Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 16, 2018

Weekly Pricing Pulse volatility and boom

Volatility and booming supply erase year-to-date commodity price gains

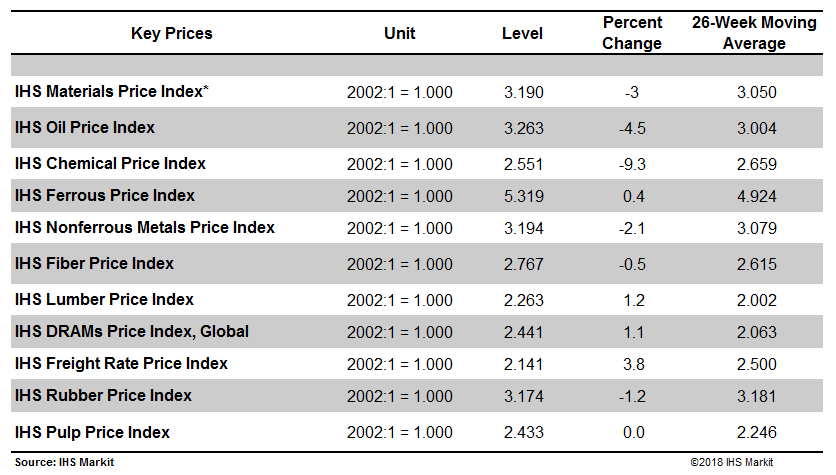

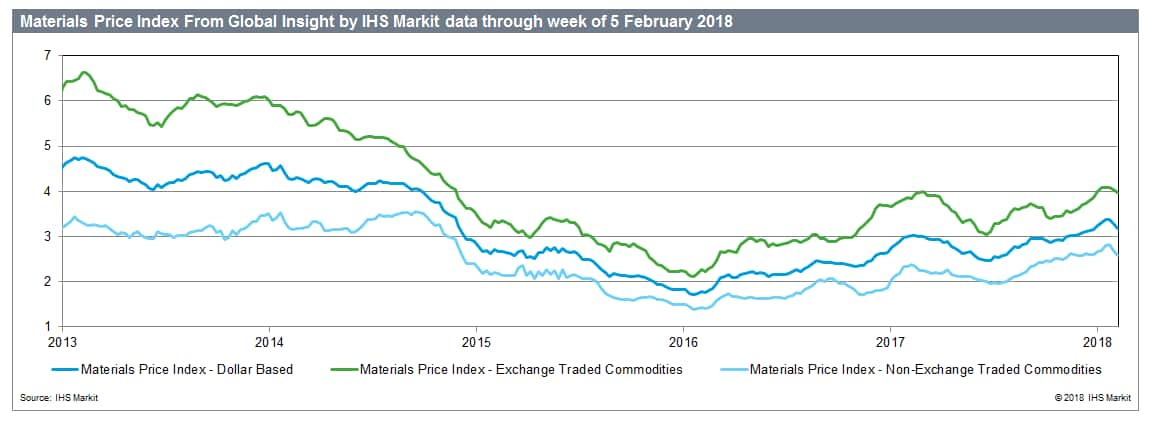

The IHS Materials Price Index (MPI) plunged 3.0% last week, marking a second week of sharp declines. This brings the MPI roughly back to its level at the start of the year, erasing the gains made in January. Five sub-indexes drove the index lower; chemical and oil prices saw the biggest decreases, falling 9.3% and 4.5%, respectively.

The return of volatility shook markets again last week, dampening appetites for risk and souring the exuberant mood that has prevailed this year. In oil and chemical markets, risk aversion paired with climbing supply levels caused price levels to plummet. The EIA reported US inventory builds across the board last week, with crude oil, gasoline, and diesel stocks all rising; two days later, the Baker Hughes rig count shot up by 22, further pushing down crude prices. The decline in oil prices pushed downstream to chemical markets, where fundamentals are already creating price weakness. Falling chemicals demand due to derivative production shutdowns is putting downward pressure on the chemical complex, while climbing propylene inventory and easing feedstock costs for ethylene are adding to the pressure.

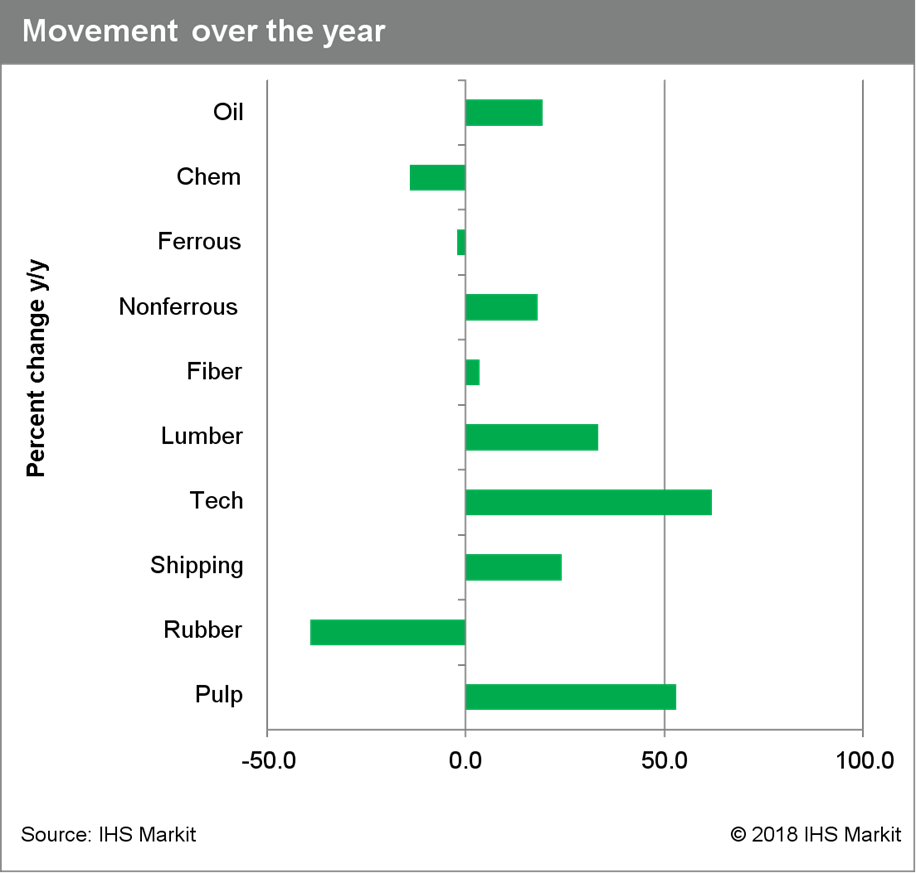

Data releases were mixed last week. In China, inflation reports showed slowing y/y inflation, with food, transportation, and communication price escalation decelerating. In the United States, the PMI Services Index came in at a moderate 53.3; slowing output is behind the moderation, but job growth and order backlogs continuing to show strength. The Eurozone remains a bright spot with the PMI Composite for January coming in at 58.8, its highest reading since June 2006. The retreat in commodity markets does not signal weakness in the global economy; indeed, the outlook remains bright. But we feel a combination of factors – slightly slower growth in China, higher interest rates, and flat or slightly lower oil prices – will work to check further strong increases in commodity prices. In the past two weeks, two of these three factors have been in evidence.

The Pricing Pulse provides a weekly look at our proprietary Materials Price Index and the latest news and analysis from commodity price forecasting experts at IHS Markit to ensure you have the greatest price visibility possible. Learn more.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fWeekly-Pricing-Pulse-volatility-and-boom.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fWeekly-Pricing-Pulse-volatility-and-boom.html&text=Weekly+Pricing+Pulse+volatility+and+boom","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fWeekly-Pricing-Pulse-volatility-and-boom.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse volatility and boom&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fWeekly-Pricing-Pulse-volatility-and-boom.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse+volatility+and+boom http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fWeekly-Pricing-Pulse-volatility-and-boom.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}