Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 05, 2018

China PMI surveys signal business activity growth at weakest in two years

- Caixin Composite PMI Output Index slips to 50.5 in October, the lowest since mid-2016

- Service business activity slows noticeably

- Trade war woes weigh on business sentiment

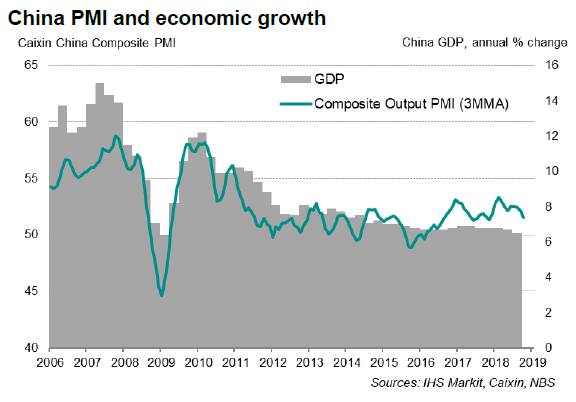

Business activity in China expanded at the slowest pace for over two years at the start of the fourth quarter, according to the latest Caixin PMI data. October saw the export-led slowdown spread beyond manufacturing to the service sector. Softer demand conditions hint at the risk of a further slowdown in coming months.

With trade wars dominating the media headlines, it was not surprising to see an increasing number of survey participants (particularly in manufacturing) expressing concerns over the negative impact of US-China trade dispute on future output.

Weak start to fourth quarter

The Caixin China Composite PMI™ Output Index (which covers both manufacturing and services) fell from 52.1 in September to 50.5 in October, which was the biggest drop (in terms of index points) for five-and-a-half years.

The latest reading was the lowest since June 2016, signalling only a mild improvement in the health of the Chinese economy.

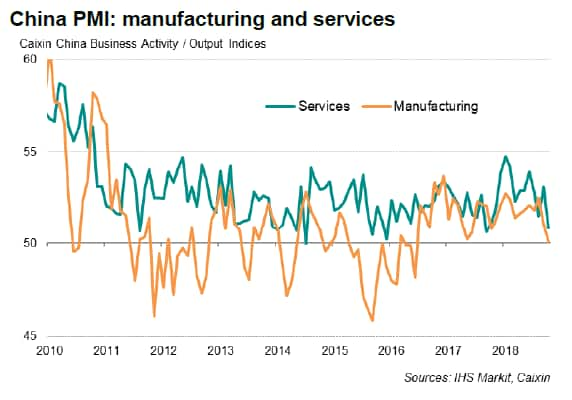

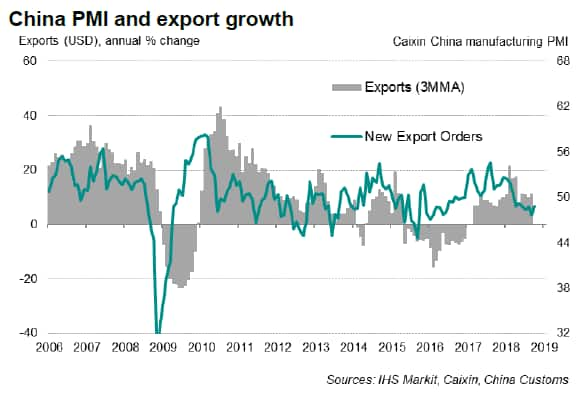

Manufacturing led the slowdown, with factory output broadly stagnant in October, compared to the prior two years of expansion. Manufacturing orders grew marginally, dragged down by a further decline in new export business. Foreign sales have now shrunk for seven straight months. The export downturn was linked by some firms to rising trade tensions.

The October surveys also brought news that the slowdown in manufacturing appeared to have broadened to the service sector, which reported the softest rise in business activity for just over a year. In addition, new business received by service providers barely grew.

Trade war jitters

With forward-looking survey indicators pointing to weaker performance ahead, the latest PMI data set the stage for a softer end to the year, and therefore underscore the need for new supply-side policy measures designed to stimulate economic activity.

Combined new order growth across both manufacturing and services was the weakest in October since early 2016. Business expectations of future growth meanwhile slipped to a three-month low, easing to a near one-year low in manufacturing. Worries over rising trade frictions between the US and China were a key factor affecting business sentiment. The labour market consequently remained sluggish, with factory job numbers continuing to decline.

Rising costs

Cost pressures meanwhile remained strong. Manufacturers continued to see elevated levels of price pressures, with higher steel prices mentioned in particular. The rate of increase in manufacturing costs was also notably steeper compared to input prices faced by service providers.

Chinese firms partially passed on greater cost burdens by increasing output charges. However, competitive pressures reportedly limited the extent to which many firms were able to raise prices. While manufacturers hiked average selling prices at a rate similar to recent months, service sector charges rose at the strongest for four months.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-signal-business-activity-growth-at-weakest-in-two-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-signal-business-activity-growth-at-weakest-in-two-years.html&text=China+PMI+surveys+signal+business+activity+growth+at+weakest+in+two+years+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-signal-business-activity-growth-at-weakest-in-two-years.html","enabled":true},{"name":"email","url":"?subject=China PMI surveys signal business activity growth at weakest in two years | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-signal-business-activity-growth-at-weakest-in-two-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+PMI+surveys+signal+business+activity+growth+at+weakest+in+two+years+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-signal-business-activity-growth-at-weakest-in-two-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}