Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 01, 2018

January global manufacturing PMI signals solid start to 2018

- Global PMI close to seven-year high in January

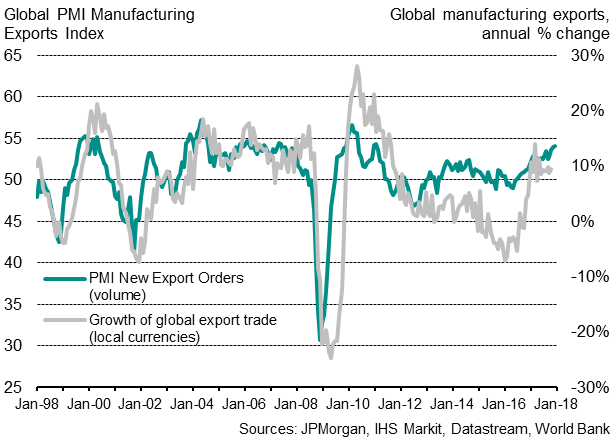

- Rising exports point to increased global trade

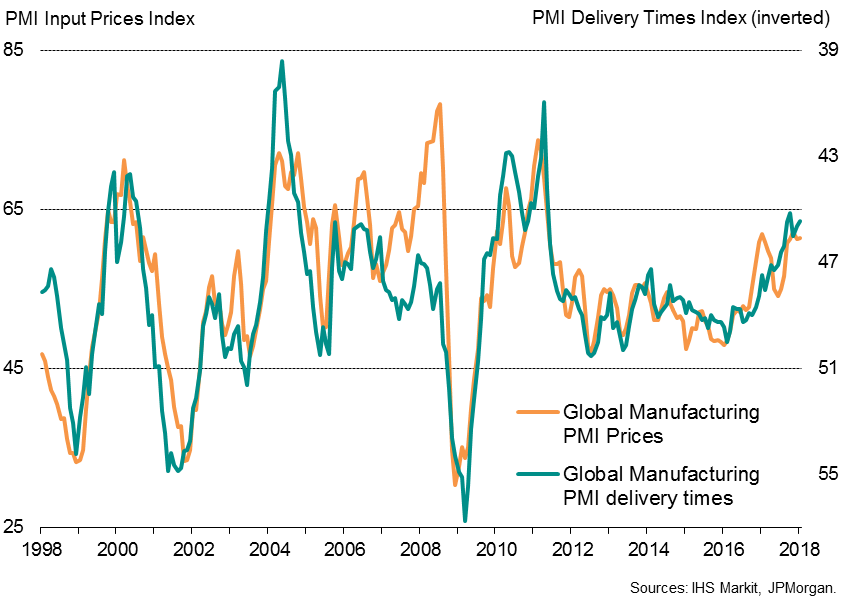

- Producer price inflation close to seven-year high

- Eurozone leads the global upturn

Global manufacturing started 2018 on an upbeat note, with businesses registering one of the strongest expansions for seven years.

The headline JPMorgan Manufacturing PMI, compiled by IHS Markit, registered 54.4 in January, down from 54.5 in December but nevertheless recording the second-highest reading since February 2011.

Output and employment rose at identical rates to December, which had seen the largest monthly gains for almost seven years. Although new order growth slipped slightly from December’s recent high it remained elevated. New export orders – a key gauge of international trade flows – meanwhile rose to its highest since early 2011.

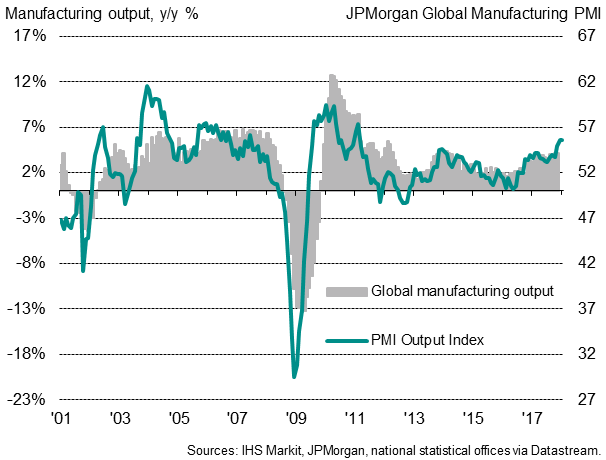

Over the past two decades, the PMI shows an 86% correlation with the official manufacturing output data, with the PMI acting with a four-month lead. Historical comparisons indicate that the latest surveys are running at a pace broadly consistent with global factory production growth accelerating to an annual rate of approximately 6%.

Capacity meanwhile continued to be stretched, as evidenced by a further marked rise in unfilled orders and widespread supplier delivery delays, the latter generally reflecting demand exceeding supply.

Recent months have seen the longest lengthening of supplier lead-times for seven years – a development which tends to be accompanied by rising prices. Accordingly, global input cost inflation continued to run at its steepest for nearly seven years, with enhanced supplier pricing power accompanied by higher oil prices.

Factory gate prices rose at the second-highest rate since May 2011 as producers passed increased costs onto customers.

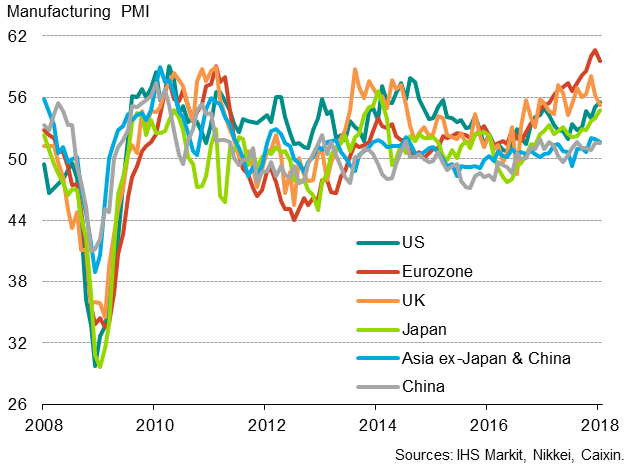

Europe again leads the rankings

Analysis of the individual surveys shows that, if the Eurozone as a whole was treated as a single country, it would have once again topped the rankings in January, followed by neighbouring Czech Republic. The fastest expansions were seen in northern Europe, clustered around Germany, albeit led by the Netherlands.

Eurozone growth remained close to a two-decade survey record in January, while growth accelerated in both the US and Japan to the highest since March 2015 and February 2014 respectively. Growth meanwhile slowed in the UK, albeit remaining robust.

All countries in fact reported improved manufacturing conditions with the sole exception of Indonesia, where the PMI reading of 49.9 signalled a very marginal deterioration.

Taiwan was again the highest-ranking Asian economy in an otherwise exceptional performance for the region: the lower end of the rankings continued to be dominated by Asian economies. With major emerging markets such as Brazil, China, Russia and India all low in the rankings, emerging markets as a whole continued to significantly lag behind the developed world in terms of the extent to which the health of the goods-producing sector improved at the start of 2018.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fJanuary-global-manufacturing-PMI-signals-solid-start-to-2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fJanuary-global-manufacturing-PMI-signals-solid-start-to-2018.html&text=January+global+manufacturing+PMI+signals+solid+start+to+2018","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fJanuary-global-manufacturing-PMI-signals-solid-start-to-2018.html","enabled":true},{"name":"email","url":"?subject=January global manufacturing PMI signals solid start to 2018&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fJanuary-global-manufacturing-PMI-signals-solid-start-to-2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=January+global+manufacturing+PMI+signals+solid+start+to+2018 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fJanuary-global-manufacturing-PMI-signals-solid-start-to-2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}