Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 27, 2016

Worsening UK economic environment points to slower growth ahead

A slowing in the pace of UK economic growth is signalled by a worsening of financial conditions and an increase in economic uncertainty.

Indicators deteriorated markedly in February to signal the worst economic environment in terms of financial conditions and uncertainty since July 2012, and showed only a minor recovery in March. The data suggest the growth environment remains far more adverse than the averages seen throughout the past three-and-a-half years.

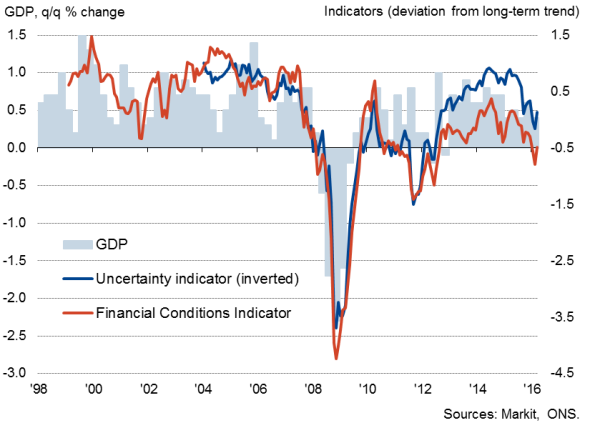

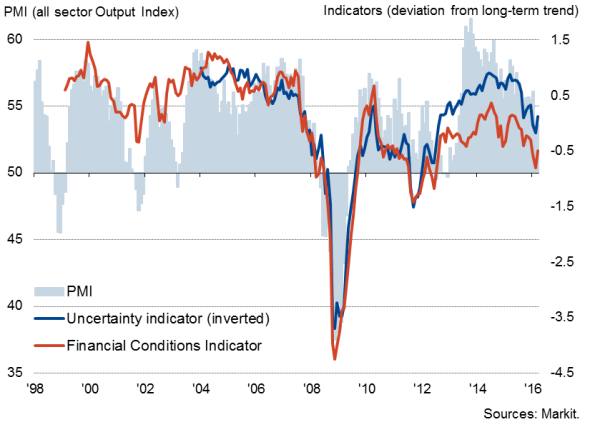

The indicators, developed by Markit using a wide variety of data sources as inputs, exhibit a high correlation with measures of economic growth such as gross domestic product and the PMI (see our background research paper).

The volatility of sterling, stock market volatility and corporate bond market deterioration have all contributed to a tightening of financial conditions so far this year, offsetting positive contributions from improved lending and money supply figures.

Business and consumer confidence gauges have meanwhile also deteriorated in recent months, alongside an increase in the cost of insuring against corporate default, all of which signal heightened economic uncertainty and growing risk aversion.

The tightening of financial conditions and increased risk aversion suggest that economic growth could slow further in the second quarter, having already eased in the opening three months of the year. GDP rose 0.4% in the first quarter, down from 0.6% in the fourth quarter of last year. A slowdown to 0.2% or worse could be seen in the second quarter as uncertainty surrounding the EU referendum exacerbates existing pressures on the economy, such as worries about global economic growth and the impact of further deficit-fighting austerity measures.

Financial conditions & economic uncertainty

Compared to GDP

Compared to PMI

The Financial Conditions Index (FCI) shows an 85% correlation against quarterly growth of GDP. The indicator also has an 89% correlation with the PMI, achieved with the index lagged by one month against the PMI. The indicator also has a 71% correlation against business investment, with the FCI leading the annual rate of growth by six months.

The Economic Uncertainty Index (EUI) exhibits a 76% correlation against quarterly growth of GDP, an 84% correlation with the PMI (achieved with no leads or lags applied) and has a 68% correlation with the annual rate of change of business investment, with the EUI, leading investment by six months.

The indicators also act as leading indicators of business investment.

Measuring Economic Uncertainty

Economic uncertainty is a key driver of investment decisions, whether these relate to companies investing in new capacity, households buying property or investors choosing between safe havens and riskier assets.

Components of the uncertainty indicator therefore include variables that measure concerns about job security, indicators of financial market volatility and risk premia. We also look at the spread of economic forecasts (a wide range of forecasts suggest a large degree of doubt exists) as well as web data and media searches relating to terms such as “recession”.

Measuring Financial Conditions

The primary function of the second index is to provide a well-rounded overall view of financial conditions. Its signals should capture the majority of the interactions between the financial sector and the real economy.

We therefore use a variety of components that aim to capture changes in financial conditions and move away from the traditional interest/exchange rate combinations that tended to dominate macroeconomic model building pre-financial crisis. While interest rates and the exchange rate remain important components, coverage is also broadened out to include measures of the supply of credit and changes in asset prices, including corporate debt, property and commodities. An example is the inclusion of data concerning changes in the supply of lending to households and (non-financial) companies. The rationale is that an increase (decrease) in lending is indicative of looser (tighter) financial conditions.

Similarly, strong movements in interest rate spreads can be associated with changes in risk premiums (or credit risk) and financial conditions. We gauge such impacts via a measure of the difference between ‘safe’ treasury bills and LIBOR, the lending rate to commercial banks.

Volatility in financial markets is meanwhile captured by the inclusion of a UK equity volatility measure (the VIX).

Methodology

For both of our indices, we use principal components analysis (PCA). This technique essentially extracts components (or factors) that can help explain patterns of correlations within a given dataset.

The resulting combination of these artificially produced factors (r) provides a clearer signal of what the fundamental drivers are of a data set containing a potentially large (and what may seem disparate) number of variables (N). In essence it is a variable reduction exercise, that is r << N. By conducting such an exercise, it makes our understanding and interpretation of the signals provided within a dataset much easier.

To extract the principal components, all of the individual series that we use in the dataset have been normalised (i.e. de-meaned and divided by their standard deviations). This ensures that measurement units and/or magnitudes of these variables don’t have any undue influence. As most of the data are expressed in growth rates or are flow variables, we don’t concern ourselves with issues related to stationarity.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042016-Economics-Worsening-UK-economic-environment-points-to-slower-growth-ahead.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042016-Economics-Worsening-UK-economic-environment-points-to-slower-growth-ahead.html&text=Worsening+UK+economic+environment+points+to+slower+growth+ahead","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042016-Economics-Worsening-UK-economic-environment-points-to-slower-growth-ahead.html","enabled":true},{"name":"email","url":"?subject=Worsening UK economic environment points to slower growth ahead&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042016-Economics-Worsening-UK-economic-environment-points-to-slower-growth-ahead.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Worsening+UK+economic+environment+points+to+slower+growth+ahead http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042016-Economics-Worsening-UK-economic-environment-points-to-slower-growth-ahead.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}