Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 29, 2014

Betting Against UK Bookmakers

Ahead of what looks set to be sweeping restrictions on one of their largest source of income, we’ve seen short sellers congregate in bookmaker shares

- Paddy Power and Ladbrokes have seen short interest surge in recent weeks

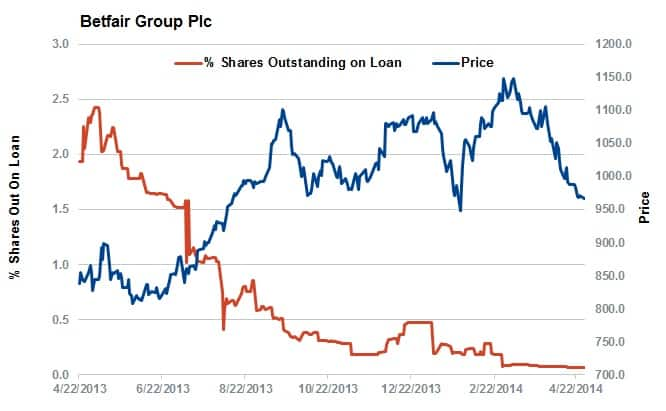

- Online competitors less affected with former short favourite Betfair seeing record low demand to borrow

- Bwin has seen a surge in demand to borrow after activist shareholders started to agitate for change

UK bookmakers have been living on borrowed time for the last 13 years, thanks to the advent of the fixed odds betting terminal (FOBT). The relentless march of e-commerce has been delayed somewhat in the bookmakers industry thanks to these fridge sized betting machines, referred to by some as the “crack cocaine” of the betting industry.

But these machines seem to have become a victim of their own success, as UK high streets face the proliferation of betting shops keen to extend their four machines to a shop footprint. Industry opponents are keen to highlight the fact that these machines often target people with the least to lose and are often placed in some countries of the most deprived areas.

Following years of growing controversy, FOBTs now face a two-pronged regulatory assault. The first occurred last month when the chancellor announced that taxes on bookmakers’ £1.5b winnings will rise by a quarter to 25%. The second piece of legislation will be unveiled tomorrow and looks set to limit the maximum allowable stake and pace of play, to try and reduce the £13b staked through these machines.

Shorts building in bookmakers

The turning legislative tide has seen short sellers pile into UK bookmakers with heavy bricks and mortar presence. This comes as little surprise as these firms stand to lose out after the reshuffle. The recent developments have also take a hit on share prices, with all three listed UK bookmakers posting double digit percent price falls since the start of the year.

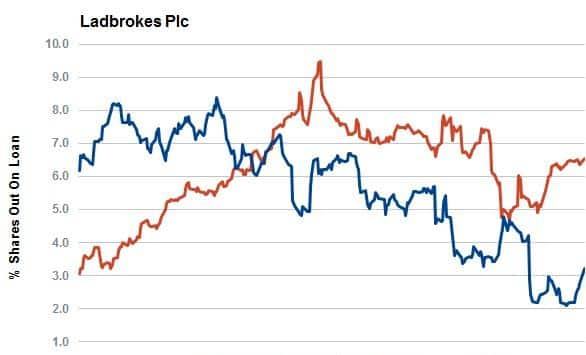

Most shorted of the lot is Ladbrokes, which has over 6% of its shares outstanding currently on loan. The company arguably has the most to lose as it relies on physical stores for 72% of its revenue. While the current demand to borrow stands lower than the all-time high reported last November, demand to borrow has picked up by over a quarter in the run-up to tomorrow’s guidance announcement.

Industry leader William Hill, which also relies on UK-based physical stores for the majority of business, has seen a surge in demand to borrow in recent weeks. Demand to borrow now stands at 2.6% of shares outstanding, making the company the 17th most shorted constituent of the FTSE 100.

Finally, Paddy Power, which has 15% of its business tied to physical UK operations, has the highest proportion of its shares out on loan in over three years.

Online companies avoid this fate

While the physical companies have come under scrutiny from short sellers, online companies have seen some of the lowest demand to borrow.

Former short favourite Betfair Group currently sees an all-time low demand to borrow. The 70,000 shares of the online betting exchange out on loan represent less than a tenth of a percent of shares outstanding, down from over 10% in 2011. The company has seen a string of strong results in this timeframe and is set to grow its dividend by 40% in the coming year; the highest in the UK gaming sector.

888 has also seen short covering in the last couple of years.

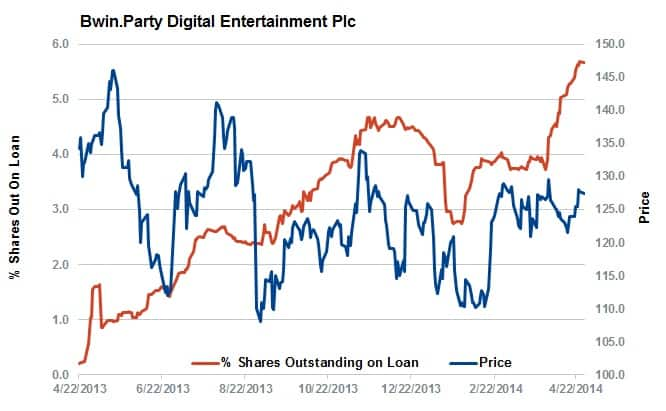

The exception to the rule is Bwin. Party Digital Entertainment which has seen short interest surge up in recent weeks. The current 5.7% of the company’s shares out on loan represents a three year high. The fact that the company’s shares have lingered in the doldrums in the last couple of years has also seen activist investors start to agitate for change, with US investor SpringOwl asking for a seat on the company’s board after acquiring a 5.3% stake in the company.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042014120000Betting-Against-UK-Bookmakers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042014120000Betting-Against-UK-Bookmakers.html&text=Betting+Against+UK+Bookmakers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042014120000Betting-Against-UK-Bookmakers.html","enabled":true},{"name":"email","url":"?subject=Betting Against UK Bookmakers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042014120000Betting-Against-UK-Bookmakers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Betting+Against+UK+Bookmakers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042014120000Betting-Against-UK-Bookmakers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}