Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 31, 2015

Week Ahead Economic Overview

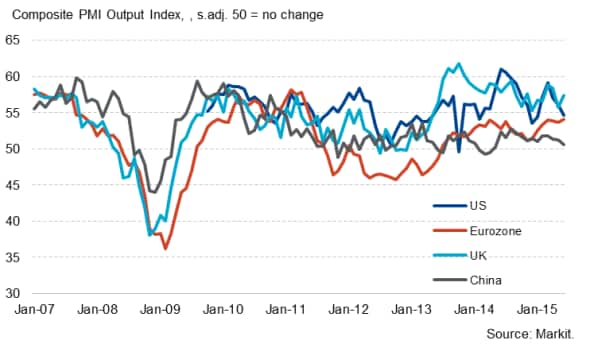

The release of manufacturing and services PMI survey results will provide insights into global economic trends as we move into the second half of the year, followed on Friday by an update on the US labour market. Meanwhile, the Bank of England and Bank of Japan announce their latest monetary policy decisions.

PMI surveys

No change is expected at the Bank of England meeting on Wednesday, but the minutes of the meeting (which are published alongside the announcement for the first time) are likely to show that at least two members of the Monetary Policy Committee voted for a rate rise. Official data showed that the UK economy expanded by 0.7% in the second quarter, in line with survey data and a welcome pick-up from the 0.4% seen in the first quarter.

The release of manufacturing, construction and services PMI data will also be watched closely by policy makers for signs that the UK economic recovery continued in July.

The Bank will be especially concerned that higher interest rates will inevitably lead to upward pressure on sterling, which has already risen to its highest since 2007 on a trade-weighted basis. Analysts will therefore also be watching official trade and industrial production data for signs that the strong pound continues to create an uneven recovery, hitting the export-focused manufacturing sector in particular, which has slipped back into decline.

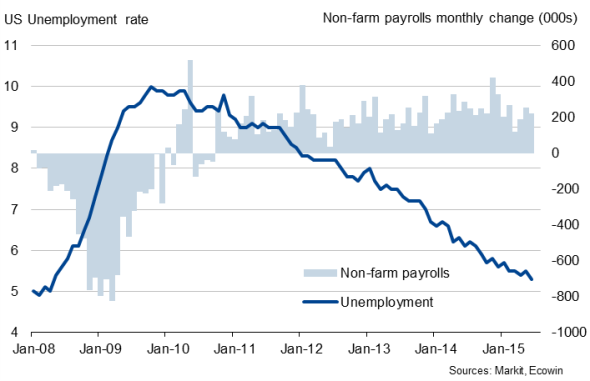

The likelihood of US policy makers hiking interest rates as early as September is data dependent, meaning all eyes will be focused on Friday's labour market update. Non-farm payrolls increased by 223k in June, just shy of expectations and in line with Markit's PMI survey data, which pointed to a 220k increase. Flash PMI results for July point to further impressive hiring, with non-farm payrolls set to rise by around 225k, building the case for an early rate hike.

US labour market

Final business survey results for the US manufacturing and service sectors will also be released during the week by Markit. Flash PMI data pointed to an upturn in economic growth at the start of the third quarter. The US also sees the release of factory orders and construction spending numbers.

Japan's Central Bank announces its latest monetary policy decision on Friday. Recent signs for the economy have not been encouraging: Flash manufacturing PMI data suggest that the goods-producing sector showed tentative signs of stirring back into life at the start of the third quarter after its worst performance for a year in the second quarter, but signs of inflation picking up remain disappointingly scarce. Final manufacturing and services PMI data (both released before the BoJ meeting) will provide policy makers with more information about the health of the country's economy.

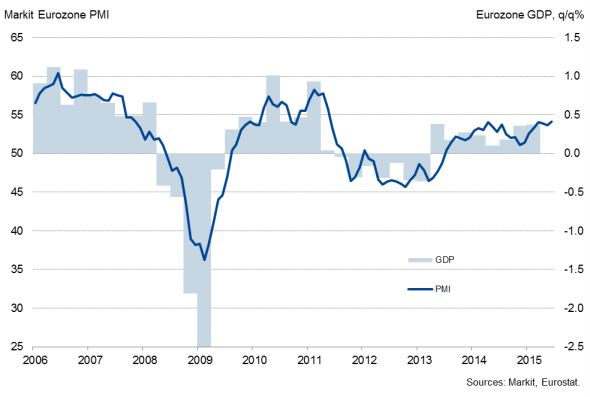

Final PMI results are also published for the euro area and will include more national detail. Flash data for July showed that the region lost only slight growth momentum in July amid the rollercoaster events of the Greek debt crisis. The rate of expansion remained reassuringly robust to suggest that it was by-and-large 'business as usual' for the region as a whole. The survey indicates that the economy grew 0.4% in the second quarter. Other important releases in the currency bloc include industrial production numbers in France, Germany, Italy and Spain, plus inflation and unemployment data in Greece.

Eurozone GDP and the PMI

Elsewhere in the world, data watchers will be awaiting business survey results, after PMI data highlighted that global economic growth slowed for a third month running in June. The main source of global economic weakness was once again the emerging markets, which saw business conditions deteriorate at the fastest rate since April 2009. China's composite PMI, covering both manufacturing and services, fell to 50.6, signalling a near-stagnation of the economy and the worst performance since May of last year. All three other BRIC economies saw deteriorating business conditions.

The state of the Chinese economy, and its hunger for raw materials, will be especially important for policymakers in Australia, where a cut in interest rates looks likely given the country's dependence on strong commodity demand.

Monday 3 August

Worldwide manufacturing PMI results are released by Markit.

In Australia, the AIG Manufacturing Index and HIA new home sales data are released.

Brazil sees the publication of trade balance figures.

Personal income and construction spending numbers are meanwhile issued in the US.

Tuesday 4 August

Whole economy PMI results are published in the Middle East.

Australia sees the publication of retail sales and trade balance numbers.

Moreover, the Reserve Bank of Australia and the Reserve Bank of India hold interest rate meetings.

Consumer price data are meanwhile out in Russia.

In the eurozone, producer price figures are released.

In the UK, Nationwide house price numbers and latest construction PMI results are published.

Industrial output figures are issued in Brazil.

The US sees the release of factory orders data.

Wednesday 5 August

Worldwide services PMI results are published by Markit.

The AIG Services Index is released in Australia.

M3 money supply information are out in India.

Business confidence data are meanwhile issued in South Africa.

Italy sees the release of industrial output numbers.

The ECB Governing Council meets, but no interest rate announcement is scheduled.

The Bank of England announces its latest interest rate decision.

In Canada, trade balance data are out.

ADP employment numbers and international trade figures are published in the US.

Thursday 6 August

The Eurozone Retail PMI is published by Markit.

Labour market data are updated in Australia.

In Japan, the latest leading indicator is released.

Germany sees the publication of industrial orders numbers plus construction and retail PMI data.

Unemployment numbers are issued in Greece.

Industrial output figures are released in the UK.

Initial jobless claims numbers are out in the US.

Friday 7 August

Markit releases latest global sector PMI data.

The AIG Construction Index is published in Australia.

Japan's Central Bank announces its latest interest rate decision.

Industrial output numbers are released in Spain, Germany and France, with the latter two also seeing the publication of trade data.

Meanwhile, inflation figures are out in Greece.

The UK also sees the release of trade data.

Consumer price information are updated in Brazil.

Building permit and employment numbers are published in Canada.

In the US, non-farm payrolls data are issued.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}