Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 29, 2014

Yahoo stub trade

In the wake of the highly anticipated Alibaba listing, we investigate whether investors are playing the fact that Yahoo, which now owns 16% of the firm, is currently trading at a discount to the sum of its cash and minority investments.

- The aggregate value of BABA shares out on loan stands at just over $1bn

- The other element of the stub trade, Yahoo Japan, has not seen a significant rise in demand to borrow

- Conversely to the stub trade scenario, the demand to borrow Yahoo shares has shot up in recent weeks and now stands at a two year high

Valuing a tech company is never easy, as traditional profit and revenue metrics take second stage to factors such as growth potential and the "disruptive" potential of a company's business model. While the recent wave of listings have seen the top end of valuations set new highs, as evident by the fact that Twitter currently trades at 178 times its forecasted 12 month forward profits, common sense and financial theory dictates that the lower bound ought to be set by the current value of a company's assets. While these can prove hard to measure, the market can provides some insight when one public company holds a stake in another publicly traded entity.

Cases when a company's net cash position and the value of its publically traded interests are worth more than its market cap create the opportunity of a stub trade, in which investors can take a view that the company's core business will rise by shorting the minority stakes whilst going long the underlying. Such an opportunity has arisen in the wake of the Alibaba listing which has seen early investing company Yahoo trade at a discount to the value of its stake in the Chinese web portal company and its Japanese subsidiary.

Yahoo stub recap

Yahoo's early investment in Chinese Ecommerce platform Alibaba is arguably the canniest tech investment of the last decade as its early backing of founder Jack Ma surged to see its stake jump to over $40bn in the wake of Alibaba's recent listing. This includes a $36bn value for its 16.3% post IPO stake and $5.6bn net cash proceed from its disposal of 121.7 million shares in the Alibaba IPO.

Combine this number with Yahoo's 35% stake in Yahoo Japan (current value ?7.7bn) and its billion or so of net cash it currently holds and the accounting arithmetic currently have "core" Yahoo at a negative valuation given the $40.4bn value the market currently has for the sum of the parts. Note that this valuation makes no assumption of the cost of disposing any of Yahoo's minority interests such as taxes incurred on disposal, though some commentators have posited that these could be minimised below Yahoo's marginal tax rate.

Investors looking to hedge themselves in a stub trade would have to short about 40 BABA share and 200 Yahoo Japan shares for every 100 shares of the parent Yahoo in order to out on a fully hedged in a stub trade.

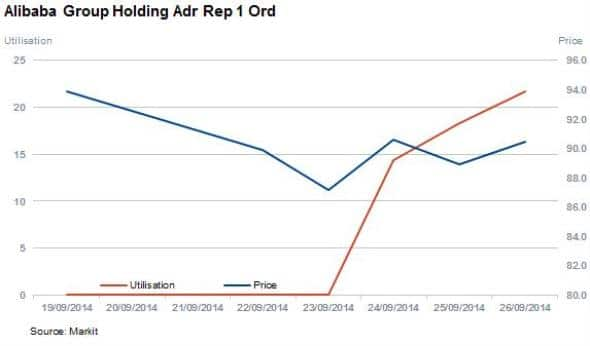

Borrowing BABA

Demand to borrow shares in the days immediately following Alibaba's listing has stayed relatively subdued with 11.4 million shares out on loan as of the end of last week. This lacklustre demand to borrow is not constrained by any of the usual limiting factors of the securities lending world as the current demand to borrow only represents about a fifth of the 50 million shares sitting in lending programs. The fee is also relatively low for a new listing as investors can borrow BABA shares at a cheaper rate than the average fee commanded by S&P 500 shares.

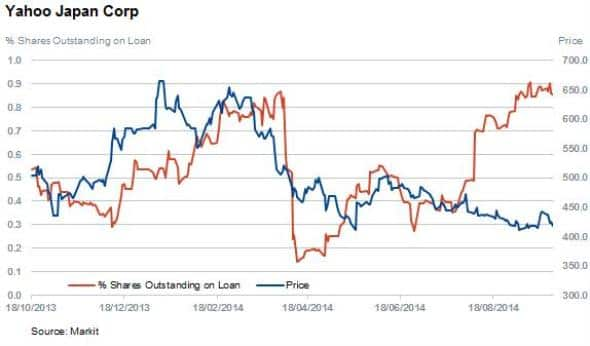

The other part of the stub trade has also seen relatively tame stock borrow activity in recent weeks. The aggregate borrow of shares in Yahoo Japan is actually down slightly with 4.3% of the free float out on loan.

his lacklustre demand to borrow both BABA and Yahoo Japan shares indicate little appetite for the trade immediately following Alibaba's listing.

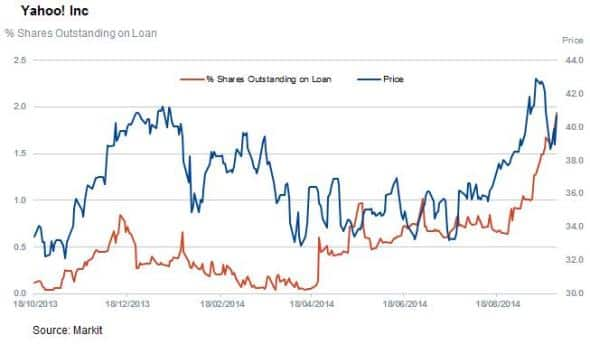

Yahoo short

Interestingly, the demand to borrow shares of Yahoo has shot up in recent weeks. the current Yahoo short interest represents 2% of its shares out on loan, up fourfold from the number seen a couple of months ago.

Whether there is anything to be inferred from the recent spike in demand remains to be seen, but it runs against the commonly accepted stub trade playbook.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092014-Equities-Yahoo-stub-trade.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092014-Equities-Yahoo-stub-trade.html&text=Yahoo+stub+trade","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092014-Equities-Yahoo-stub-trade.html","enabled":true},{"name":"email","url":"?subject=Yahoo stub trade&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092014-Equities-Yahoo-stub-trade.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Yahoo+stub+trade http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092014-Equities-Yahoo-stub-trade.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}