Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 29, 2016

Japan takes rates negative; Mexico beats EM peers

Credit markets react positively to Bank of Japan's introduction of negative interest rates, while Mexican government bonds outperform emerging market peers.

- Japan's 10-yr government bond yield dropped 13bps to 0.11%

- Some respite in commodity markets has seen Glencore's 5-yr CDS spread tighten 90bps

- Mexican government bonds have outperformed EM so far this year, returning 1.2%

Japan surprises

The monetary policy divergence between the US and other developed nations was further extended this week as the Bank of Japan introduced negative interest rates for the first time in history.

Japan has been long struggling to stimulate inflation despite the best efforts of Prime Minister Shinzo Abe, with the latest move seen as it's boldest to date.

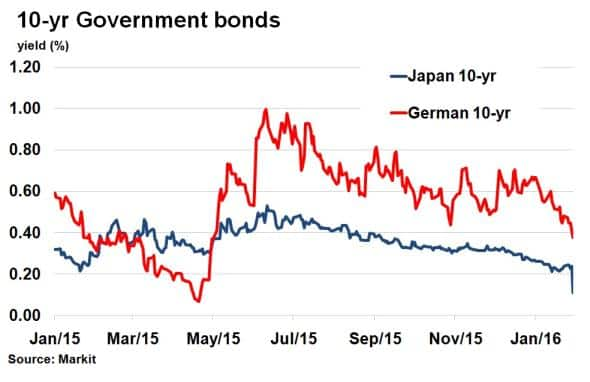

Bond markets reacted, with the 10-yr Japanese government bond yield falling 13bps to 0.11%, according to Markit's bond pricing service. Global equity indices rallied and corporate credit indices tightened; typical moves seen in the wake of dovish central bank action. With markets embroiled in volatility stemming from weak commodity prices and the threat of slowing global trade it seems central banks have taken the vanguard.

Just last week, ECB president Mario Draghi hinted at the possibility of further monetary easing in March, sending German bund yields lower and calming corporate credit markets. Japan's latest decision further spurred 10-yr German bund yields to levels last seen in May 2015, as they approach the record low yields seen last April.

Best CDS performers of the week

It was a week of respite for commodity credits, as a rebound in prices halted credit quality from further deterioration.

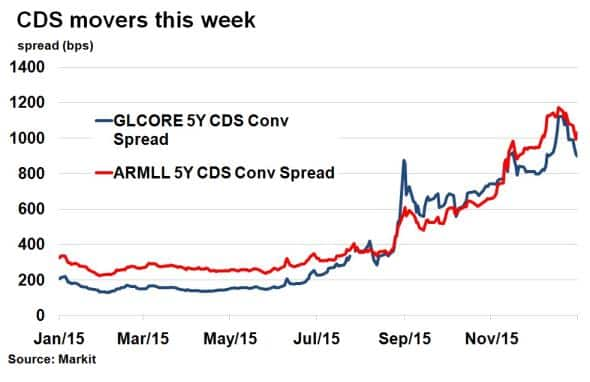

Among the best weekly credit performers were commodities trading house Glencore and steel giant ArcelorMittal; two names that have seen their credit risk soar over the past year. Glencore's 5-yr CDS spread widened to a record high 1,121bps on January 15th but has since tightened to 899bps as of January 28th. More positive market sentiment, coupled with a rebound in commodity prices this week has helped appease credit risk, bringing spreads tighter 90bps over the past week, but Glencore's corporate debt being downgraded remains a real threat. Meanwhile ArcelorMittal's 5-yr CDS briefly dipped below 1,000bps for the first time in four weeks.

Mexico leads EM

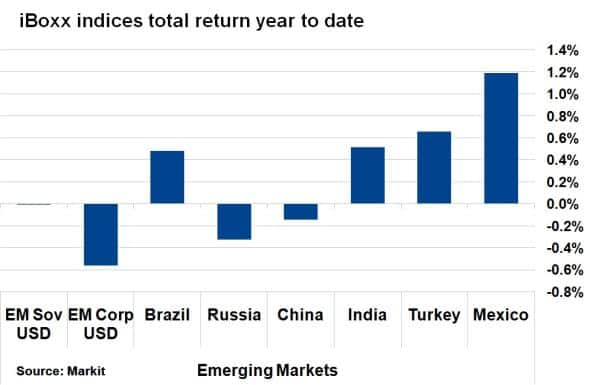

Emerging markets have lagged their developed nation peers when it comes to returns on government bonds so far this year.

According to Markit's iBoxx indices, German bunds have returned 2% so far this year while US treasuries have returned 1.9%, as the risk off environment has sent investors towards safe haven assets.

Unsurprisingly, riskier emerging market debt has fared much worse, despite the higher coupon returns. Russian government bonds returned over 30% last year but a fresh plunge in oil prices over the past month has accelerated another selloff.

Government bond returns in India, Turkey and Brazil have all underperformed their developed nation rivals. The only bright spot has been Mexico, where bonds have returned 1.2% so far this year. The Central American nation has seen healthy expansion in its manufacturing industry, with latest Markit PMI coming reading 52.4, indicating an expansionary phase. Its close links with the US, fiscal prudence and buoyant capital markets have bred confidence in investors.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-credit-japan-takes-rates-negative-mexico-beats-em-peers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-credit-japan-takes-rates-negative-mexico-beats-em-peers.html&text=Japan+takes+rates+negative%3b+Mexico+beats+EM+peers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-credit-japan-takes-rates-negative-mexico-beats-em-peers.html","enabled":true},{"name":"email","url":"?subject=Japan takes rates negative; Mexico beats EM peers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-credit-japan-takes-rates-negative-mexico-beats-em-peers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+takes+rates+negative%3b+Mexico+beats+EM+peers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-credit-japan-takes-rates-negative-mexico-beats-em-peers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}