Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 04, 2018

Chinese economic growth stymied in April by falling exports

- Caixin Composite PMI Output Index edges up to 52.3 in April

- Exports fall for first time in nearly 1½ years

- Optimism slips to three-month low

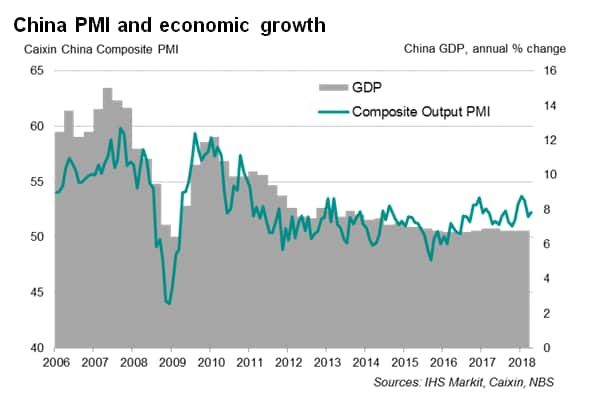

Chinese economic growth regained some momentum at the start of the second quarter, according to the latest PMI data, which goes some way to help allay concerns of a slowdown in the months ahead. Detailed survey data suggested that domestic demand was a key source of growth, but was countered by falling exports.

The Caixin Composite PMI™ Output Index rose from 51.8 in March to 52.3 in April, signalling a modest improvement in the health of the economy. While waning external demand had likely restricted business activity, particularly in the manufacturing sector, the pickup in growth momentum signalled by the April PMI survey provided evidence that the domestic market remains resilient.

Domestic-driven growth

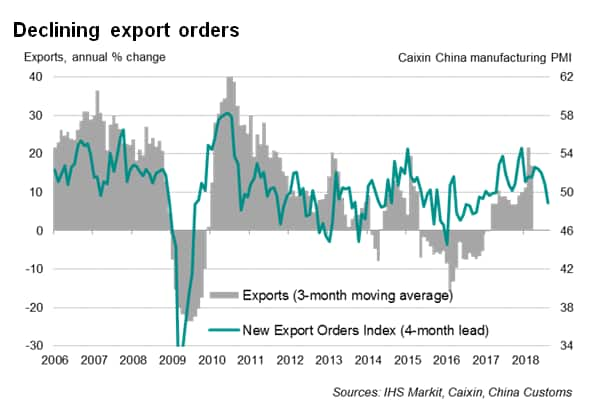

The main area of concern focused on exports, which fell for the first time for almost one-and-a-half years. The PMI's gauge of new export orders exhibits a 66% correlation with the annual growth (three-month moving average) of merchandise exports in USD terms - with a lead of four months.

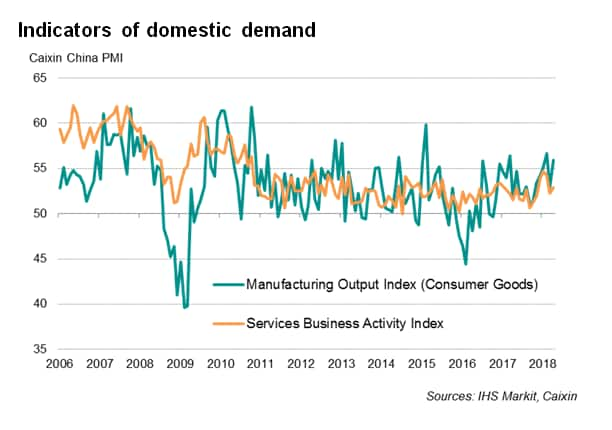

The good news is that rising domestic demand has partially compensated for the loss of momentum in export sales. Despite the dip in new business from abroad, manufacturing order books grew further in April, albeit at the slowest rate in seven months.

Sub-sector details bode well for the progress of China's transition to a consumer-led economy. Output of consumer goods producers rose further, contrasting with declines in the production of intermediate and investment products, pointing to reduced inventory building and capex respectively.

Within the service sector, inflows of new business rose further, with the rate of increase above the average seen in the last five years.

Stable employment

The labour market meanwhile showed signs of stabilising in April. Survey data showed unchanged levels of overall employment as service sector job gains were sufficient to offset job shedding in the manufacturing sector. However, limited spare capacity and higher sales in the manufacturing sector could boost hiring in the months ahead.

Inflationary pressures ease

Despite the upturn, the survey data showed further signs of weaker price pressures. Anecdotal evidence suggested that easing prices for steel and pork in particular have helped tempered the rise in cost inflation. Input costs at the composite level grew at the slowest pace since last June, linked in part to higher commodity prices (such as fuel, plastics, chemicals and fibreboards) and wage inflation.

Average output prices rose further, but the rate of inflation remained steady, similar to the past few months, and below the 2017 average.

Outlook

Slightly quicker growth of new orders and increased backlogs of unfinished work in April suggest that business activity will continue to rise in coming months. However, while the overall picture remains positive, there are some downside risks that could affect future growth.

First, Chinese firms were less optimistic about the business outlook over the next 12 months, with some expressing concerns of a potential negative impact on economic activity arising from an escalation in the US-China trade tensions.

Second, on-going environmental-related regulations could limit future output from heavy industries, as well as throttle the supply of raw materials, particularly steel, which in turn, could disrupt the production levels of other manufacturers.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-growth-stymied-in-april-by-falling-exports.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-growth-stymied-in-april-by-falling-exports.html&text=Chinese+economic+growth+stymied+in+April+by+falling+exports+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-growth-stymied-in-april-by-falling-exports.html","enabled":true},{"name":"email","url":"?subject=Chinese economic growth stymied in April by falling exports | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-growth-stymied-in-april-by-falling-exports.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+economic+growth+stymied+in+April+by+falling+exports+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-growth-stymied-in-april-by-falling-exports.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}