Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 21, 2018

Brexit and the economic consequences

- The UK-EU withdrawal agreement and the political declaration are broadly aligned with our baseline view, implying no significant impact on our short-term growth projections.

- But Brexit uncertainty is expected to stalk economic growth in 2019.

- The UK economy lacks sufficient strength to absorb the full impact of a chaotic Brexit, which would trigger painful recession.

UK prime minister Theresa May has obtained cabinet support for a draft Brexit withdrawal agreement designed to permit an orderly UK exit from the European Union (EU) on 29 March 2019, followed by a transition period scheduled to end in December 2020. In addition, the UK and EU issued a political declaration to work towards a relatively harmonious relationship covering the key areas of trade in goods, customs union, and services.

But, the Brexit deal led to several ministerial resignations from May's government, followed by her postponing the first parliamentary vote on the agreement, fearing it would be lost.

The vote will now take place the week beginning of January 14, 2019. Although the risk of the UK leaving the EU without a deal is unwanted both sides, it remains elevated as any eventual parliamentary rejection of the Brexit agreement would prove disruptive to overall procedures.

The withdrawal agreement and the political declaration are broadly aligned with our baseline view, implying no significant impact on our short-term growth projections. We assume that the UK and EU will converge on some free-trade agreement for goods, alongside specific sector agreements for UK service providers to access parts of the Single Market.

UK firms remain nervous about the Brexit political process.

- The corporate sector has broadly backed the withdrawal agreement as the first step towards a more business-friendly settlement, but it fears that political divisions over the exit agreement could scupper the plan.

- Firms have begun to prepare for the possibility of the UK crashing out of the EU without a deal. This includes precautionary stocks to protect their capacity to produce in a "no-deal" outcome. Clearly, they want to better understand the Brexit political process, mainly the point where a no-deal scenario is off the table.

There is some uncertainty regarding UK growth in early 2019.

- Consumers and firms could bring forward purchases to protect themselves from the possibility of a no-deal exit.

- But, a delayed vote on the exit deal suggests that Brexit business uncertainty will continue to weigh heavily on activity during the first quarter.

Brexit uncertainty to stalk economic activity in 2019.

- UK business confidence is low. Our November Global Business Outlook survey revealed that UK business confidence had slumped to its lowest level since the height of the global financial crisis.

- Firms reveal that the Brexit uncertainty is damaging economic growth, alongside low profit expectations, currency volatility, higher interest rates, a global slowdown, trade wars, rising prices, and weak consumer spending. This is downside risk to future investment and employment intentions.

- GfK reveals UK consumer confidence plummeted to 5-year low in December.

- Therefore, we currently forecasts the UK economy to grow by 1.1% in 2019, below the December consensus of 1.5%.

Growth is expected to accelerate to 1.3% in 2020, helped by greater clarity about the Brexit end-game. Still, risks are significant, and our main concern is that the political declaration on the future UK-EU relationship is not legally binding and faces a prolonged period of complex negotiations, generating continued uncertainty.

The withdrawal agreement and political declaration are broadly supportive outcome the UK, but some economic losses are inevitable when compared with a scenario whereby the UK remains a full member of the EU. We believe that any future trade agreement will fall short of the "frictionless arrangements" that the UK currently enjoys as part of the Customs Union and Single Market. The principle of equivalence for the trade in services in general represents some risk to UK exports of services to the EU.

We acknowledge that parliamentary rejection of the deal would keep the risk elevated of the UK leaving the EU without any arrangements in place.

Our scenario predicts that the economic consequences of a no-deal Brexit would be damaging. The UK economy lacks sufficient strength to absorb the full impact of a chaotic Brexit. Firms would face new trade tariffs, potentially severe cross-border delays, and disrupted domestic supply chains, prompting the delay or cancellation of investment projects and recruitment. In addition, the household economy would be hit via substantial real income and wealth losses.

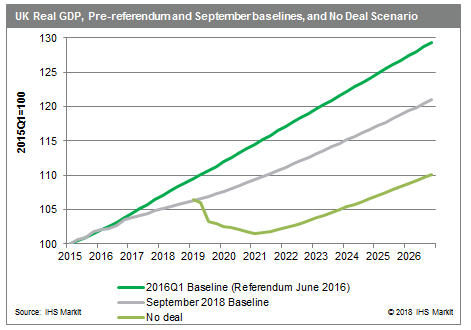

The no-deal scenario assumes that the UK would be in recession from mid-2019 to early 2021, and that its economy would contract by 0.9% in 2019, 2.4% in 2020, and 0.5% in 2021. By 2026, real GDP would be 9% lower in the no-deal scenario when compared with the September 2018 baseline, which assumes an orderly exit and transition period for the UK.

Sterling would depreciate notably in the immediate aftermath of Brexit without a deal, with markets expecting significant damage to the UK economy. Sterling has lost its safe-haven characteristics since the June 2016 Brexit referendum result.

Finally, the graph below illustrates three potential GDP paths, comparing pre-referendum and present baselines and "no deal" scenario.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-and-economic-consequences.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-and-economic-consequences.html&text=Brexit+and+the+economic+consequences+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-and-economic-consequences.html","enabled":true},{"name":"email","url":"?subject=Brexit and the economic consequences | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-and-economic-consequences.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brexit+and+the+economic+consequences+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-and-economic-consequences.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}