Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 28, 2015

Europe credit risk now higher than during Grexit

Corporate credit risk in Europe has surged on the back of deteriorating mining fundamentals, which have been exacerbated by the automobiles industry.

- Markit iTraxx Europe index is wider than during the Greek crisis, reaching widest level since February 2014

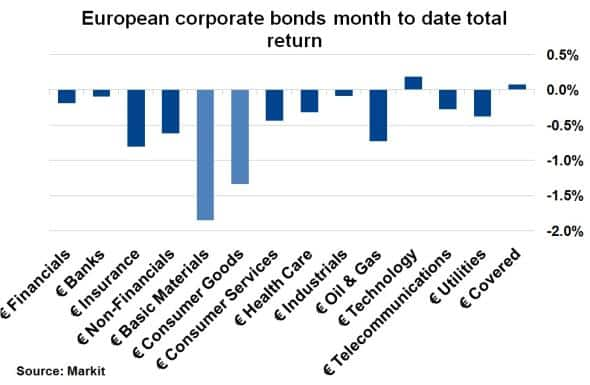

- Iboxx indices show consumer goods and basic materials have led the deteriorating credit conditions

- Volkswagen and Glencore's CDS spreads continue to widen intraday, 16% and 36% respectively

The level of credit risk among European corporations is a far cry away from the lows reached in March earlier this year. Then, the ECB had just announced a massive QE programme to boost growth in the Eurozone. Europe was even relatively insulated by the falling price of oil, unlike HY credit in the US and certain emerging markets. Investors reacted with the stock market rallying and credit risk falling. The iTraxx Europe Main index, made up of 125 European corporate single name CDS, hit 59bps, a one year low at the time.

Bearish sentiment has since taken over. First was the threat of a Eurozone breakup involving Greece and the potential contagion on the wider economies. The iTraxx Europe Main index widened to 81bps at the height of the Greek crisis, before subsiding after a deal was announced, averting a potential breakup.

But uncertainty in credit markets has returned in the wake of slowing global growth led by China and exacerbated by the recent Volkswagen scandal hitting the European automobile industry. The iTraxx Main index at its latest level, 84bps, has now surpassed what was seen during the Greek crisis, and is at its highest level since February 2014.

Leading sectors

European sector bond indices also represent the deteriorating credit conditions. Unsurprisingly the iBoxx € Basic Materials index is the worst performing sector, having returned -1.85% on a total return basis month to date. Constituents include mining corporations that have seen their bond spreads increase as slowing demand from China is expected to be a strain on operations.

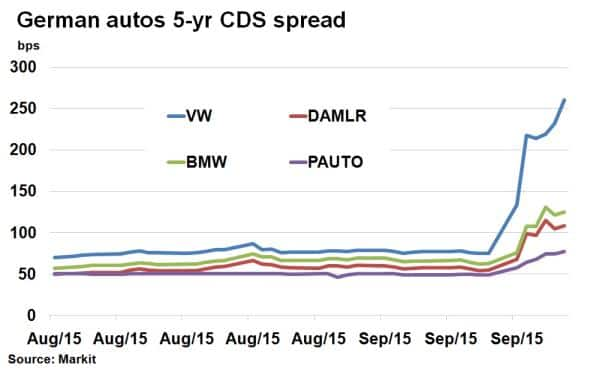

The second worst performing sector has been the iBoxx € Consumer Goods index, which has seen a -1.34% return so far this month. This has been led by the auto industry, which makes up just under half of the index. The performance shows that Volkswagen's emissions scandal and its effects have not been isolated, as credit risk among other German automakers has increased amid the uncertainty.

Credit spreads demonstrate the extent to which the contagion has spread among German automakers. Volkswagen's 5-yr CDS spread, a proxy for default risk, has reached a new high of 260bps (+16% intraday) as of the latest level, quadruple the level seen on September 18th. Similarly, BMW and Daimler have seen their CDS spreads double over the same period.

Among mining names, Glencore's credit risk is soaring and has surpassed 700bps on an intraday basis (+36%), with spreads implying junk credit status. Glencore's 5-yr CDS now trades at the widest level of all iTraxx main constituents, with Volkswagen in fourth.

Volkswagen threat

Moody's is the latest ratings agency to alter its outlook for Volkswagen's debt. With the high level of uncertainty and potential reputational damage done in the world's largest automobile market (US), bond yields have followed synthetic credit. Glencore's Euro bond due 2020 has seen its yield soar to 1.86%, according to Markit's bond pricing service.

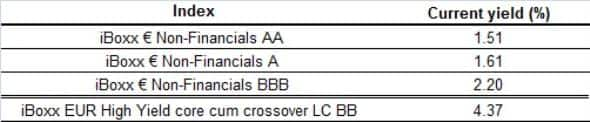

Yields for the A/BBB rated credit however remain well below average BBB rated bonds and 2.5% above the junk horizon.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092015-Credit-Europe-credit-risk-now-higher-than-during-Grexit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092015-Credit-Europe-credit-risk-now-higher-than-during-Grexit.html&text=Europe+credit+risk+now+higher+than+during+Grexit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092015-Credit-Europe-credit-risk-now-higher-than-during-Grexit.html","enabled":true},{"name":"email","url":"?subject=Europe credit risk now higher than during Grexit&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092015-Credit-Europe-credit-risk-now-higher-than-during-Grexit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Europe+credit+risk+now+higher+than+during+Grexit http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092015-Credit-Europe-credit-risk-now-higher-than-during-Grexit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}