Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

STRUCTURED FINANCE COMMENTARY

Mar 27, 2017

CLOs Get Seared

Retail Struggles Continue in CLOs in 2017

Sears' $2.2 billion annual net loss reported this month for 2016 marks the fifth consecutive year in the red for the struggling brick and mortar store. Sears Holdings faces significant liquidity pitfalls and bankruptcy risk as cited in their annual report filed last week: "Substantial doubt exists related to the Company's ability to continue as a going concern." Sears sold its Craftsman brand on January 5th to Stanley Black & Decker for $900 million, but only receives $525 million of that upfront with the remainder being paid over the next three years. They also created additional liquidity in 2016 by adding $722 million in senior secured term loans and $291 million in second lien agreements to its credit facility. In addition to covenant and reserve modifications, Sears added $250 million in credit capacity to their general debt basket and announced a restructuring plan focused on cost-cutting opportunities.

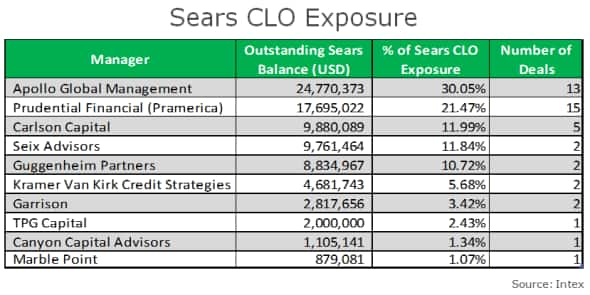

These moves account to a 43% increase in debt/capitalized lease obligations at over $4.1 billion on their balance sheet. Sears Holdings' stock fell nearly 10% in trading after bankruptcy concerns emerged from its filing this week. Currently $82 million of Sears Holdings term loans are outstanding in U.S. CLOs across 44 deals from ten managers.

Although investors have highlighted the retail industry as a collateral risk recently, much of these concerns remain idiosyncratic and targeted at firms lacking e-commerce presence. Neiman Marcus has displayed similar struggles over the last year with disappointing earnings throughout 2016 leading to a CCC+ rating downgrade and announcement of a debt restructuring plan earlier this month. However, Neiman Marcus has a much greater presence amongst CLOs with $932 million in outstanding term loans.

J. Crew Group's disappointing earnings release last week showed an $80 million drop in revenue and a 3% drop year-over-year. Management has gone to the table with its creditors to seek a restructuring plan for its $2 billion of debt currently outstanding. $537 million of this debt is currently term loans outstanding in CLOs. As the struggles amongst major retail names begin to further accumulate, so has its impact on CLOs trading in the secondary market.

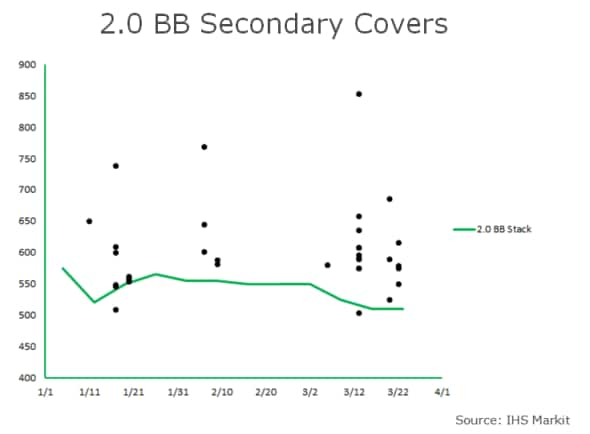

Throughout the first quarter of 2017, 2.0 U.S. BBs with high retail exposure have been trading increasingly wider moving into the second quarter. This is echoing equity markets, as the SPDR S&P Retail ETF (XRT) is down over 6% since year-end despite the Trump rally. Although the impact of Sears's struggles will have miniscule impact on the CLO market given its relatively low loan volume, it is another major retail name enhancing the overall negative sentiment on the sector.

IHS Markit's Securitized Products Pricing service provides independent evaluated pricing, sector level time series and transparency metrics across Agency Pass-Through, Agency CMO, Non-Agency RMBS, Consumer ABS, European ABS, CMBS, TruPS, CDO and CLO asset classes. For further information please email: USABSPricing@Markit.com

Paul Sloand, Associate, Securitized Products

Tel: +1 646 679 3434

paul.sloand@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-structured-finance-clos-get-seared.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-structured-finance-clos-get-seared.html&text=CLOs+Get+Seared","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-structured-finance-clos-get-seared.html","enabled":true},{"name":"email","url":"?subject=CLOs Get Seared&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-structured-finance-clos-get-seared.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CLOs+Get+Seared http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-structured-finance-clos-get-seared.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}