Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

MUNICIPAL MARKET COMMENTARY

Nov 20, 2018

95% of daily quoted US corporate bonds receive their first quote before 9:30am

The daily dealer bond quoting intraday patterns have not changed much over the years, with thousands of offers, bids, and two-way markets flooding corporate bond investors' screens shortly after sunrise every morning. The ultimate goal of the quotes is to lead to a trade, but they also act as a mechanism for price discovery and client engagement and most quotes are subject to a call before a trade can be executed.

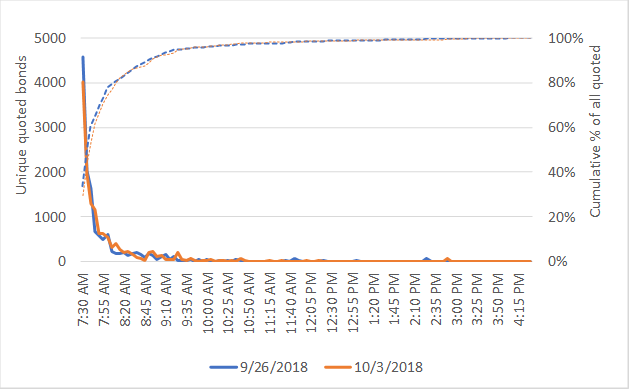

We reviewed quote activity for US dollar denominated corporate bonds during US trading hours on September 26 and October 3 at five-minute intervals. Both days are Wednesdays to be somewhat consistent, as quoting patterns can vary significantly by the day of the week. Figure 1 shows that over 25% of all the unique quoted bonds appear at 7:30am for both days, which is consistent with the typical early morning barrage of dealer runs. It's also interesting that approximately 75% of all the bonds quoted on both days appeared by 8:00am and 95% by 9:25am. There were a total of 13,637 unique bonds quoted between 7:30am and 4:30pm on September 26 and 13,731 on October 26, with a 94% overlap in quoted bonds between the two days. We compared the quoted bonds to $1 million and the larger trades on those days: 1,392 (10.2%) traded on September 26 and 1,400 (10.2%) traded on October 3, with 512 bonds quoted and traded on both days.

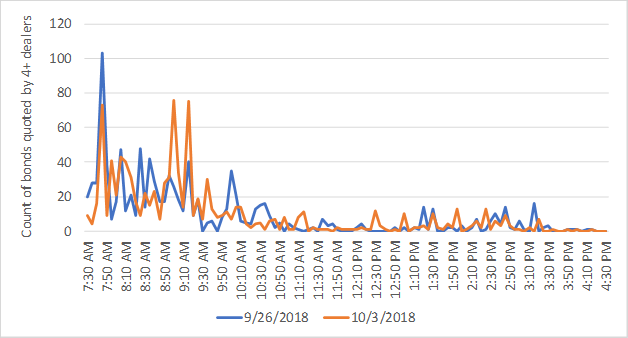

The number of dealers quoting a bond is directly correlated to the likelihood of the bond trading and the frequency of highly quoted bonds appears to be more concentrated in the morning. Figure 2 shows the frequency of bonds quoted by 4 or more dealers in 5-minute intervals and highlights that the frequency of these more liquid bonds was higher in the morning for both days. We compared each quote interval to the roundlot size trades that occurred during those intervals and 2.3% of the higher quote depth bonds traded in the same interval on September 26 and 1.5% on October 3. We note that there is some degree of error with those calculations due to the possibility that the trade preceded the quote in the interval and that a quote and trade could have occurred within seconds of one another, but they did not match because they were bucketed in different intervals. The data also reinforces the correlation between dealer quote depth and liquidity, since 35% of the highly quoted bonds on September 26 traded and 33% on October 3, which is more than triple the frequency of the entire quoted market both days.

It is important to note that final results for both days didn't diverge much, despite October 3 being a particularly gloomy day for the rates markets with 10-year US Treasury yields increasing sharply starting around 9:30am and closing 12bps higher, and the 25bps increase in the Fed Funds rate in the afternoon. It also must be stated that two days are definitely not representative of every trading day, but both days did show very similar quote frequency, timing, and traded percentage despite being one week apart and occurring during very different rates markets. Expanding the analyses to at least an entire year of trading days would provide benchmarks that enable a more rapid identification of market anomalies.

Intraday parsed quote patterns have been used by quantitative bond strategies for quite some time to identify inefficiencies in the quoted market. This same data does also provide an almost real time view of changes in an issuer or sector's liquidity and can be used to estimate the time between the release of a quote and an actual trade that may have been triggered by the quote. Although, there is no way to know if the quoting dealer is the one who actually executed the trade.

<span/>Figure 1: Count of first daily appearance of quoted USD corporate bonds

<span/>Figure 2: Frequency of USD corporate bonds quoted by 4+ dealers at 5-minute intervals

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f95-of-daily-quoted-us-corporate-bonds-receive-their-first-quote.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f95-of-daily-quoted-us-corporate-bonds-receive-their-first-quote.html&text=95%25+of+daily+quoted+US+corporate+bonds+receive+their+first+quote+before+9%3a30am+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f95-of-daily-quoted-us-corporate-bonds-receive-their-first-quote.html","enabled":true},{"name":"email","url":"?subject=95% of daily quoted US corporate bonds receive their first quote before 9:30am | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f95-of-daily-quoted-us-corporate-bonds-receive-their-first-quote.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=95%25+of+daily+quoted+US+corporate+bonds+receive+their+first+quote+before+9%3a30am+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f95-of-daily-quoted-us-corporate-bonds-receive-their-first-quote.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}