Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 24, 2018

US has mixed start to 2018 as faster factory growth is offset by services slowdown

- Flash composite PMI down to eight-month low on weaker service sector expansion

- Survey data signal c.2.0% annualised GDP growth rate in January

- Manufacturing upturn gains momentum amid higher exports

- Job growth slows but signals 190k payroll rise

- Price pressures pick up

The flash PMI surveys indicated a mixed but broadly encouraging start to 2018 for the US economy. A better than expected manufacturing PMI was countered by a weaker than anticipated service sector number, leading to an overall slowing in the economy. However, digging down into the details of the survey data suggests the slowdown could well prove transitory.

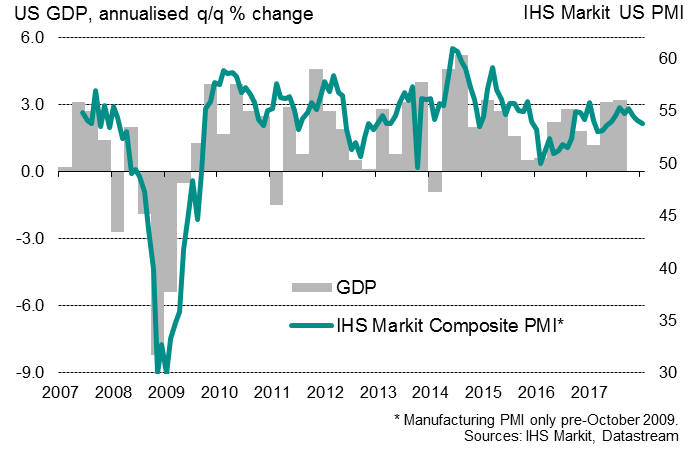

At 53.8 in January, down from 54.1 in December, the IHS Markit Flash U.S. Composite PMI Output Index signalled the slowest rate of business activity expansion since May 2017. At this level, the PMI is historically consistent with the economy growing at an annualised rate of around 2%.

The slowdown reflected the weakest rise in services activity for nine months, the rate of growth of which has slowed steadily since peaking last August.

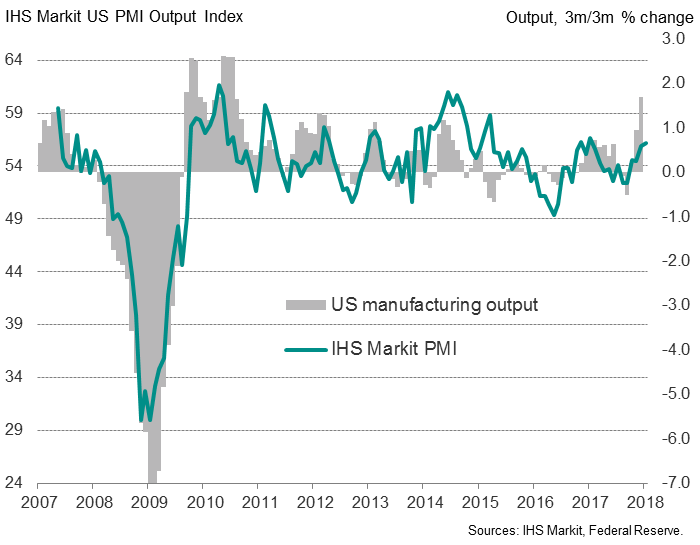

In contrast, manufacturers reported one of the strongest rates of production growth since the first quarter of 2015, supported by rising exports, improving domestic sales and sustained inventory building in January. Exports, buoyed by a strengthening global economic upturn and the weakened dollar, rose at the fastest rate for nearly one and a half years.

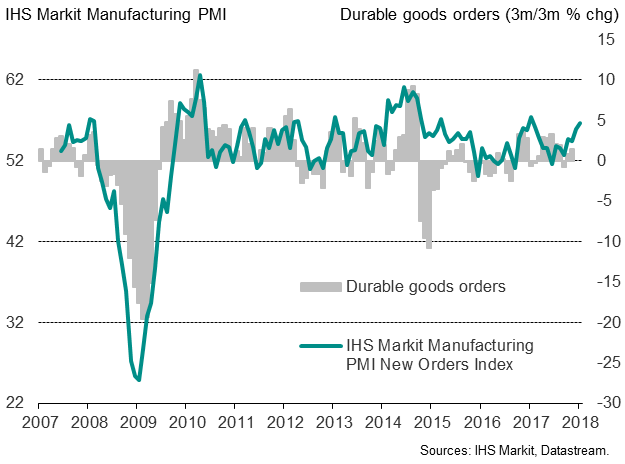

The PMI gauge of total manufacturing order book growth, which exhibits a high (76%) correlation with durable goods orders and an 89% correlation with official output measures, struck a one-year high, boding well for the future expansion of production.

Similarly, inflows of new orders in the service sector revived to a five-month high, further boosting scope for business activity growth to accelerate again in February.

Business optimism about the year ahead also improved markedly in January to suggest the outlook has brightened, although overall confidence was below the average level seen for last year.

Payroll growth slowed to a seven-month low, though the survey barometer remained at a relatively elevated level. The latest reading was indicative of official non-farm payroll growth of approximately 190,000, suggesting the labour market remains in good health.

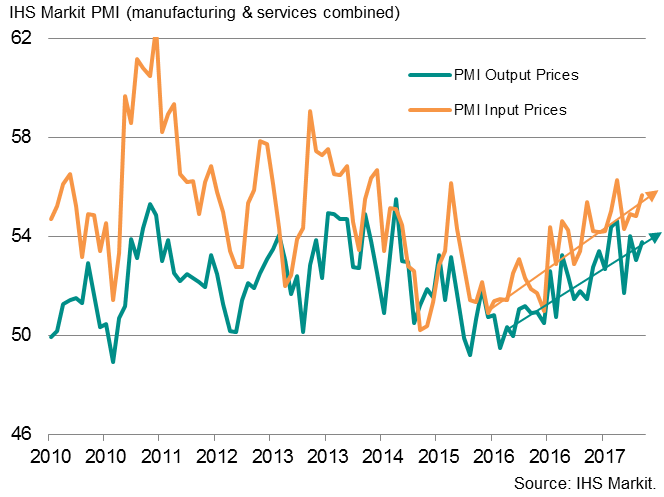

Price pressures meanwhile ticked higher, continuing a general upward trend that has been evident since early-2016. Input price inflation hit the highest since September 2017, with a number of firms citing greater fuel, energy and oil-related costs in January. More generally, stronger demand is also helping companies push through price hikes. The rise in factory gate prices was the joint-largest since December 2013.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUS-has-mixed-start-to-2018-as-faster-factory-growth-is-offset-by-services-slowdown.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUS-has-mixed-start-to-2018-as-faster-factory-growth-is-offset-by-services-slowdown.html&text=US+has+mixed+start+to+2018+as+faster+factory+growth+is+offset+by+services+slowdown","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUS-has-mixed-start-to-2018-as-faster-factory-growth-is-offset-by-services-slowdown.html","enabled":true},{"name":"email","url":"?subject=US has mixed start to 2018 as faster factory growth is offset by services slowdown&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUS-has-mixed-start-to-2018-as-faster-factory-growth-is-offset-by-services-slowdown.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+has+mixed+start+to+2018+as+faster+factory+growth+is+offset+by+services+slowdown http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUS-has-mixed-start-to-2018-as-faster-factory-growth-is-offset-by-services-slowdown.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}