Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 30, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings this week

- Canadian Western still heavily shorted despite its recent rally

- Petrofac short sellers come back for another bear raid ahead of earnings

- Australian short sellers continue to favor mining firms

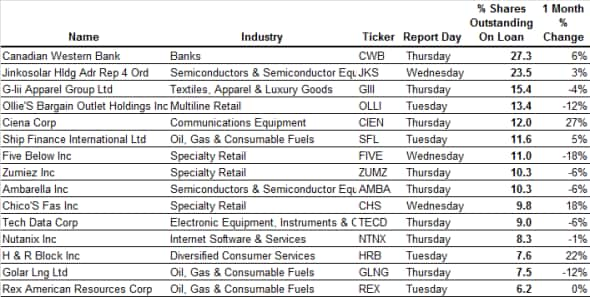

North America

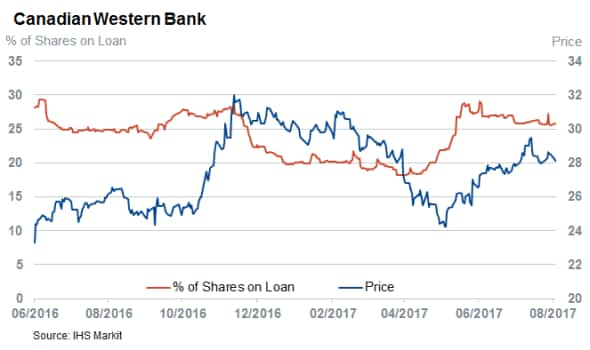

Canadian Western is the high conviction short among North American firms announcing earnings this week. After fellow lender Home Capital Group was forced to seek emergency liquidity, the Canadian lender's shares have come under intense scrutiny.

Although Canadian Western shares fell significantly on fears that Home Capital troubles could wreak havoc on the Canadian financial system, the slump turned out to be temporary.

Short sellers, who were already highly active in Canadian Western before April, don't seem to be buying this rally. This skepticism has driven a sharp increase in the demand to borrow Canadian Western shares in the last few months. Canadian Western bears have been wrong before, but their tenacity in light of the recent rally indicates all may not be well with Canadian mortgage lenders.

On the tech front, we've seen short sellers cover more than two thirds of their positions in HD video chip manufacturer Ambarella over the last 18 months. Interestingly, this despites the fact that the company's biggest customer, action camera maker GoPro, is keen to design Ambarella's chips.

In addition, communication equipment firm Ciena and tax adviser H&R block have seen the demand to borrow their shares jump by more than a fifth over the last month.

Retailers, which have all eyes watching this earnings season, again feature in our screen of the most shorted companies. Ollie's bargain outlet, whose shares have managed to escape the woes of its retail peers, is this week's high conviction retail short. It has more than 13% of shares out on loan, a fifth more than the second-most shorted, Five Below.

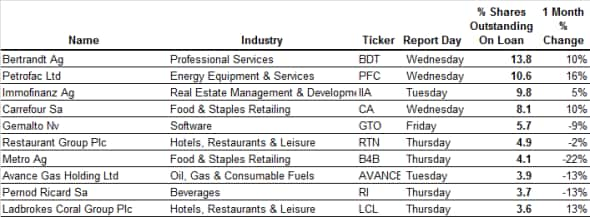

Europe

The big short in Europe this week is German mid cap Bertrandt Group, which helps automobile and aviation firms with design solutions. Short sellers, who have been targeting Bertrandt for much of the year, should feel vindicated for their tenacity.

Several weeks ago, sellside analysts slashed their guidance on Bertrandt, citing a lack of demand from its top customers, and shares fell heavily as a result. Bertrandt is trading at a five-year low, but short sellers think there may still be an opportunity. Thus, the company's short interest has climbed to an all-time high.

UK short sellers hoping to enjoy a quiet bank holiday week will be disappointed. Several of the country's most shorted firms are due to release trading updates in the coming week.

The most shorted of this week's UK lot is Petrofac, which has 10.6% of its shares out on loan. Petrofac shares have suffered heavily since May, when the UK's serious fraud office announced the firm was under investigation for bribery claims.

Petrofac short sellers were eager to take profit off the table immediately, and the demand to borrow its shares nearly halved in a few weeks. This restraint proved to be temporary, and Petrofac's short interest increased to the highest level in 18 months.

The other notable UK short targets this week include Restaurant Group and Ladbrokes Coral.

Retail bears have also started to target continental firms. French grocer Carrefour has seen the demand to borrow tick up to 8% of all outstanding shares.

Asia

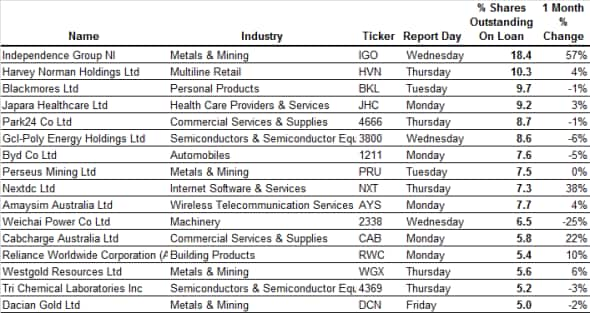

Australia firms once again make up the majority of this week's screen of Asian firms seeing high short interest.

The vagrancies of the nickel market continue to be on short sellers' minds. Nickel and copper miner Independence Group sees the most short interest among these firms.

Short sellers are betting that nickel's recent slide would negatively impact shares of the commodity's miners. But Western Area, who topped last week's list of high conviction shorts, saw its shares trade significantly higher after it announced better than expected earnings.

Independence group isn't the only Australian miner to attract short seller scrutiny. Perseus Mining, Westgold Resources and Dacian all place on this week's screen too.

Australian short sellers are also profiting from the struggles felt by brick and mortar retailers. Department store operator Harvey Norman has a heavy demand to borrow shares leading up to Thursday's earnings announcement.

Carmaker Byd is the most significant short play outside of Australia. Its residual short interest is significant, with short sellers committing more than $430m towards bearish bets.

Simon Colvin, Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30082017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30082017-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30082017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30082017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30082017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}