Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 27, 2015

ETFs and the collateral conundrum

Despite their ability to hold many of the required attributes to classify as high quality collateral, many market participants don't accept ETFs as securities lending collateral; the newly launched Markit ETF collateral lists aim to bridge this gap.

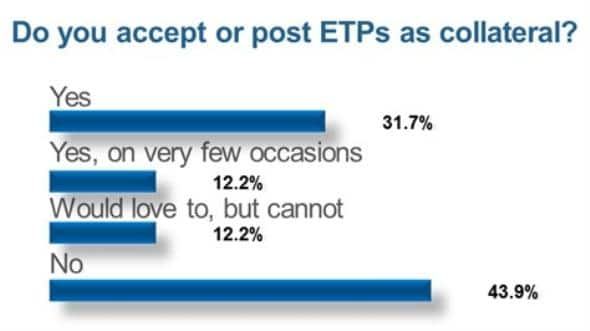

- Over 55% of attendees of Markit's London Securities Finance forum did not accept ETPs as collateral

- More than $516bn of ETFs efficiently track assets readily accepted as collateral

- The value of ETF assets in lending programs has remained flat at $140bn in the last 18 months

The growing acceptance of ETFs as an asset class is demonstrated by the fact that aggregate AUM managed by the 5,000 plus funds reached the $3trn milestone earlier this year, off the back of strong inflows and buoyant markets. While the asset class is growing in popularity among an increasingly diverse range of investors, increasing appetite for ETFs has not yet translated into wide acceptance within the collateral management world; particularly in the European markets.

This was highlighted at the recent Markit Securities Finance Forum held in London, where over 55% of polled delegates stated that they didn't accept or post ETPs as collateral.

Failure to accept assets held in ETFs as collateral comes at a time when high quality collateral has arguably never been as scarce in the financial industry. This could in turn see investors treat ETPs differently to their underlying assets.

While it makes no sense to argue that a triple inverse natural gas ETN meets the criteria for even the most accommodative of risk managers, the majority of ETF assets are physically backed funds that track the very assets that are currently in short supply in the collateral market.

In an effort to alleviate the "shadow" cost of capital carried by this conundrum, Markit has consulted with ETF and securities lending market participants to come up with filtering criteria that aims to highlight ETFs that track assets which are already widely accepted as securities lending collateral.

Markit ETF collateral lists

The inaugural ETF collateral lists highlight fixed income and equity ETFs that track the most liquid indexes in developed markets. The lists also screens out subscale funds and those whose net asset value (NAV) deviates by more than 1% from the value of the assets tracked by the fund.

The inaugural lists, which are built using Markit's ETP Analytics and Encyclopaedia solutions, highlight over $516bn of ETFs that track assets that currently meet widely accepted collateral rules.

Most of the assets held by the funds are equity products, which make up $480bn of the assets identified by the collateral lists. The largest fund on the equities list is the SPDR S&P 500 tracker which has over $180bn of AUM and whose average share price has deviated by less than .1bps from its NAV over the last month.

While the majority of the assets that currently meet the criteria of the Markit ETF collateral lists are listed in North America, the rules also have relevance for European ETF investors as the equity and fixed income collateral lists have identified $75bn of assets that meet the criteria. The largest European listed ETF that currently meets the criteria is the iShares DAX UCITS ETF index; the largest fund with over $10bn of AUM.

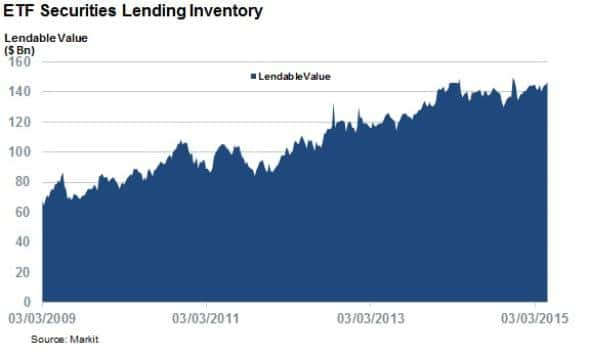

ETF lendable flat

Better acceptance of ETFs within the wider securities industry would be no bad thing, as the value of ETFs currently sitting in lending programmes has hovered at around the $140bn mark over the last 15 months despite the impressive growth seen by the asset class. Wider acceptance as collateral will no doubt see more ETF assets become available through securities lending programs.

Simon Colvin, Research Analyst at IHS Markit

Posted 27 July 2015

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072015-Equities-ETFs-and-the-collateral-conundrum.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072015-Equities-ETFs-and-the-collateral-conundrum.html&text=ETFs+and+the+collateral+conundrum","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072015-Equities-ETFs-and-the-collateral-conundrum.html","enabled":true},{"name":"email","url":"?subject=ETFs and the collateral conundrum&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072015-Equities-ETFs-and-the-collateral-conundrum.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ETFs+and+the+collateral+conundrum http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072015-Equities-ETFs-and-the-collateral-conundrum.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}