Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 06, 2018

Bulgaria’s long and winding road to Eurozone accession

- Bulgaria is expected to submit its application to join the Exchange Rate Mechanism (ERM) II by mid-2018, with full-scale euro adoption possible in 2021 should current economic conditions persist; however EU finance ministers will still need to approve formal accession in mid-2020.

- Bulgaria already meets the Maastricht criteria that establish economic conditions for Eurozone membership. However, this narrow set of criteria is insufficient to assess the country’s readiness to join the Eurozone. Importantly, the Maastricht criteria fail to consider sufficiently key issues such as the scope of banking supervision by the central bank, judicial reform, and corruption, which will be central parameters in the assessment of an aspiring Eurozone member state.

- Overall, the European Union is supportive of Eurozone expansion. Taking Brexit into account, the EU would be keen to present Bulgaria's aspirations to join the common currency as an indicator of the political success of the EU project.

Bulgaria's Minister of Finance Vladislav Goranov announced on 11 January 2018 that Bulgaria was likely to apply to join the ERM II by July 2018, nearly eight years after its original target date for entry. At present, IHS Markit's baseline forecast is that Bulgaria will be admitted into the two-year ERM II 'waiting room' by late-2018 or early 2019, with a view to adopting the euro in 2021.

The Maastricht criteria

INFLATION

Although Bulgarian inflation has fluctuated widely in the decade since it joined the EU, reaching highs of 12.6% and lows of -1.7%, the country appears broadly to have mastered price stability in recent years. The level achieved in 2017 was within the 1.5 percentage-point tolerance band for the reference value of 0.6% for price stability.

FISCAL MATTERS

Government budget: Since joining the EU, Bulgaria has performed well on this metric, exceeding the 3%-of-GDP deficit limit only twice – in 2009 and 2014. However, the European Commission assessed the excess deficit in 2014 to have been exceptional and temporary, owing to the collapse of Corporate Commercial Bank (KTB), Bulgaria's then-fourth-largest bank, which required government support. This is much better than many established Eurozone and wider EU member states.

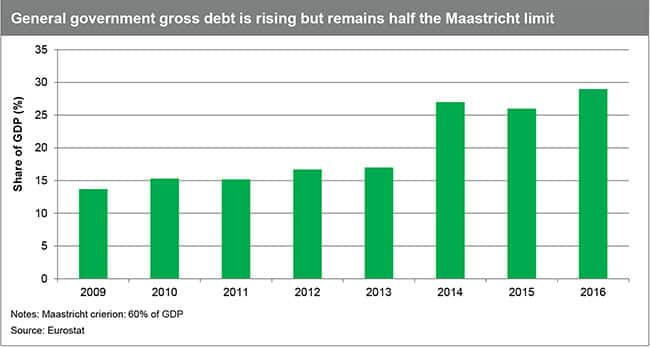

Government debt-to-GDP ratio: Bulgaria's general government has complied with the Maastricht criteria since it joined the EU, although it has been on an upward trajectory since achieving a low of 13% of GDP in 2008. Even with the small increase in debt levels forecast by IHS Markit for 2019–21, risks are likely to remain fairly limited and comfortably below the 60% cap.

EXCHANGE RATE STABILITY

Bulgaria has successfully maintained a currency peg since 1997, first against the Deutsche mark and then since 1999 against the euro (at BGN0.95583/EUR1), therefore, it already complies with this criterion, although the country has yet to join the ERM-II waiting room.

LONG-TERM INTEREST RATES

In 2017, Bulgaria's long-term interest rates were 1.6% on average, well below the 3.32% reference value for interest rate convergence. In fact, long-term 12-month average interest rates in Bulgaria have been declining since 2009, falling from a high of more than 7%.

Although Bulgaria essentially qualifies for ERM II membership based on the strict economic conditions contained in the Maastricht criteria, the EU's possible reluctance to allow Bulgaria into the ERM II is due to factors that are less precise and more qualitative, regarding institutional readiness.

Institutional readiness

A precondition for Eurozone entry, under the convergence criteria, is the compatibility of Bulgaria's national legislation with the regulatory framework of the Economic and Monetary Union (EMU). The latest EU and ECB reports found deficits in Bulgaria’s compatibility with EU legislation.

STATE OF PUBLIC INSTITUTIONS

During the past years, Bulgaria's civil society, business organisations, and international partners have expressed concerns over the independence of the judiciary and the persistent problems with organised crime and widespread perceived corruption. The latest annual report by the European Commission states that Bulgaria has successfully adopted legislative amendments to address previous recommendations, although further effort is needed to establish a coherent track record of achieving final convictions in serious organised crime and corruption cases.

POLITICAL CONTEXT

Joining ERM II and eventually the Eurozone would be a tangible recognition of progress made by the Bulgarian economy and would be a political accomplishment for its government, led for a third time by Prime Minister Boyko Borisov. However, Borisov has a history of instability in government, with three previous terms ending prematurely. A collapse of the current administration would present obvious risks of delays to Bulgaria's adoption of the euro and related legislation.

Overall, the EU is supportive of Eurozone expansion, with the stated objective that all EU members (except for Denmark and the United Kingdom, which have an opt-out) should adopt the common currency at some point. Taking Brexit into account, the EU would be keen to present Bulgaria's aspirations to join the Eurozone as an indicator of the political success of the wider EU project.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbulgarias-long-and-winding-road-to-eurozone-accession.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbulgarias-long-and-winding-road-to-eurozone-accession.html&text=Bulgaria%e2%80%99s+long+and+winding+road+to+Eurozone+accession","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbulgarias-long-and-winding-road-to-eurozone-accession.html","enabled":true},{"name":"email","url":"?subject=Bulgaria’s long and winding road to Eurozone accession&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbulgarias-long-and-winding-road-to-eurozone-accession.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bulgaria%e2%80%99s+long+and+winding+road+to+Eurozone+accession http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbulgarias-long-and-winding-road-to-eurozone-accession.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}