Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 29, 2015

ECB action benefits consumer shares

Despite stubbornly low inflation which looks set to hurt revenue growth in the near term, investor sentiment in European consumer focused companies has shown signs of resilience.

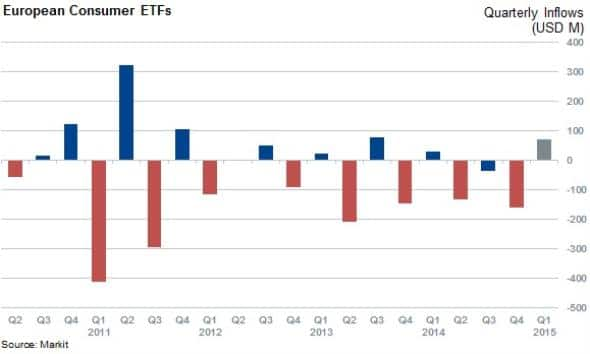

- European focused consumer exposed ETFs are on track for their first quarterly inflow in four quarters

- Both staples and discretionary shares have seen little appetite from short sellers

- Short interest in retailers has shown signs of spreading beyond UK firms in recent months; average demand to borrow continental retailers is up by 50% from a year ago

Eurozone consumer prices fell for the first time since the recession according to the latest data from the European Central Bank (ECB). This latest survey of prices across the region, spurred on by falling oil prices and weak consumer spending, looks set to compound problems in consumer focused companies. These firms have already been struggling due to their heavy exposure to the region's slack economic climate which showed consumer confidence trend lower in the closing months of the year according to the European Commission consumer confidence indicator.

Faced with the prospects of a downward spiral in prices, the ECB's recent quantitative easing move was aimed at halting what has historically been a destructive feedback loop.

These steps were generally well received by the market over the last few weeks, according to ETF flows; a useful tool for measuring investor sentiment.

ETF investors return to consumer sector

ETF investors had broadly avoided the European consumer sector over much of last year as evident by the fact that investors withdrew their cash from funds exposed to European consumer sectors over the last three quarters of 2014. These outflows totaled over $270m for the year; roughly 17% of the total assets managed by the 31 consumer focused products at the start of the year.

Investors appear to have had a change of heart regarding the sector over the last few weeks however, as European consumer focused ETFs have experienced over $71m of inflows so far this month. This trend puts the first quarter on track for its best ever performance since the third quarter of 2013.

Both branches of the consumer tree have benefited from the resurgent ETF flows in the last few weeks, as the inflows have been roughly evenly split among products exposed to discretionary and staples sides of the consumer divide.

Investor's faith in the sector has played out well so far as the both the largest products tracking the broad consumer discretionary and staples sectors, SPDR MSCI Europe Consumer Staples ETF and SPDR MSCI Europe Consumer Discretionary ETF, have outperformed the broader Stoxx 600 index since the start of the year; both returning over 10%.

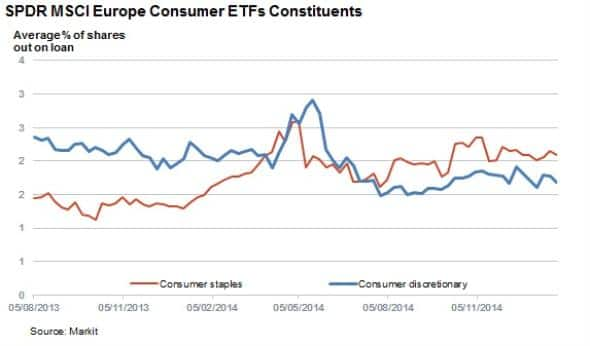

Short sellers avoid

Short sellers have also been largely avoiding the sector in the wake of the recent ECB moves. Demand to borrow constituents of the previously mentioned SPDR consumer discretionary and staples ETFs had tapered off somewhat in the weeks leading up to the start of the year. There has been no large surge in shorting activity in the wake of the recent strong performance, which indicates that shorts are not actively trading on a short term trend reversion.

.

.

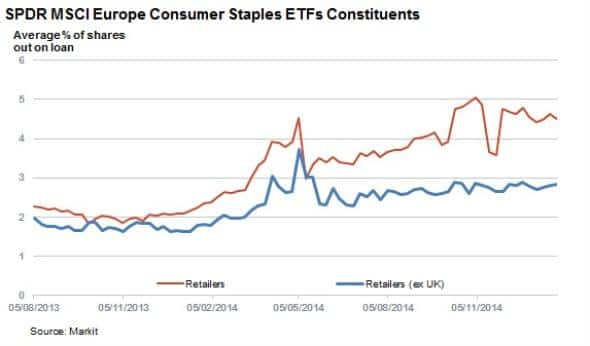

Retail shorts move beyond UK firms

The outlook is not universally bright however as retail short sellers, which had largely confined their attention to UK firms over the last year, have started to focus their attentions onto the continent.

Retail constituents of the SPDR MSCI Europe Consumer Staples ETF have seen short interest double in the last 18 months, owing in large part to UK firms Sainsbury's and Morrison's, which have seen covering of late.

Non UK-based retailers within this ETF have seen the opposite trend however, as average demand to borrow shares of continental constituents has ticked up since the start of the year to 2.8% of shares outstanding.

This increase was driven by French retailers Carrefour and Casino.

Short sellers are not solely focused on French firms, as Spanish firm Distribuidora Internacional De Alimentacion Sa and German retailer Metro have also seen demand to borrow climb to new highs.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012015-Equities-ECB-action-benefits-consumer-shares.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012015-Equities-ECB-action-benefits-consumer-shares.html&text=ECB+action+benefits+consumer+shares","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012015-Equities-ECB-action-benefits-consumer-shares.html","enabled":true},{"name":"email","url":"?subject=ECB action benefits consumer shares&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012015-Equities-ECB-action-benefits-consumer-shares.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ECB+action+benefits+consumer+shares http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012015-Equities-ECB-action-benefits-consumer-shares.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}