Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 30, 2014

CDX short interest declines

We examine short selling trends in companies with non-investment grade credit seeing high CDS spreads, and find bullish developments over the last couple of years’ loose monetary policy with both CDS spreads and short interest declining significantly.

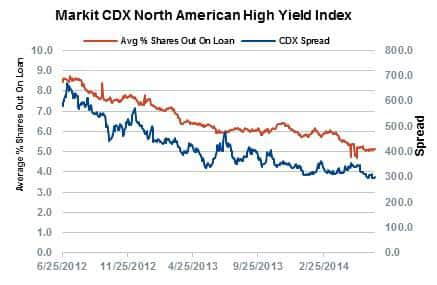

- CDS spreads and short interest has decreased over the past two years for the constituents of the Markit CDX North American High Yield Index

- Average short interest across the CDX high yield constituents has nearly halved over the last 24 months

- This covering is driven by former short favourites as Supervalu, Kb Home, and Amkor Tech have seen their short interest collapse

The last few years of easy money have taken a lot of the uncertainty out of the market. This in turn has seen investors’ views on risk assets shift dramatically. While this is reflected in option implied volatility, yield spreads and equity valuation, few risk asset stories have benefited from the current market mood more than at the riskiest end of the spectrum. To this end, our look at the current constituents of the Markit CDX North American High Yield index, an index of the 100 high yield issuers which trade actively in the CDS market, has revealed bullish overall trends in both credit and equity trading among these risky companies.

CDX spreads tightening

The spreads in the Markit CDX North American High yield index have steadily fallen over the past two years. Note that while this trend has been seen in both the investment grade and high yield CDX indices, the extra spread carried by high yield firms over their investment grade peers has more than halved over the last 24 months and currently sits at its lowest level in two years.

As for equities, the improving credit valuation seen in high yield names has been mirrored by significant short covering amongst CDX high yield constituents. The last 24 months have seen the average % of shares out on loan across the 100 constituents nearly halve and now stands at a two year low.

Most shorted lead the covering

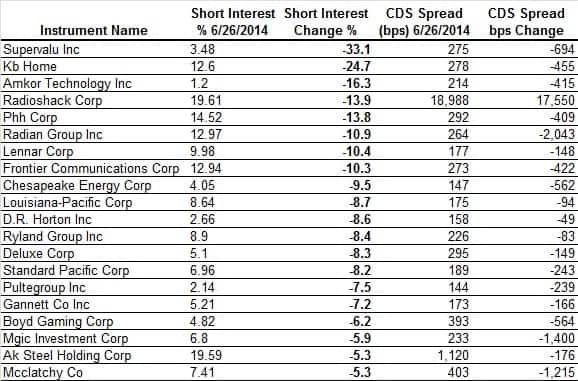

The table below shows the 20 index members whose issuers equity shares have seen the largest decrease in short interest as a percentage of shares outstanding. The delta columns show the change in values from June 25th 2012.

Highlights

The grocery retailer Supervalu has enjoyed a significant decline in short interest and currently only 3.48% of shares outstanding are sold short. This is down from 36% in June of 2012. Shares tanked 49% in early July 2012 after they announced disappointing earnings, negative revenue growth and suspended their dividend. After a CEO change and management overhaul, Supervalu beat analyst earnings expectations in late April and showed growth in its save-a-lot store segment.

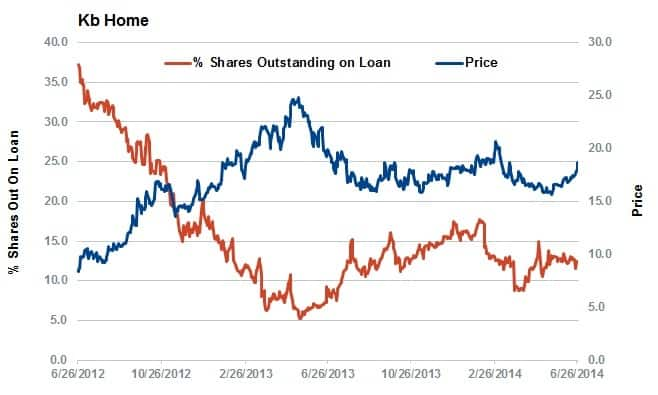

US focused homebuilder KB Homes ranks second on the list of largest decreases in short interest with a decrease of over 24%. With 12.6% of shares outstanding sold short, KBH remains a target for shorts but not nearly at the levels seen in mid-2012. KBH struggled in the beginning of 2012 with declining orders and low new home sales, they lost 59 cents per share in the three months ending February 29th 2012. KBH has turned things around and its stock has taken off from its lows two years ago. Helped by decreasing interest rates so far this year and a slowly improving credit availability, KB Home was able to beat estimates last Friday and has had positive EPS the past four quarters now.

Amkor Technologies, a provider of semiconductor assembly and test services, has risen 167% in the past year and forced shorts to run for cover. This is due to a strengthening semiconductor industry and multiple earnings estimates that were revised higher in 2014. Short interest recently reached an all-time low of 0.5% and is down from over 17% of shares outstanding in June of 2012. Amkor’s CDS spread has fallen by 415bps in the past two years indicating decreased risk of loan default on issued debt.

Andrew Laird, Analyst, IHS Markit

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062014120000CDX-short-interest-declines.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062014120000CDX-short-interest-declines.html&text=CDX+short+interest+declines","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062014120000CDX-short-interest-declines.html","enabled":true},{"name":"email","url":"?subject=CDX short interest declines&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062014120000CDX-short-interest-declines.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CDX+short+interest+declines http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062014120000CDX-short-interest-declines.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}