Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 29, 2020

Daily Global Market Summary - 29 October 2020

US equity markets closed modestly higher, while European and APAC markets closed mixed. European iTraxx credit indices closed slightly tighter across IG and high yield, while CDX-NA was wider on the day. Most benchmark European government bonds closed higher on the day, except for UK gilts. US government bonds were sharply lower and the US dollar was higher. Silver closed flat, while gold and oil were lower on the day.

Americas

- US equity markets closed higher; Nasdaq +1.6%, Russell 2000/S&P 500 +1.2%, and DJIA +0.5%.

- 10yr US govt bonds closed +6bps/0.83% yield and 30yr bonds +5bps/1.61% yield.

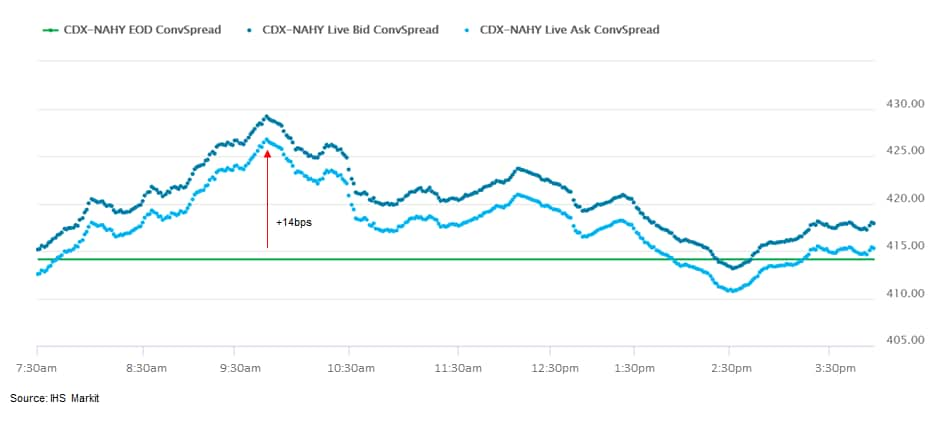

- CDX-NAIG closed +1bp/65bps and CDX-NAHY +4bps/418bps. CDX-NAHY

was as wide as +14bps at the NY market open, but tightened

alongside the rally in equities.

- DXY US dollar index closed +0.5%/93.92.

- Gold closed -0.6%/$1,868 per ounce and silver flat/$23.36 per ounce.

- Crude oil closed -3.3%/$36.17 per barrel.

- US seasonally adjusted (SA) initial claims for unemployment

insurance fell by 40,000 to 751,000 in the week ended 24 October.

Despite trending down, initial claims remain at historically high

levels—the high during the Great Recession was 665,000. The not

seasonally adjusted (NSA) tally of initial claims fell by 28,354 to

732,223. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 709,000 to 7,756,000 in the week ended 17 October. Prior to seasonal adjustment, continuing claims fell by 662,405 to 7,422,454. The insured unemployment rate in the week ended 17 October was down 0.5 percentage point to 5.3%.

- There were 359,667 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 24 October. In the week ended 10 October, continuing claims for PUA rose by 172,026 to 10,324,779.

- In the week ended 10 October, there were 3,683,496 such claims for Pandemic Emergency Unemployment Compensation (PEUC)benefits.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 10 October, the unadjusted total fell by 415,727 to 22,654,453.

- US GDP rose at a 33.1% annual rate in the third quarter,

according to the Bureau of Economic Analysis's "advance" estimate,

reflecting the gradual reopening of the economy that started in

May. While this is a record quarterly growth rate, it leaves GDP

3.5% below the previous peak and roughly 3.5% below potential GDP.

Note: this statement corrects a previous reference to the level of

real GDP in the third quarter relative to its previous peak. (IHS

Markit Economists Ken Matheny, Michael Konidaris, and Lawrence

Nelson)

- Despite the strong rebound in the third quarter, most of the rebound took place in May and June. A sequential slowing was evident in the months that followed. As a result, the fourth quarter will be characterized by lackluster growth as the economy continues to operate under constraints and the effect of fiscal stimulus from earlier in the year wanes.

- Within GDP, final sales to domestic purchasers rose at a 29.2% annual rate in the third quarter, reflecting sharp increases in personal consumption expenditures (40.7%) and business fixed investment (20.3%). Inventory investment rose $286 billion, more than reversing the negative contribution to GDP growth in the second quarter. The only major components of GDP to decline were government consumption and gross investment (-4.5%), accounted for by lower fees to administer Paycheck Protection Program (PPP) loans, and net exports (-$236 billion), which subtracted 3.1 percentage points from GDP growth.

- The waning of federal stimulus caused disposable personal income to fall 13.2%, as transfer payments fell more than $1.2 trillion. This was partially offset by a $527-billion increase in labor compensation.

- Inflation rebounded sharply in the third quarter, though somewhat less than we expected. The GDP price index rose at a 3.6% rate, up from a 1.8% decline in the second quarter. The core personal consumption expenditures (PCE) index rose at a 3.5% rate in the third quarter, up from a 0.8% decline in the second quarter.

- The US Pending Home Sales Index (PHSI) edged down 2.2% in

September to 130.0 from an August record high. (IHS Markit

Economist Patrick Newport)

- The Northeast was the only region registering a gain.

- "The demand for home buying remains super strong," wrote Lawrence Yun, the National Association of Realtors chief economist.

- What is driving sales? Partly, it is near-record-low mortgage rates, pent-up demand, and record-low inventories, which have led to bidding wars and a rush to buy.

- It is unclear how much telework—which is here to stay—is also driving sales (for those able to work from home living in cities, such as San Francisco, Boston, or New York, where real estate is pricey, it is an ideal time to cash out and move into a larger, less-expensive house where traffic is never an issue).

- Applications to buy homes—particularly high-end homes—remain strong: the Mortgage Bankers Association's Purchase Index for the week ending 28 October was 24% higher than a year earlier and the average loan size set a record-high $372,600. The Purchase Index has been slipping lately, though, declining nearly 7% in the past five weeks—a sign that sales may have peaked.

- The PHSI leads existing home sales by a month or two, according to the National Association of Realtors. Expect solid existing home sales in October or November or both.

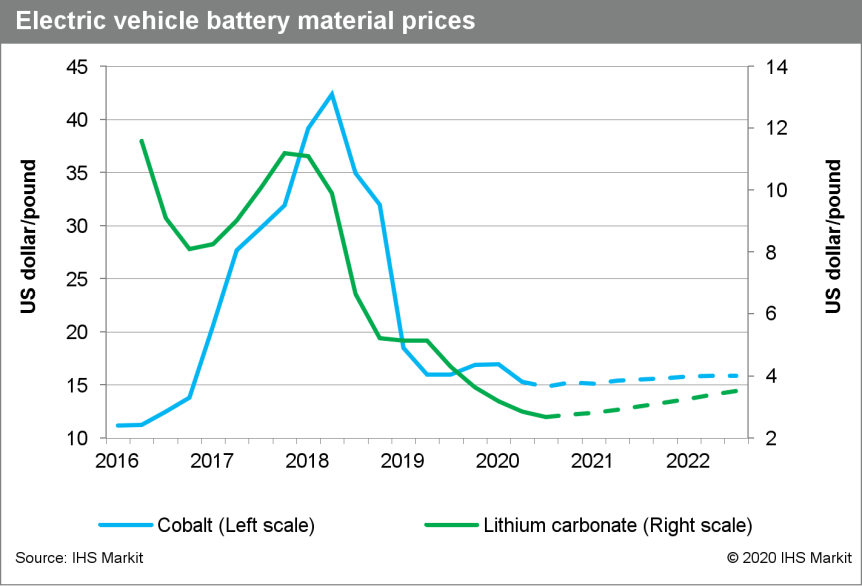

- Cobalt prices rose in late summer as supply-side factors and

strategic reserve purchases lifted spot market activity. After

averaging $13.88/pound in July, prices in September moved to

$15.57/pound. The 12.2% gain since July points to stabilizing

market conditions in 2021 and reinforces the IHS Markit view of

further upside price risk through year-end. (IHS Markit Pricing and

Purchasing's KC Chang)

- Notwithstanding September's rise, spot cobalt prices are still 15.5% lower than a year earlier, when Glencore placed its big Mutanda mine, located in the Democratic Republic of the Congo (DRC), on care and maintenance. Supply-side tightness will increase in 2021 as the market feels the impact of Mutanda's closure. IHS Markit estimates cobalt mine production in 2019 fell by 0.7% to 142,000 metric tons, and 2020 production will show a larger decline.

- Other bottlenecks in Africa are also hampering the cobalt market. South Africa still maintains tight border controls with neighboring countries that require access to South Africa's main seaport of Durban. South African officials temporarily closed seaports on 26 March as part of their COVID-19 containment efforts. With access to Durban being intermittent for regional miners, intermediate and semi-processed cobalt from the DRC and Zambia will continue to experience supply-chain challenges through year-end.

- On the demand side of the market, cobalt also faces significant headwinds. Superalloy steel production uses cobalt for different purposes and historically represents 30% of global demand. The aerospace industry is an important market segment that faces a generational downturn over the next 12-18 months. We expect cobalt-based steels for jet engine turbine blades to decline by 7% in 2020 and remain stagnant through 2022.

- The soft lithium price environment gives category managers strong bargaining leverage with long-term supply agreements. In September, Orocobre signed a memorandum of understanding with Prime Planet Energy Solutions to supply lithium carbonate and hydroxide starting in 2021. The battery producer is a joint venture between Toyota Motors and Panasonic to make NEV batteries for the automotive industry. Although there are still challenges for lithium producers in 2020, the auto industry remains focused on expanding battery manufacturing capacity during the next two years, promising strong consumption growth.

- Although lithium carbonate prices have stayed under $3/pound since April, the expansion of NEV battery production and NEV charging infrastructure in Europe and mainland China points to rising lithium demand in the coming years. Mainland China remains committed to growing NEV usage as policymakers focus on promoting NEV purchases in rural communities.

- Cobalt and lithium prices have more upside than downside risk

through year-end as visible inventory gradually declines and

supply-chain risks grow. While the penalty for delaying purchases

remains low at current spot prices, key producer markets face

prolonged and difficult COVID-19 containment efforts. The use of

long-term supply contracts can help minimize potential upward price

volatility and temporary supply shortages in the next 12

months.

- Ørsted has announced possible delays to some of its offshore wind projects. In its recent Q3 2020 earnings call, Chief Executive Officer (CEO) Henrik Poulsen revealed that the Bureau of Ocean Energy Management (BOEM) had not issued Notices of Intent (NOI) for some of its advanced-stage development projects. The NOI signifies BOEM's acknowledgement that it has received a company's completed construction and operations plan and kick-starts the two-year regulatory timeline for BOEM's ultimate approval of the construction and operations plan. Ørsted has stated that even if the permitting process starts in the first quarter 0f 2021, it expects that offshore projects such as Revolution Wind (704 MW), Ocean Wind (1,100 MW), Skipjack (120 MW) and Sunrise Wind (880 MW) will be delayed beyond the previously expected 2023 and 2024 construction years. Although the company has stated that these projects have some flexibility in their timelines, it has stated that until there is a clear timeline from BOEM, it cannot re-baseline its construction schedules. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Ford returned USD2.4 billion in net income in the third quarter on higher demand and stronger pricing as the company prepares for key fourth-quarter vehicle launches. Ford's overall performance in the third quarter was largely a result of its performance in the North American market, as in most other regions, the company posted losses. However, the overall result represented an improvement on a year earlier, despite the ongoing effects on the auto industry's sales volumes and production from the COVID-19 pandemic. The third-quarter performance enabled Ford to provide revised guidance for the fourth quarter and the full year 2020. In the fourth quarter, in terms of adjusted EBIT, the company is now expecting between a USD500-million loss and a breakeven figure. For the full year 2020, Ford is expecting adjusted EBIT of between USD600 million and USD1.1 billion. Ford has revised its guidance on capital spending this year to between USD5.9 billion and USD6.4 billion, down from USD7.6 billion in 2019. Overall, assuming no further drastic disruptions, Ford appears to be among the companies coming out of the extremely difficult first half with a strong balance sheet and product opportunities poised to be delivered in 2021. Ford's overall performance in the third quarter was largely a result of its performance in the North American market, as in most other regions, the company posted losses. However, the overall result represented an improvement on a year earlier, despite the ongoing effects on the auto industry's sales volumes and production from the COVID-19 pandemic. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Dana made sales of USD1.99 billion in the third quarter of 2020 (versus USD2.16 billion in the third quarter of 2019), a decline attributable to weaker end-market demand as a result of the shutdown in the second quarter and the eventual restart in June, Dana says. Dana reported net income, although at USD45 million it was a sharp drop from net income of US111 million in the third quarter of 2019. Adjusted EBITDA (earnings before interest, tax, depreciation and amortization) was USD201 million, versus USD250 million a year earlier, primarily on lower sales. Dana chairman and CEO James Kamisickas said, "As our multiple end markets rebounded from the unprecedented global COVID-19 pandemic shutdown, I want to commend the Dana team for an outstanding job, first and foremost ensuring the safety of our people, while successfully bringing our global manufacturing operations back on-line to meet growing customer demand. Light truck and agriculture demand were especially strong, while many other markets, such as commercial vehicle, realized strengthened production volumes this quarter. We remain intensely focused on helping our customers navigate these challenging times all while remaining diligent about safety, cost management, and strengthening our e-Propulsion capabilities." Dana also noted an investment into Pi Innovo LLC, a software solutions and electronics control units company. Dana has acquired a non-controlling stake, enabling Dana to "enhance its in-house electric-vehicle capabilities by providing turnkey software and control solutions for its entire portfolio of technologies," according to Dana's statement. Dana did not identify the specific investment amount. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Outrider has raised USD65 million in a Series-B funding round led by Koch Disruptive Technologies, reports VentureBeat. The latest round involves participation from new investors including Henry Crown and Company and Evolv Ventures, and existing investors including NEA, 8VC and Prologis Ventures. The company is developing electric autonomous trucks to automate operations in yards. The latest funding round followed USD53 million in seed and series A rounds completed earlier this year, bringing Outrider's total capital raised to USD118 million (see United States: 20 February 2020: Outrider raises USD53 mil. to develop technology for autonomous trucks). Outrider said it will use the new capital to accelerate its go-to-market efforts as it plans to expand its workforce and increase its customer base. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Argentine beef exports improved in September as volumes shipped

to China rebounded to reach their highest levels since May. Exports

for the month totaled 58,291 tons, 5.1% higher y/y and more than

5,000 tons up on the figure for August of this year. The increase

was mainly due to a recovery in frozen beef sales to mainland

China, whose share of overall export volumes had slipped back in

the third quarter of this year. Shipments to mainland China totaled

42,214 tons - a rise of 1.5% on year-ago levels and significantly

up on the 33,180 tons shipped in August. The figures, which include

fresh and frozen but not processed beef, show that export prices in

September averaged USD4,206 per ton - down by almost 23% on the

same month last year. Prices paid by China were more than 30% down

on year-ago levels at USD3,389 per ton. Because of the fall in

average prices, the overall value of Argentine beef exports fell to

USD245.2 million in September -18.9% lower y/y. This continues the

trend seen since the onset of the Covid-19 pandemic, which has hit

global demand for higher value beef cuts sold in restaurants and

other catering establishments. Argentine beef exports in the first

nine months of 2020 totaled 440,015 tons - up 15% on the same

period last year. In value terms, these shipments were worth just

over USD2 billion - a drop of 1.6% y/y. Away from China, the South

American country has increased shipments to Chile, Israel and

Russia. It has also made impressive inroads in the US, which took

more than 19,000 tons of Argentine beef in the first nine months of

2020, up from just 348 tons in the same period last year. (IHS

Markit Food and Agricultural Commodities' Ana Andrade and Max

Green)

Europe/Middle East/Africa

- European equity markets closed mixed; Spain -1.0%, Italy -0.1%, France/UK flat, and Germany +0.3%.

- Most 10yr European govt bonds closed higher, except for UK +1bp; Italy -6bps, Spain -4bps, France -3bps, and Germany -1bp.

- iTraxx-Europe closed -1bp/64bps and iTraxx-Xover -7bps/366bps.

- Brent crude closed -3.5%/$38.26 per barrel.

- Although the ECB made no changes to its policy stance following

its latest policy-setting meeting, its statement and press

conference were unusually explicit in signaling that additional

stimulus will follow in December, in tandem with the update of its

macroeconomic projections. (IHS Markit Economist Ken Wattret)

- The statement said, "In the current environment of risks clearly tilted to the downside, the Governing Council will carefully assess the incoming information, including the dynamics of the pandemic, prospects for a rollout of vaccines and developments in the exchange rate. The new round of Eurosystem staff macroeconomic projections in December will allow a thorough reassessment of the economic outlook and the balance of risks. On the basis of this updated assessment, the Governing Council will recalibrate its instruments, as appropriate, pre-announcing additional easing."

- The press conference also referred explicitly to an agreement having been reached on the Governing Council to recalibrate the policy stance in December, with ECB staff reviewing the policy options available. This review will touch on "all instruments".

- This virtual pre-announcement of further easing begs the question, why not just announce a change straight away? The preference is evidently to wait for the updated macroeconomic projections, as this process can help to cement an agreement across the Governing Council in favour of a bold action. The ECB also wants more time to discuss and decide on what to do next.

- In the interim, clearly the ECB was eager to avoid disappointing financial markets by giving insufficiently dovish signals while failing to act. Notably, the euro exchange rate again featured explicitly in the policy statement, and one of the ECB's prime concerns would have been that inaction and no signal of intent would lead to a further, unwelcome appreciation.

- In tandem with the very dovish policy signals, the ECB's statement contained various changes to its economic assessment, including the prospect of a "significant softening" of economic activity in the final quarter of the year.

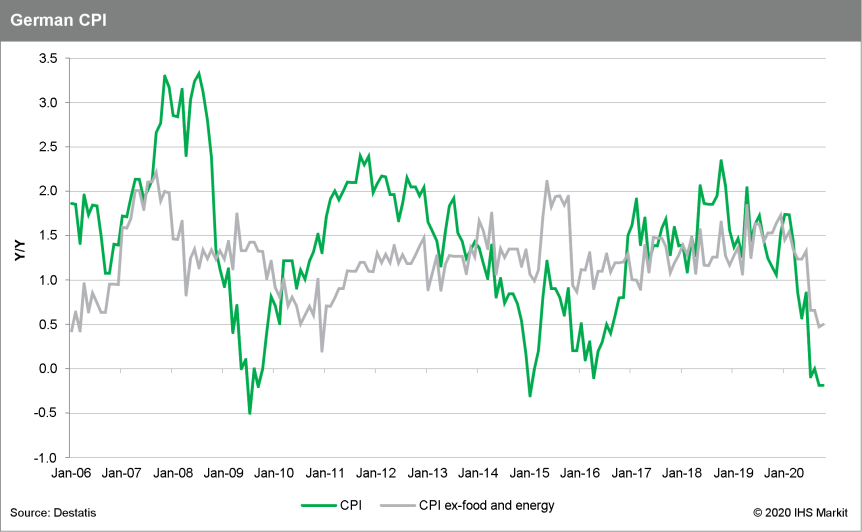

- We have long thought that an additional policy action from the ECB by December was pretty much nailed on, given the uncertain economic outlook and the persistence of low levels of headline and core inflation (see chart below), and it is now a racing certainty.

- As highlighted above, the ECB's preference is evidently to wait for the update of its macroeconomic projections and announce its next steps on 10 December, but is an inter-meeting move out of the question?

- Seasonally adjusted German unemployment has declined by 35,000

in October, its fourth monthly drop in succession following a

cumulative surge of 673,000 during the second quarter, and the

largest to date. The cumulative decline during July-October is

76,000, and the unemployment level at the end of October is 2.863

million, which compares with a cyclical low of 2.266 million in

February and March. (IHS Markit Economist Timo Klein)

- Separately, the Labor Agency has calculated that the COVID-19 effect on unemployment was -57,000 in October, following -23,000 in September, around zero in July-August, and huge increases during the second quarter. The cumulative net increase in joblessness since April that can be linked directly to the pandemic is 556,000. The German unemployment rate, which had increased from 5.0% in March (close to a 40-year low) to 6.4% during June-July, has slipped from its August-September level of 6.3% to 6.2% in October.

- Seasonally adjusted underemployment (as opposed to unemployment), which had deviated in both directions during 2019 as a result of fluctuations in the number of people receiving some form of (non-insurance-related) government support - which affects the underemployment data but not official unemployment - has once again declined more strongly than unemployment in October, falling 40,000 month on month (m/m). The Labor Agency points out that statistical under-coverage of the number of people benefiting from public support measures - in turn related to COVID-19 virus-related contact impediments and preoccupation with administering short-time work applications - is at least partly responsible. The official number for these measures (-15.2% year on year in October, down from -13.2% in September), and thus also the level of underemployed people, is likely to be revised upwards at a later stage.

- Employment is continuing to reverse its February-June plunge (cumulatively -750,000). In September (employment data lag unemployment numbers by one month), seasonally adjusted employment increased by 24,000, following rises of 23,000 in July and 7,000 in August. This compares with an average monthly increase of 21,000 during 2019 and even 40,000 during the cyclical upward trend between March 2010 and end-2018.

- As in July, the sub-category of jobs for which employers pay social security contributions - i.e. excluding the self-employed, "mini-jobs", or other forms of precarious employment - posted an annual decline of 0.3% in August (the latest data available). This contrasts with an increase of 1.3% year on year (y/y) in February before the pandemic struck. There continues to be a stark contrast between full-time and part-time work, as the former declined 0.7% y/y in August and the latter increased 0.6% y/y. If one includes all forms of employment (not just those with social security contributions), the picture is worse (-1.4% y/y in August). This illustrates that precarious forms of employment are the first to suffer in a downturn and are still lagging despite the recent rebound.

- Data on cyclically induced short-time work, an important indicator for imminent changes in labor market trends, are currently available only until August. The seasonally adjusted level of 2.59 million for August is down from 3.33 million in July, 4.43 million in June, 5.69 million in May, and a peak of 6.00 million in April. In February, before the pandemic broke out, the level had been just 129,000, and the August level is still almost double the peak of 1.4 million seen during the global financial market crisis in 2009.

- Underlining the improving tendency with respect to short-time work, company announcements about such plans, which are available in a much timelier fashion, totaled a mere 96,000 during 1-25 October, down from 107,000 in September and a peak of 8.02 million in April. This trajectory implies further significant declines in the number of short-time workers in the months ahead, although downward momentum will slow.

- Seasonally adjusted vacancies have increased by 17,000 m/m to 585,000 in October, their third consecutive increase following an interim low of 561,000 in July. Vacancies had peaked at an all-time high of 808,000 in December 2018, and stood at 706,000 in February 2020 just before the pandemic hit. By comparison, October's level is still double the previous cyclical trough in July 2009 (281,000), then hurt by the global financial market crisis. Meanwhile, the BA-X seasonally adjusted vacancy index introduced in 2005 - which measures employers' demand for labour, disregarding all seasonal and publicly subsidised job offers - has rebounded by four points to 98 in October, which is up from May's low of 91 but still 23 points lower than in October 2019 and 36 points below its all-time high of 134 in September 2018.

- Germany's Federal Statistical Office (FSO) has reported, based

on data from various regional states, that the country's national

consumer price index (CPI) increased by 0.1% month on month (m/m)

in October. This matches the average monthly change in October in

recent years and leaves the year-on-year (y/y) inflation rate

unchanged at -0.2%. The EU-harmonized CPI measure was flat m/m,

with its y/y rate thus slipping slightly further from -0.4% to

-0.5%. (IHS Markit Economist Timo Klein)

- The detailed breakdown of the German national data will only be published with the final numbers on 12 November, but components are available, for instance, from the largest and most populous state of North Rhine-Westphalia (NRW). CPI in this state was well above the average this month, with its 0.3% m/m increase pushing up its y/y rate from -0.3% in September to -0.1% in October.

- Energy prices in NRW rebounded by 0.5% m/m, thus curtailing their y/y decline from -6.2% to -5.7% and restoring its mid-year upward tendency. The main other factors that had a boosting effect during October were food (0.6% m/m) and clothing/shoes (1.2%). Dampening influences came from "miscellaneous goods and services" (-0.1%) and telecommunications (-0.2%).

- With respect to changes in y/y rates, inflation was boosted the most by food (from 0.1% to 1.0% y/y), followed by recreation and entertainment (from -0.5% to -0.1%), transport (from -2.5% to -2.3%), and clothing/shoes (from -1.9% to -1.6%). This was partially offset by softening annual rates in the case of "miscellaneous goods and services" (from 1.2% to 0.7%), hotels/restaurants (from 1.6% to 1.2%), and alcohol/tobacco (from 2.4% to 2.0%).

- NRW's core rate of inflation without food and energy remained steady at 0.5% y/y in October. Increases in the categories for recreation & entertainment and clothing/shoes were offset by declines among "miscellaneous goods and services" and hotels/restaurants.

- Service-sector inflation in NRW yet again stayed steady at 0.8%

y/y, whereas goods inflation rebounded from -1.6% in September to

-1.2% in October. Rising prices for food and energy are the key

factors for the latter.

- Daimler Trucks and Waymo together announced a new partnership aimed at deploying Waymo's self-driving technology on the Class 8 Freightliner Cascadia "in the coming years." The vehicle will be a "unique" version of the Cascadia, with deployment in the US first. Although no details have been confirmed, it seems more likely that Waymo will deploy the autonomous Freightliner Cascadia, in the way that it does with its minivans from FCA, rather than Daimler and Freightliner getting into the business of goods delivery as well as making trucks. The brief statement notes Waymo's more than a decade of experience developing its autonomous technology, which it calls the World's Most Experienced Driver. Waymo claims more than 20 million miles on public roads with its system, along with 15 billion miles on a simulator. In explaining the partnership, the statement says, "Both Waymo and Daimler Trucks share the common goal of improving road safety and efficiency for fleet customers… Waymo and Daimler Trucks will investigate expansion to other markets and brands in the near future." Initial deployment will be in the US "in the coming years", with expansion to other areas to be explored later. At this stage, neither company has disclosed financial details surrounding the partnership, or indicated specifics about commercial deployment. However, there is strong opportunity for Class 8 trucks to be able to operate in Level 4 situations; the partnership between Daimler Trucks and Waymo is a result of research and development into this area by both companies. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Mercedes-Benz Buses has delivered three examples of its new eCitaro G electric articulated bus to Swiss company Eurobus, according to a company statement. The buses will be used at the ETH Zentrum and ETH Hönggerberg sites at Zurich's public university, the Eidgenössische Technische Hochschule. The three 18.13-m articulated buses are equipped with fully electric drives and a current collector for intermediate charging. They have space for 131 passengers; 38 seats and standing room for 93 with two wheelchair places. They are fitted with a wheelchair ramp so that passengers with restricted mobility can enter the vehicle without obstruction. It is also fitted with USB ports for passengers to connect and charge mobile devices. This bus uses the same basic technology and powertrain as the standard rigid-bodied eCitaro, which is already in service with multiple transport companies around the world after debuting two years ago. The eCitaro G has been launched with the NMC lithium-ion battery variant that is already in use with the standard eCitaro. However, Mercedes-Benz buses has already stated it will increase the performance of the eCitaro G this year by switching to a new generation of NMC batteries. This will increase capacity considerably, from 292 kWh to up to 396 kWh. However, the most exciting technical element of the eCitaro G is that the next iteration will be available with a form of solid-state battery, which will be an option. (IHS Markit AutoIntelligence's Tim Urquhart)

- France is aiming to limit the drop in economic activity to 15% during the country's second coronavirus lockdown starting on Friday, Finance Minister Bruno Le Maire said in a government briefing on Thursday. That would be half of the 30% drop in activity during the country's first lockdown that started in March, which was caused in particular by a halt of construction work, Le Maire said. (Blomberg)

- British consumers will likely have to pay more for premium turkeys this Christmas as the industry wrestles with higher feed costs and challenges linked to Covid-19. Kelly Turkeys, one of the UK's largest producers, says it is putting up prices by 3.5% to cover higher production costs particularly for feed affected by the rise in wheat prices following one of the smallest UK harvests in decades. Managing director Paul Kelly is forecasting that there will be fewer turkeys on the market this year as fewer poults were hatched for rearing predominately because of supermarket policy. At the same time, he points out that around 4.6 million people will not be going away for Christmas and says these extra mouths to feed have not been accounted for by the major retailers or turkey suppliers. "Families that holiday at Christmas are the more affluent and more likely to shop in the premium end of the market," he notes. "There will be many more affluent families staying in the UK this Christmas." Kelly says supermarkets will not be carrying as many turkeys to reduce wastage as they are concerned they will not be physically able to get the numbers of people through the store if social distancing is still in place. "The seasonal turkey sector is vital to delivering the Great British Christmas and it cannot survive without access to non-UK labor. The seasonal turkey industry needs to bring in at least 1,000 workers for the 2020 Christmas period. If these vacancies cannot be filled, it will have a significant impact on the production of, and therefore cost of food - all of which will pose a risk to affordability and potentially force people to go without food this Christmas," said British Poultry Council, Chief Executive, Richard Griffiths. (IHS Markit Food and Agricultural Commodities' Max Green)

- Shell has outlined a major restructuring of its worldwide

chemicals and refining operations as part of a strategic overhaul

that will see it reduce its current 14 refining sites to 6

integrated energy and chemical parks.

- The company's chemicals business will also target growth by pivoting toward "more performance chemicals and recycled, sustainable feedstocks," it says.

- The six sites expected to become integrated energy and chemical parks are located at Deer Park and Norco in the US, Scotford in Canada, Pernis in the Netherlands, Rheinland in Germany, and Pulau Bukom in Singapore, according to Shell.

- It will also retain six chemicals-only production sites at Moerdijk in the Netherlands, Fife in the UK, Geismar and Pennsylvania in the US, Jurong Island in Singapore, and CSPC, the company's joint venture with CNOOC in China, it says. It has not given any timeframe for the restructuring.

- Shell, which first revealed its intent in late September to focus on growing its chemicals business and further integrating it with a more streamlined refining segment as part of its energy transition towards cleaner products, gave details of the restructuring during its third-quarter financial results today.

- Chemicals will be a "key business through the energy transition," it says, with demand expected to increase as the world's population grows. "For refining, we will further high-grade our footprint and maximize the integration with chemicals," it says.

- Shell will also increasingly integrate the use of low carbon fuels such as biofuels, hydrogen, and synthetic fuels, it adds. Shell's nine-month chemical earnings to the end of September totaled $441 million, 21% lower YOY, reflecting lower realized margins owing to the weak price environment.

- The chemicals manufacturing plant utilization rate averaged 81% for the period, up 3% on the equivalent period last year, due mainly to higher maintenance activities in Asia and Europe.

- Year-to-date cash capex totaled $1.18 billion, down from $3.07 billion a year earlier. The company is forecasting a chemical sales volume range of 3.5-3.9 million metric tons for the fourth quarter, with an expected manufacturing plant utilization rate of 77-85%.

- Shell reported group net earnings of $489 million for the quarter, down 92% YOY, while adjusted earnings were down 80% YOY to $955 million, beating a company-provided consensus estimate by analysts of $146 million.

- Swiss firm Novartis has announced the acquisition of US biotech Vedere Bio, a specialist in ocular gene therapies using adeno-associated virus (AAV) vectors. Vedere Bio received USD150 million in an upfront payment, and will be eligible for USD130 million in milestone payments, up to a total payment of USD280 million. Novartis will gain two preclinical AAV-based ocular gene therapy programs, together with a novel delivery technology for the treatment of all inherited retinal dystrophy subtypes and geographic atrophy, and a "first-in-class" optogenetics platform. The acquired technologies include light-sensing proteins that may be delivered to retinal cells, and modified AAV vectors that can be delivered via intravitreal injection. Vedere's technology aims to develop novel strategies for the treatment and prevention of vision loss and blindness. This acquisition is closely in line with Novartis's growing focus on cellular and gene therapies, including the 2018 acquisition of US firm AveXis, the original developer of the groundbreaking spinal muscular atrophy (SMA) gene therapy Zolgensma (AVXS-101; onasemnogene abeparvovec), and its subsequent integration as the renamed Novartis Gene Therapy division. (IHS Markit Life Sciences' Janet Beal)

- Clariant says its third-quarter sales declined 14% year on year

(YOY) to 893.0 million Swiss francs ($979.5 million) due to lower

volumes and negative currency effects that also squeezed

profitability, with EBITDA for the period lower by 16% YOY, to

SFr127 million. The company's EBITDA margin recorded a slight YOY

decrease of 0.3 percentage points, to 14.2%. Net profits have not

been disclosed.

- Clariant's care chemicals and catalysis businesses recorded higher EBITDA margins owing to more favorable product mixes, cost mitigation, and efficiency improvement, the company says. Natural resources posted a lower EBITDA margin, mainly because of lower volumes in industries affected the most by COVID-19 such as automotive, textiles, and oil, the company says.

- Clariant expects third-quarter sales to be the lowest of the first three quarters of 2020. Its natural resources business was affected the most, with all three segments of the business impacted negatively by oversupply in oil markets and the pandemic. Sales in care chemicals and catalysis softened only slightly, it says.

- Natural resources' EBITDA fell 38% YOY, to SFr44 million on 22% YOY lower sales, to SFr356 million, due to lower volumes resulting from weaker demand, especially in the oil and mining services segment. Care chemical sales decreased 9% YOY, to SFr330 million, but EBITDA increased 16% YOY, to SFr72 million, due to performance measures and a favorable product mix, the company says. Sales of Clariant's catalysis business were 9% lower YOY, to SFr207 million, and EBITDA decreased 5%, to SFr42 million.

- Clariant anticipates that the COVID-19 pandemic will have a continued, but slightly less negative impact on sales and profits in the fourth quarter of 2020 compared with the third quarter. The company says it will continue with its performance programs to achieve above-market growth, higher profitability, and stronger cash generation in the midterm.

- In a press release, Equinor reported third-quarter 2020 net loss of $2,124 million, compared with a net loss of $1,107 million a year-ago period. The earnings were negatively impacted by net impairments of $2,930 million mainly due to reduced future price assumptions, Equinor said. Adjusted earnings were $780 million, down 70% from $2,593 million a year ago. The decrease was primarily due to lower oil and gas prices, the company said. Net operating loss was $2,019 million, compared with a net operating loss of $469 million a year ago. The decrease was primarily due to net impairments of $2,930 billion mainly due to reduced future price assumptions as well as some reductions in reserves estimates, the company said. Cash flows provided by operating activities decreased by $1,549 million from a year ago, primarily due to lower liquids and gas prices and a change in working capital, partially offset by decreased tax payments, the company said. Equity production was 1,994,000 boe/d, up 4% from year ago, primarily due to increased flexible gas production, increased production from the new fields on the Norwegian Continental Shelf (NCS) and in the UK. This production increase was partially offset by expected natural decline mainly on the NCS, production halt in Brazil and divestment of the Eagle Ford asset in the E&P USA segment in the fourth quarter of 2019, the company said. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- Icelandic inflation rate stood at 3.6% in October, its highest

level since May 2019. Contrary to developments in most other

European countries, Icelandic inflation has trended upwards since

reaching 2.1% in March 2020, mainly owing to the depreciation of

the króna, which is feeding into the prices of imported goods and

services. (IHS Economist Diego Iscaro)

- Household goods were the main driver of inflation in October. On top of the impact of the currency, restrictions to movement as a result of the pandemic have resulted in higher demand for household durables. The prices of food and non-alcoholic beverages also accelerated in October, while the fall in communication costs eased vis-à-vis September.

- On the other hand, housing and transport costs continued to ease in October, despite the latter's increase being well above the average inflation rate.

- October's figures match IHS Markit's forecast and therefore will not drive a revision of its estimate for the year. According to our latest forecast, we expect inflation to average 2.8% in 2020.

Asia-Pacific

- APAC equity markets closed lower except for Mainland China +0.1%; Australia -1.6%, South Korea -0.8%, India/Japan -0.4%, and Hong Kong -0.5%.

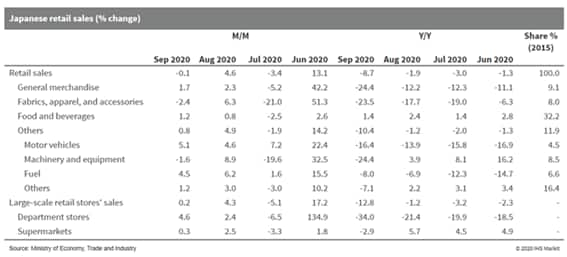

- Japanese retail sales fell by 0.1% month on month (m/m) in

September following a 4.6% m/m rise in August. The year-on-year

(y/y) contraction widened to 8.7%, but this was higher than

year-earlier figures in line with front-loaded demand ahead of the

consumption tax increase in October 2019. Although retail sales

during the third quarter of 2020 rebounded by 8.4% quarter to

quarter (q/q) after a 7.5% q/q drop in the previous quarter, the

September level was the same as in February 2020 and slightly below

the monthly average for 2019. (IHS Markit Economist Harumi Taguchi)

- The resumption of economic activity in line with easing COVID-19 virus-containment measures continued to lift sales of general merchandise, motor vehicles, and fuels. These upside factors were offset by declines in sales of fabrics, apparel, and accessories and machinery and equipment. Sales of food and beverages remained solid, supported by stay-at-home/working-from-home lifestyles.

- The consumer confidence index (CCI) continued to rise in October, moving up 0.9 point to 33.6, but this was still below the February 2020 level. Although all component indices contributed to the second straight month of improvement, the strengthening was only modest, largely because of weak confidence in improvement in employment, which remained below 30, and a weak improvement for income growth.

- The September results suggest that overall retail sales have

recovered to close to their pre-pandemic level and that private

consumption is likely to drive a rebound of real GDP growth in the

third quarter. However, the upward momentum could ease, and it may

take some time for sales of non-essential goods to return to their

pre-pandemic level.

- The BoJ left its monetary policy unchanged at its 28 and 29

October monetary policy meeting (MPM). The Bank will continue

quantitative and qualitative monetary easing (QQE) with yield curve

control. The BoJ also maintained the pace of its asset purchasing

and special lending program support financing in response to the

COVID-19 virus pandemic. (IHS Markit Economist Harumi Taguchi)

- The BoJ revised up its view on the current economy, thanks to improved exports and industrial production and modestly better corporate sentiment. However, its outlooks for GDP growth and inflation in fiscal year (FY) 2020/21 were revised downwards, reflecting a weaker-than-expected recovery in services and sluggishness for prices associated with modest economic activities, as well as the downward effects from the government's travel subsidies.

- The BoJ revised up its outlooks for GDP growth and inflation in FY 2021/22, anticipating contributions from the resumption of economic activities in Japan and overseas. Nevertheless, the Bank remarked that its outlooks are extremely unclear and could change depending on the consequences of the COVID-19 virus outbreak and the magnitude of domestic and overseas economies, as well as firms' and households' medium- to long-term growth expectations.

- The Bank's decision to maintain its monetary policy and special lending program is in line with IHS Markit's expectations, given that monthly economic indicators have improved since the September MPM. As the BoJ stated, its various measures introduced since March, as well as the government's fiscal measures, have supported firms' financing and maintained stability in financial markets.

- Nissan's discussion on electrification and the future of mobility is one of the main highlights of the virtual session hosted by the automaker as part of the Expo 2020 Dubai's Climate & Biodiversity Week, according to company sources. Guillaume Cartier, vice-chairperson and senior vice-president of marketing and sales at Nissan Africa, Middle East, India, Europe and Oceania (AMIEO) and president of Nissan Africa, Middle East, and India (AMI) said, "Our mission is to support cities in this region that are focused on optimizing transportation - to become smart cities. Through our extensive global experience in the electrification space, we understand that engaging with mobility, energy, and government stakeholders is instrumental to the emergence of smart cities. Capturing the world's imagination, Expo 2020 is a key platform to facilitate these discussions amongst thought leaders - and we look forward to sharing our expertise and working towards the joint development of sustainable mobility systems that benefit local communities." Nissan will also provide the Expo 2020 fleet with over 1,000 cars. The discussion is part of Nissan's efforts to accelerate the development towards smart cities, sustainable energy management, and electric vehicle (EV) expertise to a build a supportive ecosystem for EV adoption in the future. (IHS Markit AutoIntelligence's Tarun Thakur)

- Toyota Group has announced its global production figures for

September. It reported a 7.6% year-on-year (y/y) increase in

overall output to 973,857 units. The figure includes output at its

subsidiaries Daihatsu and Hino. (IHS Markit AutoIntelligence's

Nitin Budhiraja)

- According to data released by the automaker on its website on 29 October, worldwide output of the Toyota brand was up by 11.7% y/y to 841,915 units last month, Daihatsu's output was down by 10.1% y/y to 121,483 units, and Hino's production declined by 37.2% y/y to 10,459 units.

- By region, Toyota Group's production increased by 4.4% y/y in the domestic market to 407,127 units and by 10.0% y/y in overseas markets to 566,730 units during September.

- Japanese output of the Toyota brand was up by 4.5% y/y to 305,628 units. Volumes for Daihatsu were also up by 9.5% y/y to 91,818 units, while those for Hino were down by 29.0% y/y to 9,681 units during September.

- In overseas markets, the production volume of the Toyota brand during September was up by 16.3% y/y to 536,287 units, while Daihatsu posted a 42.2% y/y decline to 29,665 units. Hino's output declined by 74.1% y/y to 778 units.

- According to IHS Markit's latest production forecasts, Toyota Group's light-vehicle production (including the Hino, Daihatsu, Toyota, and Lexus brands) is expected to decline by 17.4% y/y to around 8.793 million units in 2020, from 10.64 million units in 2019. At its Japanese plants, total light-vehicle production during 2020 is expected to decline by 14.9% y/y to 3.712 million units.

- MINIEYE, a perception solution provider for autonomous vehicles, has raised CNY270 million (USD40.2 million) in a Series C funding round. The latest round involves participation from new investors including Harvest Investment, Oriental Fortune Capital, and VISION+ CAPITAL and existing investor NavInfo. The company will use the capital to ease the pressure on large-scale delivery of products and increase its cash flow. MINIEYE, which was founded in 2013, develops sensor systems for automated driving. The company uses artificial intelligence technology to develop sensing solutions, and has served 20 clients including General Motors (GM), Ford, SAIC, BYD, and Dongfeng Automobile. In early 2019, MINIEYE partnered with Xilinx to develop Level 1-3 automated vehicle solutions. Last year, the company raised USD20 million in a series B financing round. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese automaker Geely has introduced a plug-in hybrid (PHEV) variant of the Xingyue sport utility vehicle (SUV), expanding its PHEV offering to six models. The Xingyue epro will offer four trim level options in China starting from CNY175,800 (USD26,290) and going up to cNY216,800. The hybrid powertrain of the Xingyue epro consists of a 1.5-litre turbo-charged engine, a seven-speed transmission and an electric motor. According to Geely, the vehicle can deliver a maximum system output of 190kW and a peak torque of 415N.m, and has an electric-only range of 80 km with a 15.5-kWh battery pack. The base model, however, is fitted with a smaller 11.3-kWh battery which can deliver a range of 56km under electric-only mode. Geely continues to expand its PHV line-up with the launch of the Xingyue epro. With an electric-only range of 80km, it offers the longest range of Geely's PHEVs, placing the vehicle on a par with its international competitors. PHEVs play an important role in Geely's effort to electrify its model line-up. As well as the Geely brand, Lynk&Co provides PHEV options across its entire line-up. IHS Markit expects Geely's PHEV production to reach over 49,440 units in 2021, up 32% from around 38,000 units forecast in 2020. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Refinery/petchem integration worldwide, and the growing

interest of energy companies in chemicals was the discussion topic

of a panel session on Wednesday at the India Energy Forum by

CERAWeek, organized in a virtual format by IHS Markit.

- S.M. Vaidiya, chairman of Indian Oil, said that the company would continue to invest in the refining business to meet domestic fuel demand. However, the refining sector has been hurt during the pandemic, with low refining capacity utilization rates and poor margins. Vaidya said investment in this sector is also known for its long gestation periods and that it entails huge upfront capital costs.

- As part of its investment strategy, Indian Oil is implementing petchem integration at some of its refineries. At its Paradip and Panipat refineries, the company is targeting an eventual petchem intensity index of 15-20% on completion of ongoing projects at the sites, Vaidya said.

- Indian Oil intends to mitigate margin uncertainty in fuel products and intends to enhance its group-wide petchem integration intensity to 14-15% by 2030. The company in the past few months has approved projects worth a combined $4.6 billion, mainly to enhance the integration of refineries with petchem and specialty products. It is carrying out a petchem and lube integration project at its Vadodara refinery at a cost of $2.6 billion. With the implementation of this project, the petchem intensity of the refinery will be almost 25%.

- Indian Oil's integration plans at Paradip include undertaking a greenfield project to produce purified terephthalic (PTA) acid and para-xylene (p-xylene). The cost of this project is $1.9 billion. The complex will produce 800,000 metric tons/year of p-xylene and 1.2 million metric tons/year of PTA, and will be integrated with the company's refinery at Paradip.

- M.K. Surana, chairman and managing director at Hindustan Petroleum Corp. Ltd. (HPCL), said most companies operating in the sector intend to have a petchem portion in their respective refining set-ups, and that HPCL is no exception. HPCL's planned refinery in Rajasthan State has a 25% petchem component. Going forward, the petchem composition of HPCL's product basket could be 20-25%, he said.

- B. Anand, CEO at Nayara Energy said that Nayara would focus its investments on refining, petchems, or specialties, and that the company had produced a roadmap. In the petchem sector, it has invested $750-800 million to establish polypropylene and methyl tert-butyl ether plants, which should commence operations soon. Nayara also plans to build a petchem park at Devbhumi Dwarka, Gujarat State.

- According to the Australian Bureau of Statistics, the 1.6%

quarter-on-quarter (q/q) rise in the headline consumer price index

(CPI) during the September quarter stemmed in no small part to the

unwinding of the government's free-childcare program, as that

triggered a 12% q/q surge in the furnishings, household equipment

and services component of the CPI. According to the agency, if the

impact of childcare were removed, this component would have only

risen 1.3% q/q mostly due to higher prices for furniture and

household appliances. (IHS Markit Economist Bree Neff)

- The other major contributor to the rebound in inflation during the quarter was a 9.4% q/q increase in automotive fuel prices, which pushed the transport group back into inflationary territory as well. This was also the primary driver for a sharp increase in tradables inflation despite Australian dollar appreciation during the quarter.

- Mitigating these price increases was a second consecutive quarterly fall in housing rental costs, offsetting rising prices for new dwelling purchases, which left the housing component of the CPI unchanged during the September quarter. The core inflation measures - trimmed mean and weighted median - remained feeble during the quarter, hinting at sustained weakness in underlying demand that will take time to recover, especially if labor market weakness persists.

- The snap back in inflation was modestly weaker than IHS Markit had anticipated, as such a minor downward revision to our 2020 annual average inflation forecast from our October forecast of 0.9% is expected. Weakness in domestic demand, plunges in housing rental prices and only gradual expected depreciation of the Australian dollar, will ensure inflation remains below the RBA's 2-3% target range for the next few quarters.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-october-2020.html&text=Daily+Global+Market+Summary+-+29+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 29 October 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+29+October+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}