Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 08, 2020

COVID-19 raises risks to global financial stability

- The outbreak of the coronavirus disease 2019 (COVID-19) virus has brought economic activity to a halt and paved the way for extraordinary levels of stimulus, forbearance measures, and liquidity support for global banks.

- Central banks, governments, and industry representatives announce new support measures daily, many of which are channelled through banks.

- In spite of these support measures - and in some cases because of them - risks to emerging market banking sectors have increased significantly since the beginning of March.

- IHS Markit has reviewed its banking sector ratings for the 52 economies it covers and has revised the outlook to Negative for 41 of those.

The virus that causes coronavirus disease 2019 (COVID-19) has wreaked havoc on the global economy, yielding an unprecedented sudden halt in economic activity, breadth and levels of stimulus, forbearance measures, and liquidity support for global banks. Emerging markets have been affected by significant outflows of funding and exchange-rate pressure as global investors have fled to safe havens. For emerging-market banks this has meant that risks to sector stability have deteriorated and will be weighted heavily to the downside for the foreseeable future. The main channels of risk are a sudden halt in foreign funding for banking sectors with elevated structural liquidity risk positions and a significant deterioration of asset quality because of weakening local currencies, extreme social-distancing measures, plunging commodity prices, the sudden ceasing of tourism, and a steep drop in demand for emerging-market exports from advanced economies.

Central banks, governments, and industry representatives announce new support measures for affected borrowers daily, many of which are channelled through banks. Examples of these support measures have so far included loan-payment reprieves ranging from three to six months, state-backed credit guarantee schemes, mandatory or voluntary fee reductions on electronic payments, regulatory capital-adequacy reductions, forbearance on loan-loss recognition, and significant liquidity injections through reduced reserve requirements and lower interest rates, among other measures. However, the level of detail provided about such programmes, the size of stimulus, and information about who will ultimately shoulder the cost of such programmes have varied significantly across economies, at present leaving much of the onus on local banks.

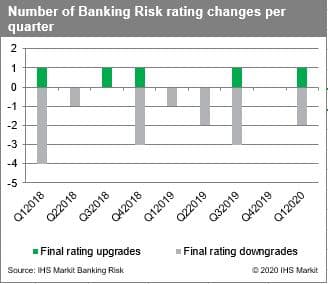

As a result, IHS Markit has reviewed its banking sector ratings for the 52 economies it covers and has revised the outlook to Negative on 41 of these, an increase of 32 Negative outlooks since the beginning of March. Across the board, risks of systemic banking crises have increased significantly since the beginning of 2020 and downgrades of our banking-sector ratings both indicatively and because of sovereign-level constraints are highly likely in the short term. This builds on what had already been a net negative two years for emerging markets' banking-sector ratings.

Outlook

- Given that the cause of the current stress is epidemiological, a positive indicator of risk would be a marked slowdown in new infections of COVID-19 or advent of a vaccine that would allow for a quick end to extreme social-distancing measures and resumption of macroeconomic activity globally.

- The sooner extreme social-distancing measures end, the fewer permanent business closures and defaults there will be, making temporary loan forbearance and payment reprieves effective measures to contain asset-quality risks and recapitalisation needs among emerging-market banks.

- Policy ineffectiveness, either at containing the virus itself or in shielding the economy from the fallout of extreme social distancing measures, risks inflaming financial sector instability over the next year.

- Banking sectors with lower risk scores going into the crisis, more effective bank regulatory and supervisory regimes, low reliance on foreign funding for liquidity, and conservative risk management practices will be more resilient to the present economic strains.

- The risks to our rated banking sectors are weighted heavily to the downside and there is a high likelihood that several banking sectors will be downgraded in the short term.

Our special report regarding the impact of COVID-19 on banking risk is now available for purchase.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-raises-risks-to-global-financial-stability.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-raises-risks-to-global-financial-stability.html&text=COVID-19+raises+risks+to+global+financial+stability+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-raises-risks-to-global-financial-stability.html","enabled":true},{"name":"email","url":"?subject=COVID-19 raises risks to global financial stability | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-raises-risks-to-global-financial-stability.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=COVID-19+raises+risks+to+global+financial+stability+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-raises-risks-to-global-financial-stability.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}