Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 29, 2016

US economic growth fails to rebound in second quarter

US economic growth failed to gain momentum in the second quarter, with GDP data signalling a pace of expansion which looks especially underwhelming when looked at in the context of the sluggish start to the year.

Consumer spending continued to provide a major boost to the economy, however, and once the impact of a downward inventory adjustment is considered, the underlying pace of growth looks healthier than the headline number.

While no doubt disappointing, the GDP data are backward looking and whether or not the Fed hikes interest rates again this year depends more on the future data flow than what happened back in the second quarter. However, the ongoing softness of growth in the second quarter will no doubt add to calls for policymakers to err on the side of caution and as such greatly reduces the chance of any rate hike before December.

Lack of rebound

Gross domestic product rose at an annualised rate of 1.2% in the second quarter after a downwardly revised 0.8% increase in the first three months of the year, according to the first estimate from the Commerce Department.

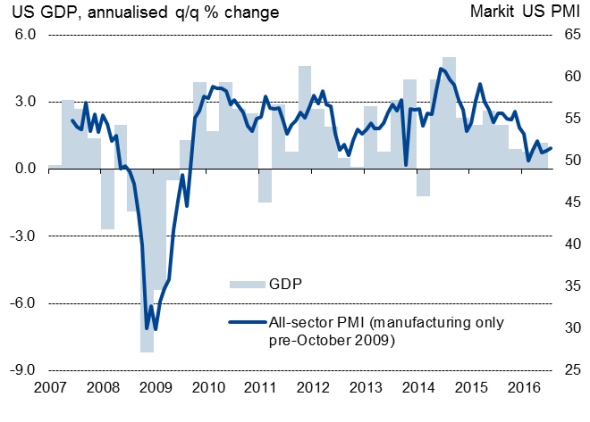

Markets had been expecting a far stronger expansion of 2.6%, but there were always downside risks. The actual print was in line with soft second quarter PMI data from IHS Markit, which found companies fighting against headwinds such as the strong dollar, the energy sector downturn and growing hesitation in committing to new spend ahead of the presidential election.

Markit PMI v GDP

he good news is that these headwinds do not appear to have led to a worrying slowing in the underlying rate of job creation in either the survey or official data.

The solid labour market has therefore helped to boost consumer spending, and joins other tailwinds such as low inflation and low oil prices, as well of course as low interest rates.

It's not surprising, therefore, given the different headwinds and tailwinds, to see growth being driven largely by the consumer. Household spending rose at a 4.2% annualised rate in the second quarter, its strongest increase since the end of 2014.

Likewise, it's no real shock to see that business investment spending on equipment fell for a third successive quarter, albeit with the rate of contraction showing a welcome easing from 3.5% to 9.5%.

Sluggishness persisting into Q3

Inventories are always the unpredictable wildcard in the GDP statistics, and the second quarter weakness was in part due to inventories falling for the first time since the third quarter of 2011. The good news is that firms should hopefully start rebuilding stock levels in the second half of the year, boosting growth.

However, so far, the first indicators of the third quarter also point to growth remaining sluggish, albeit with employment continuing to grow at a solid pace. At 51.5 in July, the flash PMI covering both manufacturing and services was unchanged on the second quarter average and continued to run at a rate signalling annualised growth of approximately 1.0%.

Data revisions

The Commerce Department revised some of the GDP back data, using new adjustments to try to eradicate some of the volatility in the numbers (especially in the first quarters). However, this only appears to have been partially successful with steep first quarter downturns still evident in 2008, 2011 and 2014.

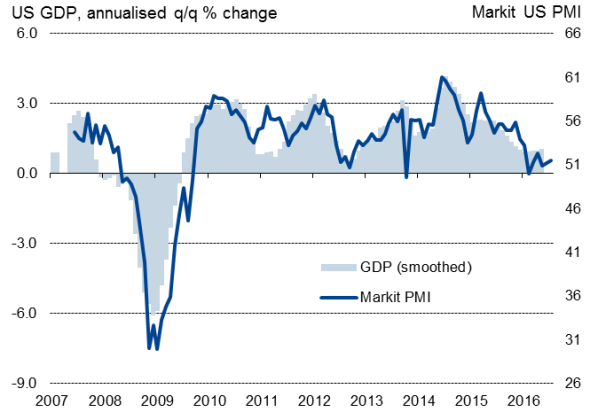

Using a centred moving average to smooth the GDP data brings the official data more into line with the PMI, boosting the correlation from 77% to 89% (see chart).

PMI v GDP moving average

Note: charts use flash PMI for July.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072016-Economics-US-economic-growth-fails-to-rebound-in-second-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072016-Economics-US-economic-growth-fails-to-rebound-in-second-quarter.html&text=US+economic+growth+fails+to+rebound+in+second+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072016-Economics-US-economic-growth-fails-to-rebound-in-second-quarter.html","enabled":true},{"name":"email","url":"?subject=US economic growth fails to rebound in second quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072016-Economics-US-economic-growth-fails-to-rebound-in-second-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+economic+growth+fails+to+rebound+in+second+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072016-Economics-US-economic-growth-fails-to-rebound-in-second-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}