kilometers (km). The mid-size electric SUV was launched originally with two battery size options, a 70-kWh and an 84-kWh battery pack. NIO's flagship SUV, the ES8, now delivers a range of more than 600 km thanks to the roll-out of the 100-kWh battery pack. The EV startup allows existing NIO owners to upgrade to the new battery pack, for which they either pay CNY58,000 (USD8,790) to buy the battery or pay a subscription fee of CNY880 per month to rent the battery. NIO's new 100-kWh battery pack was developed by battery manufacturer Contemporary Amperex Technology Co Limited (CATL). The new pack features higher energy density compared to previous CATL battery packs on the NIO ES8 and ES6, thanks to the battery maker's Cell-to Pack (CTP) technology. The company says the CTP design reduces extra hardware needed to make individual battery modules compared with other designs; as a result, the battery pack takes up less space and provides improved energy density. With the new battery pack, NIO has been able to boost the driving range of its EVs in an effort to stay ahead of the competition. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese autonomous truck startup Inceptio Technology has secured a USD120-million investment in its latest funding round, reports Reuters. Chinese electric vehicle battery maker CATL led the latest round, and logistics firms GLP, G7, and NIO Capital also participated in the funding. This comes six months after USD100 million in funding was secured in April. Inceptio was founded in April 2018 and focuses on developing Level 3 and 4 autonomous truck technologies. The company has partnerships with truckmakers such as Dongfeng Automobile, Sinotruk Hong Kong, and Foton, which are responsible for engineering vehicle platforms. Autonomous trucks are gaining a great deal of traction in the logistics industry because of a growing shortage of drivers and improved efficiency. This year, Shaanxi Heavy Duty Automobile partnered with Innoviz Technologies to deploy 600 autonomous trucks at one of the biggest ports in China. These trucks enable the autonomous loading and unloading of containers in port areas, thereby improving efficiency. Tianjin port in northeastern China has completed pilot tests of 25 driverless electric trucks developed by Sinotruk and Truck Tech. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Four autonomous delivery vehicles are being deployed at Huli Innovation Park in Xiamen, Fujian province, southeast China, reports Xinhua News Agency. The vehicles have been developed by Neolix and have 5G and artificial intelligence technologies. Each vehicle can carry more than 200 sets of breakfasts or 100 sets of lunches or dinners. Customers can access the service after paying by scanning a QR code on the vehicle with a smartphone. Delivery services are an attractive option as one of many potential autonomous-vehicle business use cases. The expectation is that, eventually, the ability to eliminate the cost of a human driver could make delivery services far more affordable for both the merchant and the consumer. Neolix was founded in 2014 and offers Level 4 autonomous delivery vehicles. The company has its own production plant and claims to operate the world's first production line for Level 4 vehicles. Neolix has partnered with Baidu, Cainiao, and Meituan Dianping to commercialize its autonomous vehicles. The company counts among its clients companies such as JD.com, Alibaba, Meituan, and Huawei Technologies. Neolix's vehicles have been deployed in tourist attractions, campuses, and logistics parks across China. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Beijing Innovation Center for Mobility Intelligent, the city's autonomous vehicle (AV) testing agency, has said that autonomous test vehicles in Beijing (China) have logged over 2 million kilometers up to this October. In Beijing, 87 cars from 14 companies have been issued temporary licenses for testing AV technology, reports Xinhua News Agency. Beijing has over 200 roads allocated for AV operation in four districts, covering a total distance of nearly 700 km. In December 2019, Beijing allowed autonomous car road tests to transport qualified passengers (volunteers), as well as goods for delivery. Recently, the city announced plans to finish setting up a connected cloud-controlled high-level demonstration zone for AVs by the end of 2020. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Honda has reported a 56.6 % year-on-year (y/y) decline in

profit attributable to owners of the parent to JPY160 billion

(USD1.54 billion) during the first half (ended 30 September) of the

fiscal year (FY) 2020/21 ending 31 March 2021. (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- Operating profit during the first six months of the current FY stood at JPY169.2 billion, down by 64.2% y/y, on sales revenue of JPY5.775 trillion, down by 25.2 % y/y.

- The decrease in operating profit was mainly due to the loss in sales volume owing to the COVID-19 virus outbreak, partially offset by reduced selling, general, and administrative (SG&A) expenses and cost reduction efforts.

- Of the total sales, sales in Japan accounted for 14.8% at JPY854.7 billion, the North American market accounted for 54.2% at JPY3.131 trillion, Europe accounted for 4.1%, while Asia accounted for 23.4%.

- Sales from the automobile segment stood at JPY3.722 trillion and accounted for 64.5% of total sales during the period.

- The motorcycle business contributed 13.2%, while financial services accounted for 21.5%. The significant decline in profit during the first half of the FY can be attributed to the poor performance of the company in the first quarter of the FY. Honda's earnings took a severe hit during the first quarter mainly because its business stagnated and demand significantly declined globally owing to the COVID-19 virus pandemic.

- Production and sales activities of all Honda's operations were affected. During the three-month period, travel restriction measures imposed by the government to contain the spread of the virus affected the automaker's production bases in Japan and overseas.

- It was prompted to temporarily suspend or reduce production and faced delays in the supply of parts within the supply chain.

- Several dealers in Japan and overseas were asked to suspend their businesses, shorten business hours, or reduce services such as inspections and repairs. Honda has been gradually resuming its business activities and the impact of the above has been decreasing.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-november-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-november-2020.html&text=Daily+Global+Market+Summary+-+9+November+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-november-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 9 November 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-november-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+9+November+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-november-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}