Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 29, 2016

European short sellers miss out Brexit bonanza

European short sellers were as unprepared for Brexit as the rest of the market and there have been few signs of a rush to short the firms most affected by last Thursday's vote.

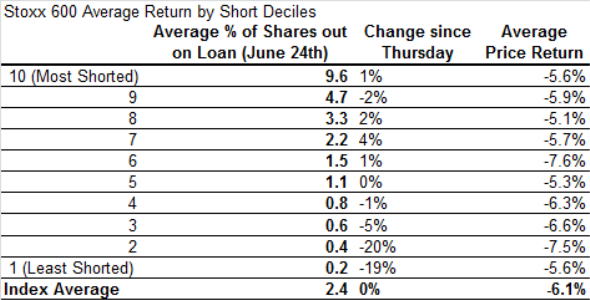

- Average short interest in Stoxx 600 index fell 5% in the ten days leading up to last Thursday

- The most shorted constituents of the index have not fallen as much as the index average

- Demand to borrow European shares to short has been flat since last Thursday

The volatility seen since last Friday would have provided European short sellers with an opportunity to profit from a seldom seem decline in the market, but the unexpected Brexit result largely caught short sellers out. While no part of the market "correctly" anticipated Friday's results, it's interesting that even historically sceptical investors stood largely unprepared to profit from the volatility.

The covering seen in the FTSE 350 index in the days leading up to Thursday's referendum was mirrored in the rest of Europe. The average shares out on loan across constituents of the Stoxx 600 stood at 2.4% of shares outstanding on the eve of the vote. This number was 5% lower than that seen ten days prior which indicates that bearish activity was on the wane leading up to Friday's volatility.

Most shorted failed to deliver

Short sellers also missed out due to the fact that their high conviction names have largely failed to deliver since last Thursday. Since the vote, the average fall seen in the 10% of the Stoxx 600 constituents that saw the greatest short activity on the eve of the vote was 5.6%.

This is 0.5% less than the average price fall seen index wide and ironically means that the most shorted group of shares has actually outperformed the index as a whole.

The average short interest among those index constituents that did underperform the index, the 60 whose share price has fallen by more than 15% since the vote, was 2.0% of shares outstanding on the eve of the vote - nearly 20% less than the index average.

There few exceptions to the trend are largely periphery banks Italian and Spanish banks such as Banco Popolare and UBI Banca, which make up the majority of firms which feature among both the high conviction short list at the end of Thursday and those whose shares have fallen by more than 15%.

The one profitable high conviction UK short of recent weeks has been London exposed real estate developer Capital & Counties which had seen large demand to borrow leading up to the referendum as investors looked to profit from a fall in London property values off the back of an "out" vote. Its shares fell by 17% in the three days after the vote and short sellers have subsequently added 14% to their already high positions.

Little appetite to sell short post Brexit

But the surge in demand to borrow Capital & Counties shares is very much against the general mood of the market as demand to borrow shares of the constituents of the Stoxx 600 index has been flat since last Thursday indicating a general lack of appetite to short the market in the wake of the vote.

This trend holds true even for the companies whose shares have been most negatively impacted by the recent volatility as the average borrow across the 60 shares which have fallen by more than 15% in the last three trading days has fallen 5% to 1.92%

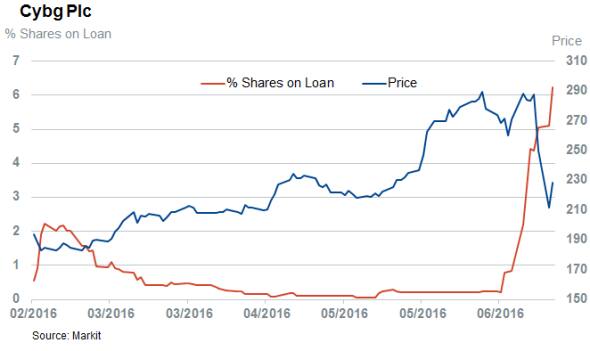

Eight index constituents have bucked this trend however and have seen demand to borrow grow by more than 1% of shares outstanding in the last three days. The majority of these firms are financials which stand to suffer the most from the uncertainty brought upon by last week's vote.

This is particularly relevant for Scottish banking group CYBG which has seen shorts increase by more than a third in the last three trading days to an all-time high 6.3% of shares outstanding.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062016-equities-european-short-sellers-miss-out-brexit-bonanza.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062016-equities-european-short-sellers-miss-out-brexit-bonanza.html&text=European+short+sellers+miss+out+Brexit+bonanza","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062016-equities-european-short-sellers-miss-out-brexit-bonanza.html","enabled":true},{"name":"email","url":"?subject=European short sellers miss out Brexit bonanza&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062016-equities-european-short-sellers-miss-out-brexit-bonanza.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+short+sellers+miss+out+Brexit+bonanza http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062016-equities-european-short-sellers-miss-out-brexit-bonanza.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}