Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 29, 2015

Week Ahead Economic Overview

Worldwide PMI results will provide data watchers with the first available information on economic trends in the closing quarter of 2015. In the UK, the Bank of England announces its latest monetary policy decision and publishes the fourth and final Inflation Report of the year. The policy debate will meanwhile continue to heat up in the US, with non-farm payrolls numbers and trade data likely to add to the discussion.

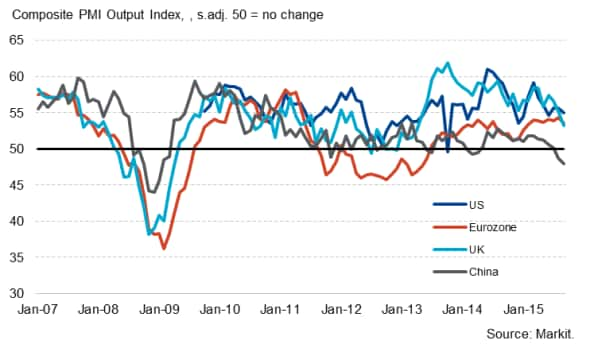

Composite PMI Output Index

The Federal Reserve kept interest rates unchanged at its October meeting, but significantly raised the likelihood of a rate rise as early as December. In a statement following the meeting, the Committee said that "In determining whether it will be appropriate to raise [rates] at its next meeting, the committee will assess progress toward its objectives of maximum employment and 2% inflation." Non-farm payrolls numbers and final PMI results for October will therefore be closely watched for signs that the US is ready for a rate hike in December.

Latest flash PMI results suggest that the US economy slowed further at the start of the fourth quarter, and recent jobs data have disappointed. Non-farm payrolls rose by just 142k in September, missing expectations of a 203k increase, and August's initial number of 173k was revised down to 136k. Economists polled by Thomson Reuters expect a rebound, with a 180k rise anticipated in October.

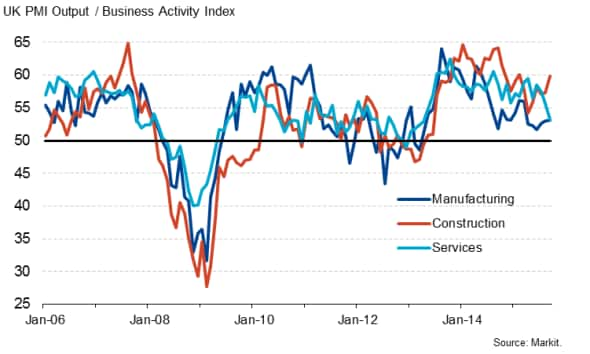

With the UK economy having lost some steam in the third quarter and gross domestic product up just 0.5% in the three months to September, it's widely expected that the Bank of England will leave monetary policy unchanged at its November meeting. On the same day (so-called "Super-Thursday") the bank also releases minutes from its latest meeting and publishes the final Inflation Report in 2015, in which revised forecasts for growth and inflation will add further insight into the trajectory of interest rates.

Meanwhile, construction, manufacturing and service PMI results will give first clues as to how the UK economy is preforming in the fourth quarter. Latest business survey results suggested that the pace of economic expansion slowed to a two-and-a-half year low in September, with growth of the mighty service sector slowing further.

UK PMI surveys

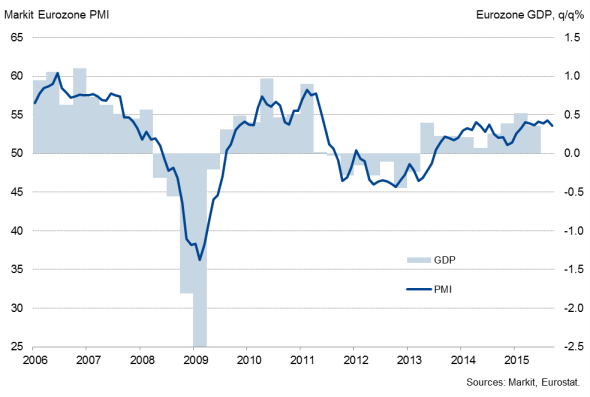

Final PMI results are also released in the eurozone and contain more national detail. Flash data suggested that economic growth regained some momentum at the start of the fourth quarter, but also highlighted that inflation is likely to remain disappointingly weak as we head towards the end of the year. Unless the PMI business activity and price indices pick up significantly in coming months, the combination of relatively weak growth and deflation signalled by the survey will fuel expectations that the ECB will step up its quantitative easing programme at the December meeting.

Eurozone GDP and the PMI

The data flow in China has also been disappointing in recent months: The Caixin China Composite PMI fell to its lowest level since January 2009 in September and GDP fell below the psychological 7.0% mark in the third quarter, adding to signs that China's Central Bank may need to cut interest rates further and possibly introduce other measures in order to stimulate the economy. PMI results for October will provide policy makers with the first available information on the health of the Chinese economy in the fourth quarter, and other Asian PMI surveys will highlight the extent to which China's slowdown is affecting the rest of the region.

Other notable PMI releases include the ISM US survey and updates for India, Russia and Brazil.

Monday 2 November

Worldwide manufacturing PMI results are released by Markit.

New home sales and building permit data are published in Australia.

Car sales figures are issued in South Africa.

Halifax house price data are meanwhile released in the UK.

Construction spending numbers are updated in the US.

Tuesday 3 November

The Reserve Bank of Australia announces its latest monetary policy decision.

The UK Construction PMI and a number of manufacturing and whole economy PMI results are published.

In Brazil, trade balance data are released.

Factory orders figures are meanwhile issued in the US.

Wednesday 4 November

Worldwide services PMI results are released by Markit.

In Australia, retail sales and trade balance numbers are released.

Consumer confidence figures are issued in Japan.

Business confidence numbers are meanwhile out in South Africa.

Eurostat issues producer price data for the currency union.

Industrial output figures are updated in Brazil.

Canada sees the release of trade data.

ADP employment and trade numbers are issued in the US.

Thursday 5 November

A number of services and retail PMI results are published.

Russia sees the release of latest consumer price data.

Retail sales numbers are published in the eurozone.

Meanwhile, Germany sees the release of industrial orders figures.

The Bank of England announces its latest monetary policy decision. Moreover, the latest Inflation Report is published.

In the US, initial jobless claims numbers are updated.

Friday 6 November

Global sector data are issued by Markit.

The AIG Construction Index is published in Australia.

In Japan, the Cabinet Office releases the latest leading economic indicator.

Industrial output data are published in Germany, France and Spain.

France sees the release of budget balance and trade data.

Industrial production and trade balance numbers are meanwhile out in the UK. Moreover, the latest KPMG/REC UK & English Regions Report on Jobs is released.

In Brazil, consumer price data and auto sales figures are issued.

Building permit and unemployment data are updated in Canada.

Non-farm payrolls numbers are issued in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}