Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 30, 2017

Japanese election prompts shorts to cover

Dramatic shifts in the demand to borrow US equities - the most traded asset in the global lending market - have caused an increasingly large portion of lendable inventory to remain unused

- The share of non-cash loans in US Equities has quadrupled in five years

- Cash-only lenders utilization rates less than a fifth of their non-cash peers

- Overseas-domiciled lenders step in to meet demand from non-cash borrowers

Three months is an eternity in politics, yet few would have predicted the phoenix-like revival Japanese Prime Minister Shinzo Abe just managed to pull off. As recently as August, his administration's approval ratings were languishing below 50% following a series of scandals that ousted several high profile cabinet members. Abe regained momentum by appointing a new cabinet and for his well-received handling of North Korean tensions; as a result, Abe was able to cement his comeback by calling last Sunday's snap election that saw his governing coalition win two thirds of the seats.

Not surprisingly, the market welcomed this new-found political stability -the Nikkei surged by a massive 7% in the four weeks since Abe dissolved Japan's parliament. In fact, the index is now trading at the highest level in over two decades on the hope that the new administration will be able to get "Abenomics" back on track and deliver the structural reforms promised when Abe was first elected in 2013.

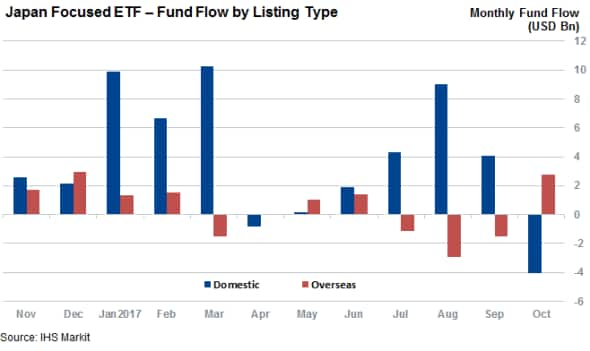

Unlike recent months, the rally can't be attributed to overzealous buying of Japanese ETFs. Japanese investors have taken their cue from their central bank and domestically listed Japanese ETFs have had more than $4bn of outflows so far in October. The last time such as sum was withdrawn from these funds was during the depths of the financial crisis, according to IHS Markit ETF analytics.

On the other hand, international investors have been eager to grab a slice of the rally, and in October, Japanese-exposed ETFs listed outside of Japan have attracted more than $2.5bn of inflows - their largest monthly tally so far in 2017. These inflows mark a step change from last quarter, when overseas investors were busy reducing their Japanese exposure in politically uncertain times. The desire to take part in the rally has been a universal across every major ETF market since the Japanese exposed funds listed in Asia, Europe and North America have all seen net inflows.

Short sellers cover

For their part, short sellers are still sitting this rally out since the demand to borrow constituent shares of the Nikkei index has stalled over the last few months. There are now more than a fifth fewer shares of Nikkei 225 constituents on loan than at the start of the year. With 1.5% of the index's shares outstanding on loan, this is the lowest such figure in more than two years.

Although shorts haven't shown any willingness to take a large cross-market view in the Nikkei, Japanese stock bears are more than willing to take bets among constituents of the index. Indeed, five constituents have more than 10% of their shares outstanding on loan.

The wrath of short sellers is especially potent for members of Japan Inc., who have failed to live up to the high standards usually associated with the country. The latest such firm, Kobe Steel, has seen the demand to borrow its shares triple in the last four weeks.

Kobe Steel recently revealed that staff members falsified specification documents of material that was used in a multitude of products, such as airplanes and rail carriages. The firm's shares have lost more than a third of their value in the two weeks since these revelations were first brought to light - but short sellers don't see this slump reversing anytime soon. The demand to borrow shares of Kobe Steel has surged above 14% of shares outstanding for the first time ever.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102017-equities-japanese-election-prompts-shorts-to-cover.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102017-equities-japanese-election-prompts-shorts-to-cover.html&text=Japanese+election+prompts+shorts+to+cover","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102017-equities-japanese-election-prompts-shorts-to-cover.html","enabled":true},{"name":"email","url":"?subject=Japanese election prompts shorts to cover&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102017-equities-japanese-election-prompts-shorts-to-cover.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japanese+election+prompts+shorts+to+cover http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102017-equities-japanese-election-prompts-shorts-to-cover.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}