Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 29, 2017

UK Shorting Activity Gathers Steam

FTSE 350 short interest has pushed past its post-Brexit high to reach the highest level in over two years

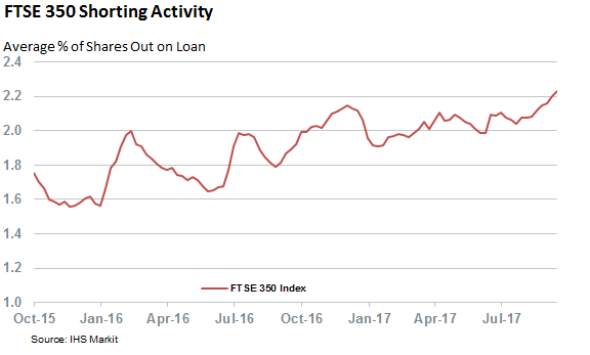

- FTSE 350 short interest jumps 14% YTD to 2.3% of shares outstanding

- Disastrous earnings from Carillion and Provident drives short sellers

- Domestically exposed firms continue to be top short priority

The pound's recent recovery and talk of a possible rate rise from the Bank of England, which was unthinkable 12 months ago, would indicate that some normalcy is returning to the UK market. Yet as Theresa May was busy laying out her vision of Brexit last week, short sellers were busy adding to their bearish bets across UK equities.

This latest deterioration in investor sentiment takes the average FTSE 350 shorting activity to the highest level in more than two years; the average percent of shares out on loan across the index surpassed the levels seen in the months following last June's referendum. Although it would be unfair to expect every investor to be fully onboard with the re-launched Brexit negotiation, the fact that a portion of British investors are this pessimistic underscores the level of uncertainty that lies ahead.

Playing this uncertainty has paid off for short sellers - several of their top UK targets have seen their shares struggle in the face of uncertain economic environments.

This is definitely the cast with Carillion, which is the most shorted constituent of the FTSE 350. Short sellers are well positioned to profit from the crash caused by its July profits warning, and they steadily increased their positions to a massive 28% of all issued shares in the 12 months since the referendum. Carillion shares lost three quarters of their value since January, but short sellers are showing no sign of relenting. The demand to borrow the company's shares is still more than a third higher than any constituent of the FTSE 350.

Provident Financial also recently saw its share price crater after a profits warning, inspiring a relentless demand to short its shares.

Brexit uncertainty is also evidenced by the fact that short sellers continue to favor companies with a domestic exposure. Retailers and UK centric services firms dominate the current list of high conviction short targets.

Some of the other popular domestic short targets include pizza firm Domino's, recently listed pet store Pets at Home and retail freeholder Intu Properties, all of which have more than 10% of their shares out on loan.

The-ever popular-supermarket short has also been heating up over the last few weeks as Sainsbury's shares experienced a 21% uptick in demand to borrow their shares by short sellers. This recent increase takes Sainsbury's short interest to the highest level since September of last year, while also taking it past competitor Morrison's as the most shorted of the "big four" supermarkets.

Another increasingly popular short is retail broker Hargreaves Lansdown, which has an all-time high of 9% of its shares out on loan. Short sellers have yet to see the type of returns delivered by the likes of Carillion. Hargreaves shares are trading at their highest level in two and a half years, but the elevated levels of short selling could be driven by a desire to play the anticipated market volatility heralded by Brexit uncertainty.

Although directional trades make up the great majority of UK short targets, some firms have been targeted by short sellers for other reasons. This is definitely the case for John Wood, which is currently in the process of taking over fellow FTSE 350 constituent Amec in an all-share deal.

The deal's recent blessing by the UK competition watchdog prompted arbitrageurs to increase the shorts in Wood Group in order to lock in the premium offered to Amec shareholders.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092017-Equities-UK-Shorting-Activity-Gathers-Steam.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092017-Equities-UK-Shorting-Activity-Gathers-Steam.html&text=UK+Shorting+Activity+Gathers+Steam","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092017-Equities-UK-Shorting-Activity-Gathers-Steam.html","enabled":true},{"name":"email","url":"?subject=UK Shorting Activity Gathers Steam&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092017-Equities-UK-Shorting-Activity-Gathers-Steam.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+Shorting+Activity+Gathers+Steam http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092017-Equities-UK-Shorting-Activity-Gathers-Steam.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}