Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 27, 2017

Week Ahead Economic Preview

The Federal Reserve, Bank of Japan and Bank of England will be in particular focus, with markets eagerly awaiting fresh signals of tighter monetary policy. Elsewhere, third-quarter GDP estimates are released for the eurozone and several member countries, while worldwide PMI surveys will offer all-important steers on how the global economy has fared at the start of the fourth quarter.

US nonfarm payrolls and the PCE price index will provide insights into post-hurricane stateside economic trends, while the euro area also sees the release of inflation and employment data.

No action expected at FOMC

The Fed policy meeting next week is unlikely to see any action, but analysts will closely monitor the policy statement for clues as to the timing of the next rate hike. The US central bank is widely expected to raise the Fed Funds rate at the December meeting, with markets highly confident of a rate move.

Recent economic data support the case for a December policy move. Flash US survey data indicated that the US economy made a strong start to the final quarter, supported by an encouraging rebound in manufacturing production.

Policy watchers will therefore be eager for further signs of the economy being back on track for tighter policy and another rate hike, following the hurricane-related disruptions in the third quarter. Key economic data releases include the employment report, which details nonfarm payrolls and wage growth, as well as PCE price data and the final October PMI numbers from IHS Markit.

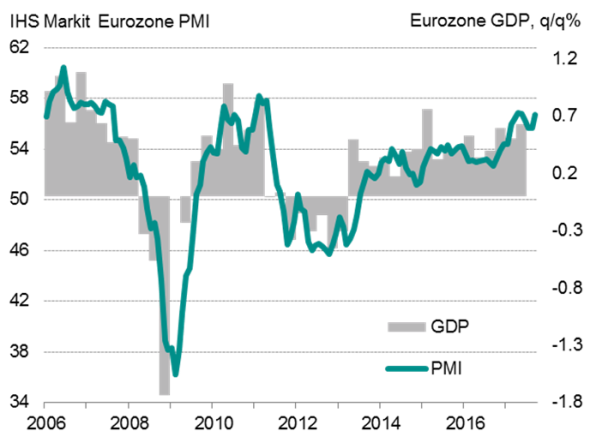

Eurozone PMI and economic growth

Sources: IHS Markit, Eurostat

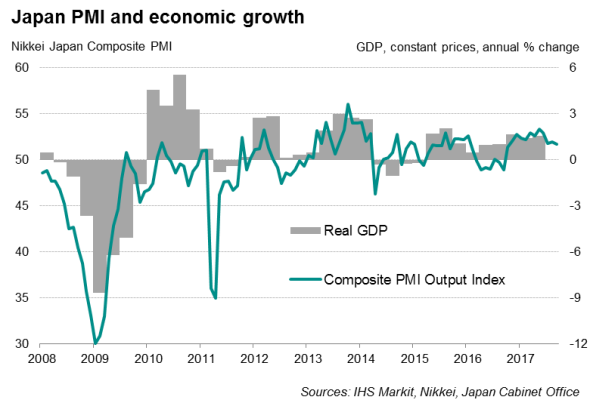

Sources: IHS Markit, Nikkei, Japan Cabinet Office

Euro area GDP and jobs

Eurostat will announce its preliminary estimate of third quarter eurozone GDP, where historical comparisons with PMI data indicate a quarterly growth rate of 0.7%. Analysts are also anticipating a drop in the unemployment rate, reflecting a strong trend of job creation as signalled by recent PMI surveys. At the recent ECB policy meeting, the central bank’s decision to scale down its asset purchase programme, starting next year, signals its growing confidence that inflation will reach its 2% target. October inflation data will therefore be another key data highlight.

BoE rate hike likely after GDP data

In the UK, a slightly stronger-than-expected flash estimate of third quarter GDP has likely bolstered the views of the hawks on the Monetary Policy Committee, thus raising the likelihood of interest rates increasing for the first time in a decade next week. Other key data highlights include housing prices, mortgage data and consumer confidence.

Bank of Japan

The Bank of Japan is deciding on monetary policy, but expectations are for an unchanged decision as underlying inflation remains low and well below the 2% target. At the same time, the BOJ will release its quarterly outlook report. The Japanese economy continued to enjoy a solid pace of growth at the start of the fourth quarter, with flash Japan manufacturing PMI signalling another robust improvement in the sector during October. Attention next week will be on retail sales, housing spending and housing statistics.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102017-Economics-Week-Ahead-Economic-Preview.html&text=Week+Ahead+Economic+Preview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102017-Economics-Week-Ahead-Economic-Preview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}