Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 31, 2017

Week Ahead Economic Overview

Worldwide PMI survey releases will provide important signals on global economic growth and inflation trends at the end of Q1, thereby giving important signals for central bank policy.

February's PMI releases showed global growth losing a little momentum but otherwise remaining solid. Traders will monitor March's data for signs of whether the slowdown will continue or was largely just a blip, and if inflationary pressures continue to build.

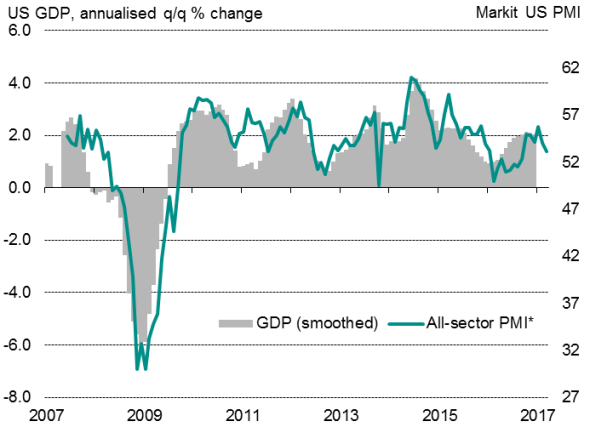

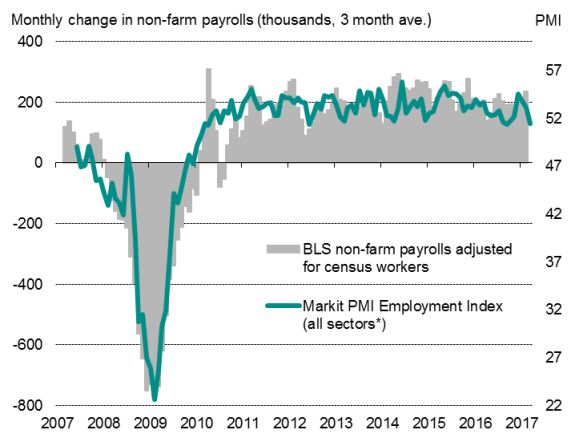

After the Fed raised interest rates in March on the back of a strengthening US economy and higher inflation, the debate has shifted to how many more hikes are in the pipeline. Updated survey data from IHS Markit's PMI surveys and the ISM on the health of the US economy, as well as non-farm payroll data and latest FOMC minutes, will offer important clues to policymakers and the markets.

Flash PMI data from IHS Markit have already shown a moderation in US economic growth and hiring in March, with business optimism remaining considerably below January's peak.

Markit US PMI and smoothed GDP

Sources: IHS Markit, Commerce Department

US employment

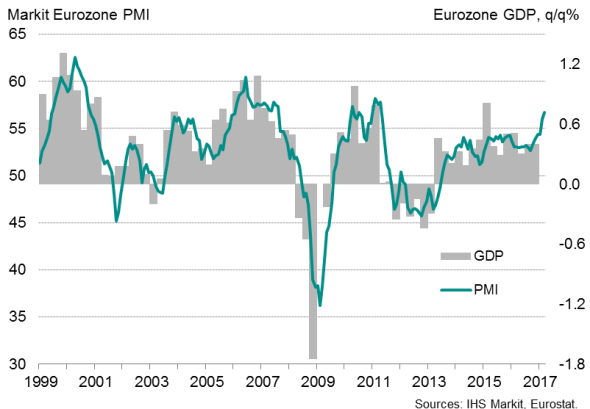

The final Eurozone PMI surveys will meanwhile provide a national breakdown of the strong flash numbers. With the March surveys showing the best employment growth in nearly a decade, the upturn is looking increasingly robust. If confirmed by the final numbers, the strong upward price trends highlighted by the PMI surveys may also add to calls for the ECB to start ramping up its tapering rhetoric.

Eurozone PMI and GDP

Japan's Nikkei PMI surveys will provide the earliest indication of how the economy performed in the first quarter. Flash manufacturing data rounded off the best quarter since early 2014.

Elsewhere in Asia, Caixin PMI surveys will be eyed for assessments of Chinese growth in the first quarter, which will also illustrate the extent of the government's efforts to transition to a services-driven economy.

In India, the Nikkei PMI will continue to provide an important gauge to the impact of demonetisation on economic growth. February's survey data showed tentative signs of a return to growth. Both the Reserve Bank of India and Reserve Bank of Australia will meet next week to decide on monetary policy.

ASEAN manufacturing has been marred by diverging national performances, underscoring the unique challenges each member economy faces. Updates to the Nikkei ASEAN PMI will indicate whether uneven growth in the region has persisted.

Other key releases include China's foreign exchange reserves and eurozone retail sales, plus fourth quarter GDP for Russia.

Monday 3 April

Worldwide manufacturing PMI results are published by IHS Markit.

Japan issues an update on its quarterly Tankan surveys.

Indonesia and Thailand release latest consumer price indices.

Eurostat issues its latest producer prices index and unemployment rate for the eurozone.

Russian GDP numbers for the fourth quarter are made available.

Tuesday 4 April

Reserve Bank of Australia decides on monetary policy.

Euro area retail sales data are issued by Eurostat.

UK Construction PMI results are published.

US trade numbers and factory orders are announced.

Wednesday 5 April

IHS Markit releases its latest set of worldwide services data for March.

Manufacturing PMI data for Taiwan is released.

Philippines updates its inflation figures.

Malaysia's trade data for February are announced.

Latest weekly figures on US crude oil stockpiles are published by EIA.

Thursday 6 April

The consumer confidence index in Japan is published.

The Reserve Bank of India meets to set monetary policy.

Minutes to FOMC meeting on 14-15 March are available.

Friday 7 April

Japan releases its latest current account data.

China's foreign exchange reserves figures are issued.

Germany's current account and industrial production data are both updated.

Data for industrial production, construction output and manufacturing production in the UK are released, along with house price index data.

Brazil announces the latest inflation figures.

US releases an update to its non-farm payroll data, earnings figures and unemployment rate.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032017-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032017-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}