Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 28, 2014

Semis draw investors after strong run

As the tech world starts to ramp up its crucial third quarter product launches, we see improving investor sentiment towards semiconductor firms.

-Short interest in semiconductor firms just hit a new 52 week low

-Industry laggard Cree is the only firm to see any significant jump in shorting activity

-Semiconductor ETFs on track for their best ever yearly inflows

September is nearly upon us, which usually heralds a flurry of tech launches as the industry shapes up for the Christmas shopping period. Already in the works are rumoured launches from Apple and Samsung along with new launches from industry stalwarts Motorola and Blackberry. Combine this with the back to school shopping period, which has grown to become a key technology purchase time, and the next month will shape the tech horizon for the coming six months.

Today's look at semiconductor companies reviews investor sentiment towards the firms that produce components powering the tech goods set to come to market in the coming months. These firms have often been looked to as a bellwether, so any shift in sentiments should be read as a view on the tech industry in general.

Shorts retreating

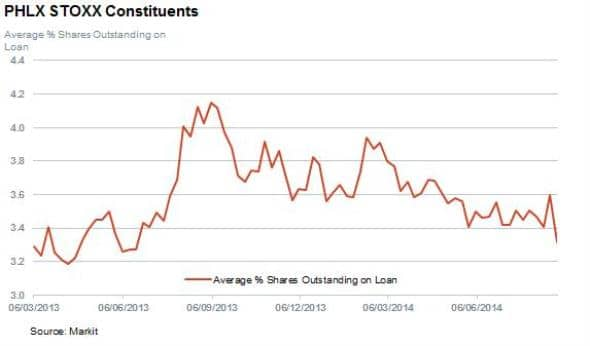

Overall average short interest across the 30 constituents which make up the PHLX SOX Semiconductor Sector index has been falling steadily over the last six months and now stands at a fresh 12 month low. This wave of short covering comes at the heels of a surge in shorting activity during the third quarter of last year after falling PC shipments and soft product launches saw the index lose 6% of its value in August.

Momentum coming into this month is much stronger as the PHLX is up by over 3.5%, while the Semiconductor Industry Association, the industry body, has reported a strong 10.8% rise in industry revenue over June to mark a new record for the industry.

Semis performing strongly

The industry's rising prospects have lifted the majority of its components, as 26 of the 30 firms in the PHLX constituents have seen their shares increase since the start of the year. This in turn has seen a majority of companies see a fall in demand to borrow.

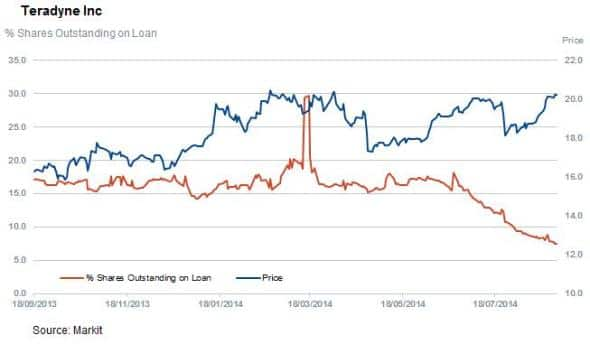

Teradyne has led the covering with after its shares out on loan more than halved, taking its short interest to a new yearly low after a string of better than expected results.

Xiling and Microchip have also seen short covering in the last eight months.

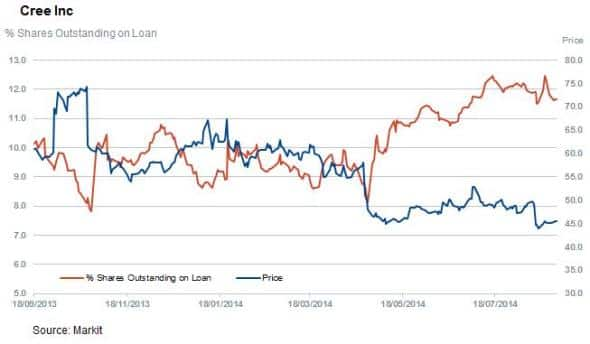

As ever there are exceptions to the rule, with Cree seeing short sellers circle after missing two straight quarterly revenue expectations. Demand to borrow shares of the firm is up by nearly a quarter after its shares have retreated by 27% since the start of the year.

This surge makes Cree the third most shorted constituent of the index behind AMD and Microchip, though both firms have seen shorts cover since the start of the year.

Investors like the story

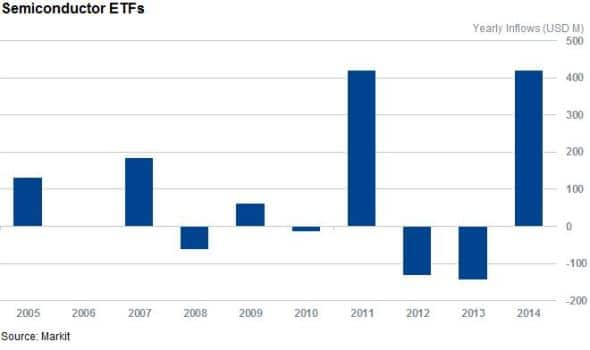

Investors seem to like the semiconductor sector heading into this period as the 11 funds which track the sector have seen large inflows since the start of the year. These funds are on track for their best ever year in terms of asset growth after investors ploughed $420m into the funds, matching 2011s record inflows.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082014semis-draw-investors-after-strong-run.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082014semis-draw-investors-after-strong-run.html&text=Semis+draw+investors+after+strong+run","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082014semis-draw-investors-after-strong-run.html","enabled":true},{"name":"email","url":"?subject=Semis draw investors after strong run&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082014semis-draw-investors-after-strong-run.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Semis+draw+investors+after+strong+run http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082014semis-draw-investors-after-strong-run.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}