Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 28, 2016

January volatility ties in with weaker corporate bond liquidity

Recent volatility has seen a selloff in corporate bonds, with Markit data indicating weaker liquidity metrics.

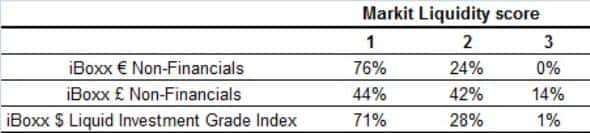

- 70%+ of large " and $ corporate bonds held a Markit liquidity score of 1, " corporates weaker

- However, dealer quote counts among " and $ corporate bonds have continued to slide on a trailing basis

- The biggest $ investment grade ETF saw bid/ask spreads widen this month, but they remain historically tight

At first the recent market jitters were confined to the risker end of the fixed income markets, namely high yield bonds. But the continuation of market volatility at the start of this year has seen investment grade corporate bonds enter the market selloff. Apart from the impact on returns, investors have also looked at how liquidity has been impacted.

Markit iBoxx provides indices covering investment grade corporate bonds across three currencies (Euro, Dollar and Sterling). Excluding financials and international bonds, this provides useful insight into the composition of the domestic corporate bond markets across the three major Western regions (Europe, US and UK).

Markedly, January's heightened volatility environment impacted liquidity across all three regions. According to Markit's bond pricing service, 76% of European bonds had a liquidity score of 1 (out of 5), the highest such rank, on January 25th. Markit's liquidity score encapsulates a wide range of metrics such as market depth, bid/ask spreads and maturity merits. Last January the figure was higher however, at 82%, and it was a similar story for $ corporate bonds, which saw a larger contribution in the liquidity score 1 bracket (89% last January as opposed to 71% this month). The UK corporate bond market continues to lag its European and US counterparts, with an almost equal weighting among liquidity scores 1 and 2.

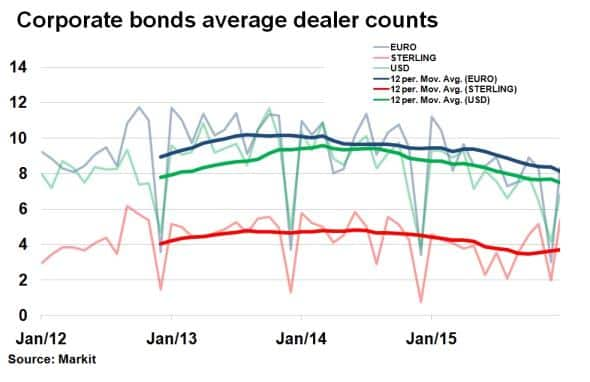

Dwindling dealer counts

Looking at the average number of dealers actively quoting the constituents of each of the three regional indices at month end, the relative weakness in the Sterling (UK) market becomes is evident. This month's volatility however, did little to affect the average dealer count, which actually climbed to 5.39, the highest level since September 2014.

Conversely, dealer quote counts among " and $ investment grade corporate bonds have continued to slide on a 12 month trailing basis. Latest levels show a fall year over year, with " averaging 8.35 dealers this month, having averaged more than 10 at the end of 2013. While $ bonds have averaged 6.85 dealers this month, down from 10.32 in January 2014.

As market volatility appeases, a continuation of weaker liquidity metrics would signal a more systemic shift in market structure, while volatility induced effects would be more transitory.

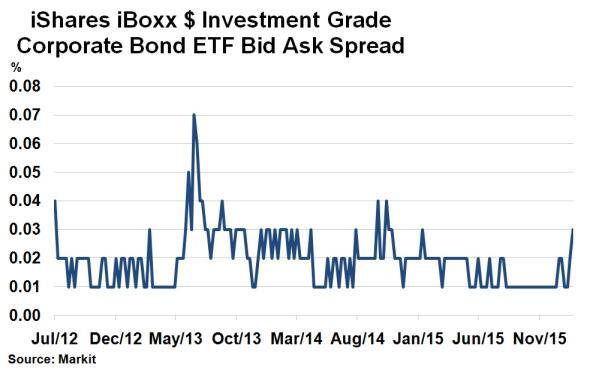

ETFs robust

Despite the deteriorating liquidity metrics, bond ETF liquidity has remained resilient this month as showcased by the iShares iBoxx $ Investment Grade Corporate Bond ETF.

Sturdy volumes and tight bid/ask spreads, which incidentally never exceeded 3bps, (much tighter than historical periods of market stress) highlight the evolution of the ETF mechanism.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28012016-Credit-January-volatility-ties-in-with-weaker-corporate-bond-liquidity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28012016-Credit-January-volatility-ties-in-with-weaker-corporate-bond-liquidity.html&text=January+volatility+ties+in+with+weaker+corporate+bond+liquidity","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28012016-Credit-January-volatility-ties-in-with-weaker-corporate-bond-liquidity.html","enabled":true},{"name":"email","url":"?subject=January volatility ties in with weaker corporate bond liquidity&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28012016-Credit-January-volatility-ties-in-with-weaker-corporate-bond-liquidity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=January+volatility+ties+in+with+weaker+corporate+bond+liquidity http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28012016-Credit-January-volatility-ties-in-with-weaker-corporate-bond-liquidity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}