Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 30, 2016

Calm returns to periphery bonds but doubts remain

Periphery sovereign credit has rallied from a setback in the wake of last Thursday's UK referendum, but investor confidence still remains shaken.

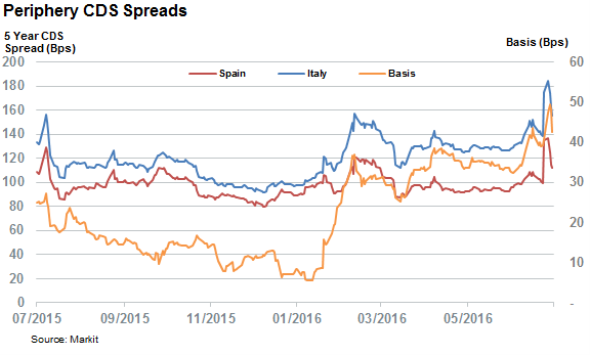

- Italian and Spanish 5 year CDS spreads have tightened by over 20bps from Monday's highs

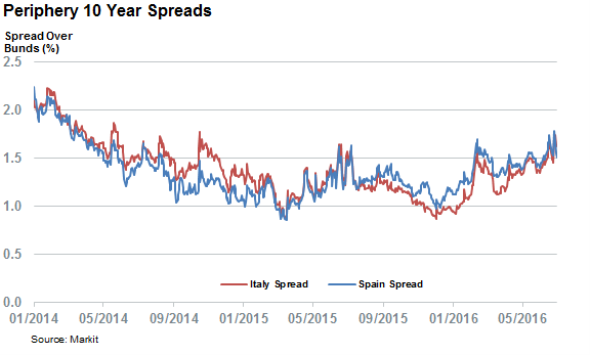

- Italian and Spanish 10 year spread over bunds 50% higher than in closing weeks of 2016

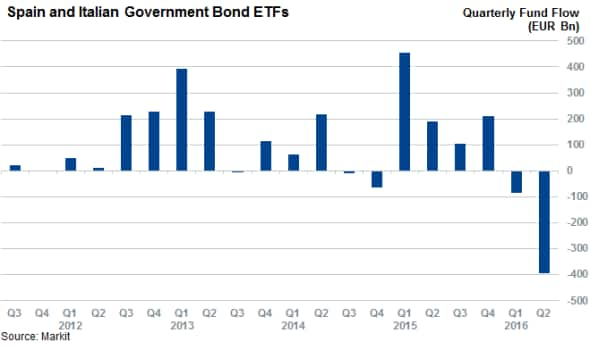

- Investors withdrew record "400m of assets from periphery bond ETFs in Q2

Periphery Southern European sovereign bonds felt more than their fair share of last week's Brexit driven volatility as investors turned against all but the safest risk assets. The resulting selloff saw Spanish and Italian CDS spreads overtake levels seen during last year's Greek trouble and highs not seen since the eurozone crisis of 2012. The selloff continued on Monday with 5 year Spanish and Italian CDS spreads hitting 137bps and 184bps respectively - over a third higher than the levels seen last Thursday.

This loss of investor confidence looks to have been relatively short lived however as both countries have subsequently seen their CDS spreads retreat in earnest. Spain's latest five year spread is now 25bps tighter while Italy has rallied by 29bps.

While Italian CDS spreads have rallied more strongly than their Spanish peers, the basis between the two, which measures the extra level of risk perceived by the market, is still eight times the level seen at the start of the year. Italy is trying to address the mounting bad debt on its domestic banks balance sheet which could see the country inject as much as "40bn. The ongoing nature of the Italian efforts to head off their banking problems has seen the market take an increasingly sceptical view of Italian credit as seen by the growing dislocation between its CDS spread and that of its Southern European peer.

Bonds also impacted

While Spain may be the relatively safe periphery play, both countries have seen the extra yield required by investors to hold their 10 year bonds over similarly dated bunds jump significantly in the last six months. That level of extra yield now stands at 1.6% for Italy and 1.5% for Spain, down from less than 1% in the middle of December of last year.

ETF investors have been eager to avoid this widening bond spread, and the relative underperformance that comes with it as Italian and Spanish government bond ETFs have experienced sustained and unprecedented outflows in the last two quarters. These outflows have gathered pace in the last three months as Q2 outflows were over four times the record pace seen in Q1.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062016-credit-calm-returns-to-periphery-bonds-but-doubts-remain.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062016-credit-calm-returns-to-periphery-bonds-but-doubts-remain.html&text=Calm+returns+to+periphery+bonds+but+doubts+remain","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062016-credit-calm-returns-to-periphery-bonds-but-doubts-remain.html","enabled":true},{"name":"email","url":"?subject=Calm returns to periphery bonds but doubts remain&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062016-credit-calm-returns-to-periphery-bonds-but-doubts-remain.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Calm+returns+to+periphery+bonds+but+doubts+remain http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062016-credit-calm-returns-to-periphery-bonds-but-doubts-remain.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}