Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 30, 2015

UK economic growth revised higher as recovery boosts incomes

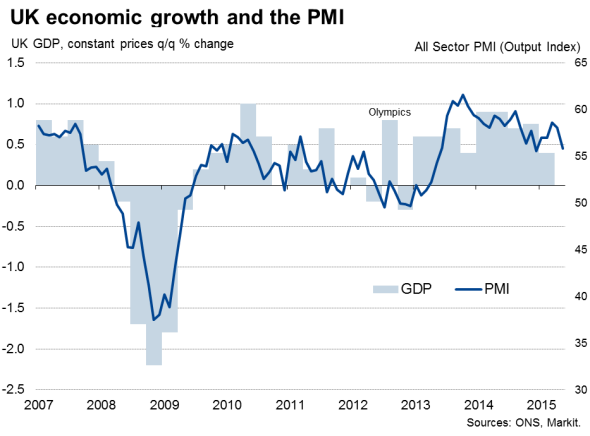

The UK economy grew faster than previously thought in the opening quarter of the year. Gross domestic product rose 0.4% in the first three months of the year, revised up from a prior estimate of 0.3%. The upward revision will mean the hawks at the Bank of England will pile more pressure on the other policymakers to consider hiking interest rates, especially as robust economic growth is now being accompanied by stronger pay pressures and rising incomes.

However, any rate rise still looks some way off. Although still robust, economic growth has slowed to half the rate seen late last year. There are also worrying imbalances and signs of weakness in the economy, as well of course as the current heightened uncertainty surrounding 'Grexit'. Today has also seen strong dovish signals from the Bank of England's Chief Economist Andy Haldane.

Incomes grow at fastest rate since 2001

The revisions to the Office for National Statistics data mean the economy grew at a robust clip of 2.9% over the year rather than the 2.5% previously estimated. The upward revisions were widely anticipated, having been flagged in advance alongside a new methodology for measuring construction sector output.

Particularly encouraging was a 4.5% increase in household disposable incomes compared to a year ago, which is the fastest rate of growth since 2001. Sitting alongside news that employee pay is now rising at an annual rate of 2.7%, its highest since early-2009, the recent data flow highlights how households are, at long last, increasingly starting to benefit from the economic upturn.

However, the data also reveal a worrying weakness in exports, with net trade acting as a 0.6% dampener on GDP in the first quarter. The current account deficit also remained worryingly high, at 5.8% of GDP in the opening quarter of 2015. The deficit hit 5.9% of GDP over 2014 as a whole, the highest since records began in 1948.

Clearly the economy remains worryingly imbalanced, with domestic consumers providing the main driver of growth and exports once again acting as a drag.

Policymakers await clarity on momentum

Policymakers will be worried about the poor export performance, and also concerned that the economy may be slowing in the summer as sterling's strength continues to hit competitiveness. PMI data for May showed one of the weakest expansions in business activity seen over the past two years, with the slowdown spreading from manufacturing and construction to services. June data are released later this week and will be closely watched for clues as to the economy's momentum heading into the second half of the year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Economics-UK-economic-growth-revised-higher-as-recovery-boosts-incomes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Economics-UK-economic-growth-revised-higher-as-recovery-boosts-incomes.html&text=UK+economic+growth+revised+higher+as+recovery+boosts+incomes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Economics-UK-economic-growth-revised-higher-as-recovery-boosts-incomes.html","enabled":true},{"name":"email","url":"?subject=UK economic growth revised higher as recovery boosts incomes&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Economics-UK-economic-growth-revised-higher-as-recovery-boosts-incomes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economic+growth+revised+higher+as+recovery+boosts+incomes http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Economics-UK-economic-growth-revised-higher-as-recovery-boosts-incomes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}