Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 28, 2015

US treasuries appealing despite low yields

Compared to German bunds, US treasuries offer attractive yields; while US high yield credit continues to improve amid improving economic conditions.

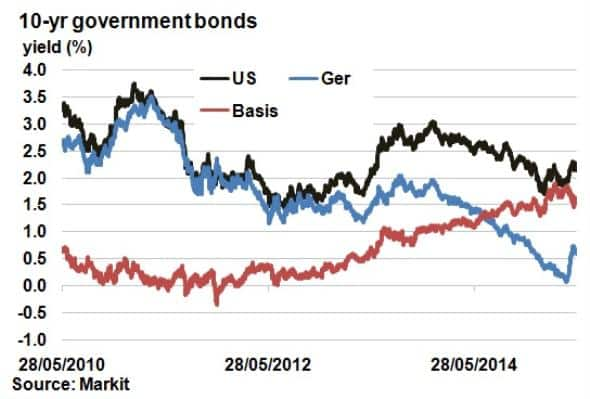

- US 10-yr treasuries yield 1.55% over equivalent bunds; 91bps above five year average

- $27bn of net inflows into US exposed fixed income ETFs so far this year

- Yield basis between high yield and investment grade bonds is 201bps; lowest since November last year

10-yr treasury yields have averaged 4.33% over the last 20 years. Why, then, would income investors consider a 10-yr treasury that yields a paltry 2.15% today?

On a relative basis, treasuries still look attractive. 10-yr US treasuries yield 1.55% more than Europe's risk free rate, German bunds. This is 91bps above the five year average. The divergence in US and European economies has ultimately led to differing monetary policies that have distorted the once closely held yield relationship.

As economic conditions being to improve, as anticipated by central bankers, one would expect this relationship to normalise and increasingly converge.

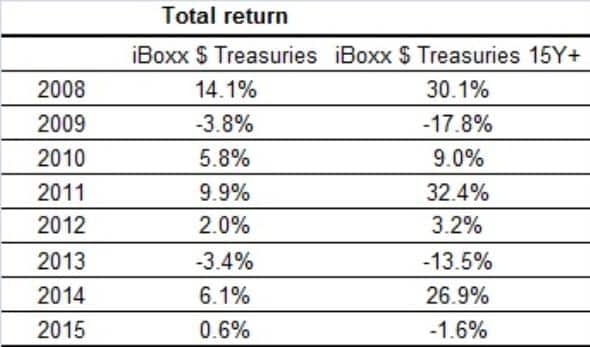

But US treasuries are not just looking attractive relative to other risk free assets. US treasuries have enjoyed a bull run spanning back thirty years and the capital gains have played a big part in total returns.

The Markit iBoxx $ Treasuries index has returned on average 4.4% per year since the financial crisis, while longer bonds, as represented by the iBoxx $ Treasuries 15Y+ have returned 8.6% per year, 2014 returning an astonishing 26.9% on a total return basis.

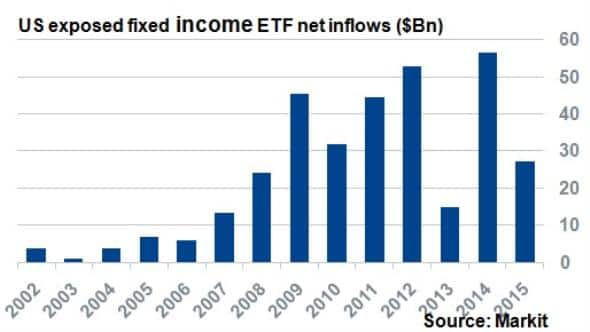

US fixed income ETF flows

Fixed income ETFs exposed to the US have continued to see net inflows in the first five months of 2015. Despite May seeing inflows teeter amid increased volatility in fixed income markets, 2015 is still on par to surpass last year's net inflows with $27bn added so far.

The most popular fund among investors has been the iShares iBoxx $ Investment Grade Corporate Bond ETF which has seen $3.15bn of net inflows so far this year. Conversely, the funds that have seen the largest outflows in 2015 have been the iShares $ High Yield Corporate Bd UCITS ETF and the iShares 20+ Year Treasury Bond ETF with $2.1bn and $1.2bn net outflows respectively.

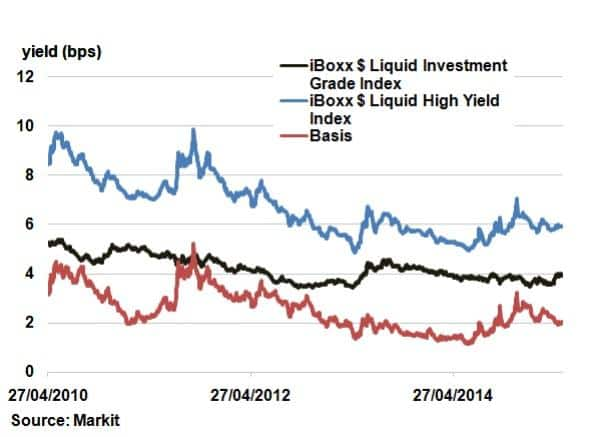

The trend out of high yield and into investment grade corporate credit this year has been matched by the decreasing yield premium between the two underlying indices.

High yield credits in the US have seen yields decrease 44bps this year as represented by the iBoxx $ Liquid High Yield Index, in part due to a stabilisation in oil prices. In contrast investment grade yields have increased, as represented by the iBoxx $ Liquid Investment Grade Index.

The basis between the two indices has tightened 57bps this year and now stands at 201bps, the lowest since November 2014.. But it is also worth noting the current five year average is 258bps, 57bps above the current level.

During calmer credit conditions mid last year, the basis tightened as low as 113bps, which may indicate that the basis has room for further tightening as economic conditions improve.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-Credit-US-treasuries-appealing-despite-low-yields.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-Credit-US-treasuries-appealing-despite-low-yields.html&text=US+treasuries+appealing+despite+low+yields","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-Credit-US-treasuries-appealing-despite-low-yields.html","enabled":true},{"name":"email","url":"?subject=US treasuries appealing despite low yields&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-Credit-US-treasuries-appealing-despite-low-yields.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+treasuries+appealing+despite+low+yields http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-Credit-US-treasuries-appealing-despite-low-yields.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}