Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 18, 2017

Chemical prices gain amid soaring demand among European manufacturers

Little-change across global commodity markets

Whilst most commodity prices remained somewhat flat, chemicals and oil stood out on the upside in November. Brent crude reached the highest monthly average since May 2015 at $62.64/barrel amid pricing speculation following OPEC cuts. Meanwhile, chemical markets were on the rise during November, with the composite price index reaching a nine-month high amid elevated supply shortages and buoyant European demand.

European manufacturing demand bolsters chemical markets

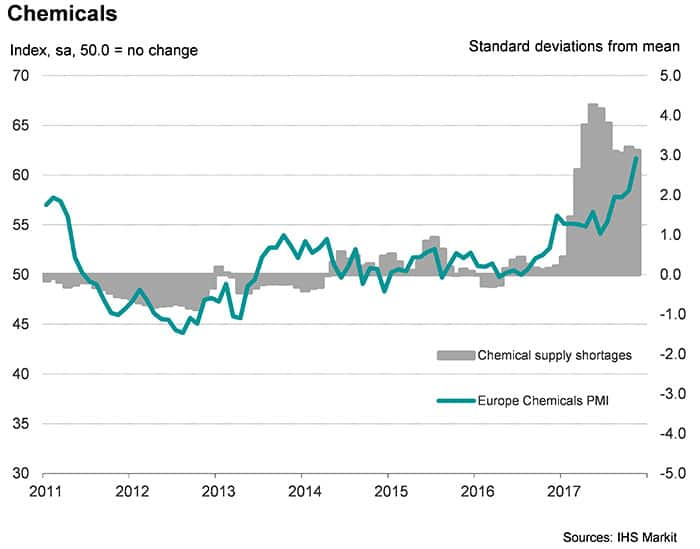

The Price & Supply Monitor's composite chemical index indicated that chemical prices reached a nine-month high after rising 4.2% during November. The uptick in prices was in line with elevated incidences of supply shortages, which reflected ongoing disruptions related to Hurricane Harvey in North America and a continued rebound in global manufacturing demand, driven particularly by Western Europe.

European chemical shortages were apparent during November's survey, particularly among manufacturers based in the Netherlands and the UK. Furthermore, purchasing activity growth among European chemical-intensive companies, as measured by the Europe Chemicals PMI, reached its sharpest since the start of the millennium. Indeed, the data suggest that global chemical prices may be increasingly driven by demand outpacing supply.

Softening Chinese growth leaves metals markets flat

November survey data presents a mixed picture for the metals market. On one hand, the JPMorgan Global Manufacturing PMI reached an 80-month high in November, which indicates higher global demand for metals. On the other hand, metal markets remain closely driven by industrial demand in China, which remained subdued in November, according to the Caixin China General Manufacturing PMI. The manufacturing sector's growth remained below the long-run average in the most recent survey. Furthermore, the PMI's purchasing activity index signalled subdued buying growth overall in China, leading metal prices to remain little-changed overall. Iron ore was the only monitored metal to gain during November; however prices remained in line with the medium-term average.

Near-term outlook

At 60.6 in December, the latest IHS Markit Eurozone Manufacturing PMI signaled the fastest upturn in business conditions since the survey began in 1997. Resurgent manufacturing growth suggests that rising European demand for chemicals may well spill over into 2018 and push chemical prices upwards. Furthermore, supply shortages remain well above the historical average, thus providing further cost pressures for manufacturing companies.

Sam Teague is an Economist at IHS Markit on the PMI team

Posted 19 December 2017

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchemical-prices-gain-amid-soaring-demand-among-european-manufacturers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchemical-prices-gain-amid-soaring-demand-among-european-manufacturers.html&text=Chemical+prices+gain+amid+soaring+demand+among+European+manufacturers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchemical-prices-gain-amid-soaring-demand-among-european-manufacturers.html","enabled":true},{"name":"email","url":"?subject=Chemical prices gain amid soaring demand among European manufacturers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchemical-prices-gain-amid-soaring-demand-among-european-manufacturers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chemical+prices+gain+amid+soaring+demand+among+European+manufacturers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchemical-prices-gain-amid-soaring-demand-among-european-manufacturers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}